Business

Nio Reports Increased Loss Despite Higher Vehicle Deliveries

SHANGHAI, China — Nio Inc. reported a net loss of RMB 6.75 billion (about $930 million) for the first quarter of 2025, marking a 30.19 percent increase from the same period last year. The rise in losses is attributed to higher research and development (R&D) and marketing expenses, according to the company’s unaudited financial results released today.

The adjusted net loss for the quarter was RMB 6.28 billion, up 28.1 percent year-on-year, but a slight decrease of 5.2 percent from the fourth quarter of 2024. Nio’s total revenue for the first quarter was RMB 12.03 billion, falling short of analysts’ expectations of RMB 12.35 billion and below its own guidance range of RMB 12.37 billion to RMB 12.86 billion.

Despite the revenue shortfall, Nio’s automotive sales saw a year-on-year increase of 18.6 percent to RMB 9.94 billion, although this was a significant decline of 43.1 percent compared to the previous quarter. The growth was largely driven by increased vehicle delivery volumes, despite a drop in average selling prices due to product mix changes.

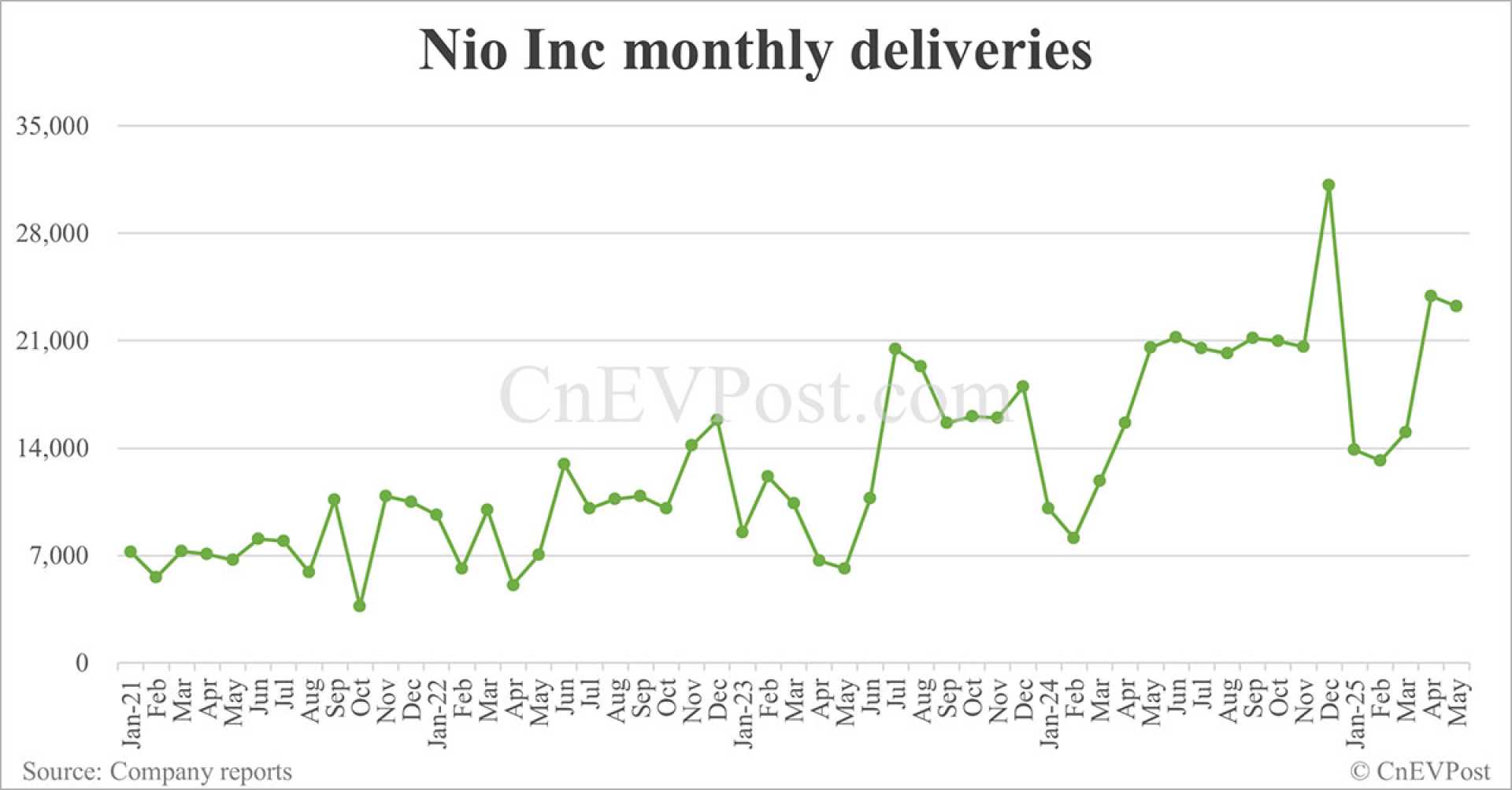

Nio delivered 42,094 vehicles in the first quarter, meeting its guidance range of 41,000 to 43,000 units. This represents an increase of 40.07 percent from the same period last year but a sharp decline of 42.09 percent from the fourth quarter of 2024. The main Nio brand saw deliveries drop by 9.12 percent year-on-year, and Onvo deliveries fell by 25.83 percent compared to the last quarter.

The company’s sales costs for the quarter were RMB 11.1 billion, an 18.0 percent increase year-on-year, influenced by a higher delivery volume, but this was offset by a reduction in material costs per vehicle. Nio’s gross profit for the first quarter was RMB 920 million, an 88.5 percent rise from last year, though down 60.2 percent from the fourth quarter.

Nio reported a first-quarter gross margin of 7.6 percent, up from 4.9 percent in the same period last year but down from 11.7 percent in the previous quarter. Vehicle margin also improved to 10.2 percent from 9.2 percent year-on-year, but decreased from 13.1 percent.

The company’s R&D expenses reached RMB 3.18 billion, an 11.1 percent rise from a year earlier, while SG&A expenses totaled RMB 4.4 billion, an increase of 46.8 percent. As of March 31, 2025, Nio’s total cash reserves were RMB 26 billion, although it reported operating cash outflow.

Looking ahead, Nio projects second-quarter deliveries to be between 72,000 and 75,000 units, expecting an increase of approximately 25.5 percent to 30.7 percent year-on-year. The company anticipates its second-quarter revenue will range between RMB 19.5 billion and RMB 20.07 billion, indicating an increase of about 11.8 percent to 15.0 percent compared to the same quarter in 2024.