Business

NIO Stock Faces Uncertainty Ahead of Q3 2024 Earnings Report

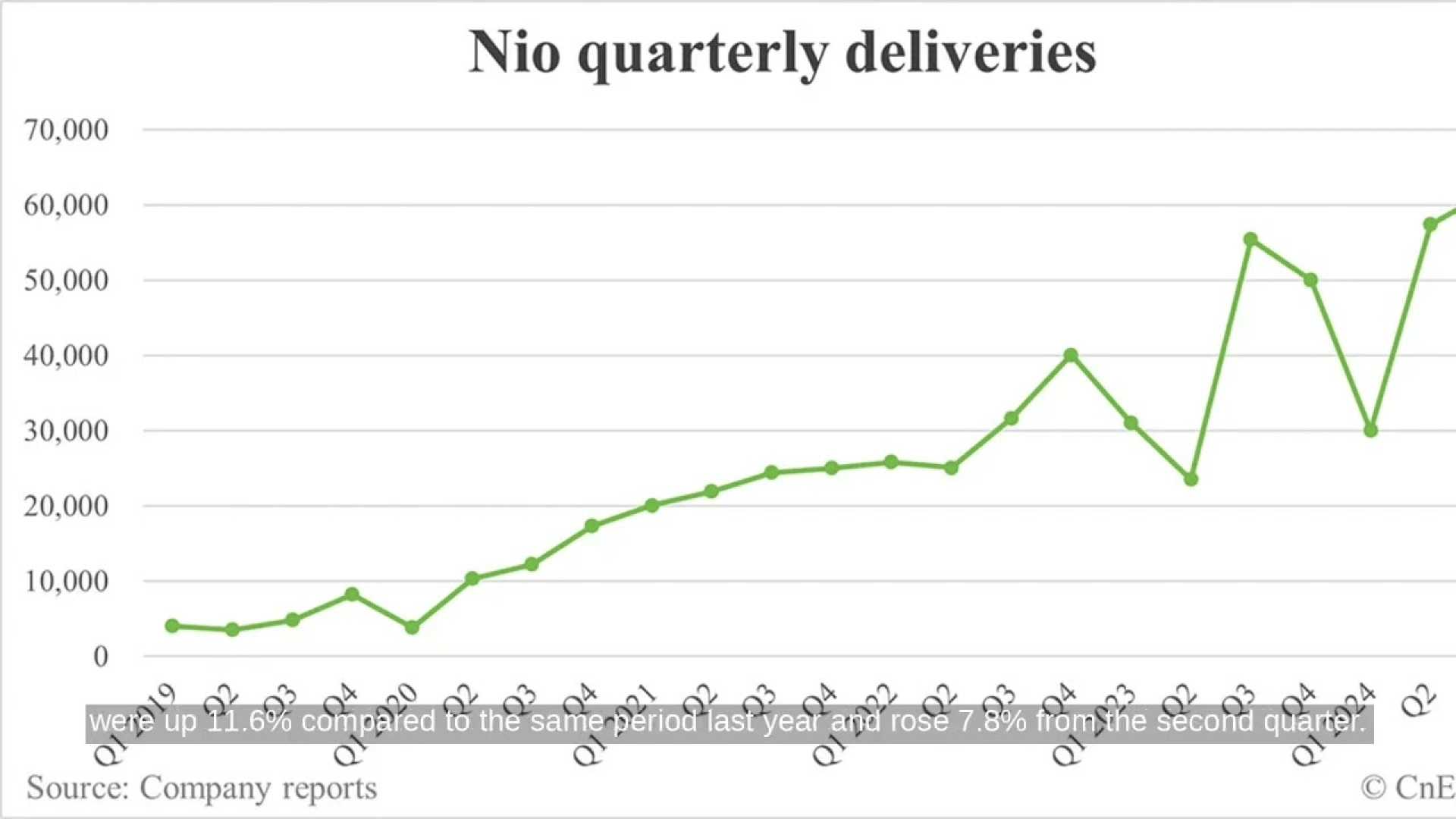

NIO Inc., the Chinese electric vehicle (EV) manufacturer, has released its unaudited third-quarter 2024 financial results, which show a mixed bag of performance metrics. As of November 20, 2024, NIO reported total revenues of RMB18,673.5 million (US$2,661.0 million), a 2.1% year-over-year decline. However, vehicle deliveries reached 61,855 units, an 11.6% increase from the same period last year.

Despite the positive delivery numbers, NIO’s net loss increased by 11.0% year-over-year to RMB5,059.7 million. The company’s vehicle margin improved to 13.1% from 11.0% in Q3 2023, reflecting reduced material costs and improved operational efficiency.

Investor sentiment remains cautious, with concerns over NIO’s long-term profitability. An investor known as Oakoff Investments expressed skepticism about NIO’s ability to achieve profitability by 2027, citing the company’s struggling battery-swapping initiative and intense competition in the Chinese EV market. Oakoff maintains a Hold rating on the stock, questioning NIO’s competitive edge and the potential impact of regulatory changes, especially in Europe.

On the other hand, Wall Street analysts are more optimistic, with a Moderate Buy consensus rating and a 12-month average price target of $6.33, implying a ~37% upside from current levels. Recent analyst actions include upgrades from JPMorgan Chase & Co. and Macquarie, though Citigroup lowered its target price to $7.00.

The geopolitical landscape, particularly the re-election of Donald Trump and potential trade tensions between the U.S. and China, adds another layer of uncertainty for NIO’s global strategy. Additionally, the European Union‘s decision to impose tariffs on Chinese vehicle imports could further complicate NIO’s expansion plans.

NIO’s stock has been volatile, with a significant decline of nearly 50% in 2024. The company’s shares dropped 1.5% on November 19, 2024, amid broader market concerns and ahead of the Q3 earnings report.