Business

Novartis to Acquire Regulus for $1.7 Billion in Cash

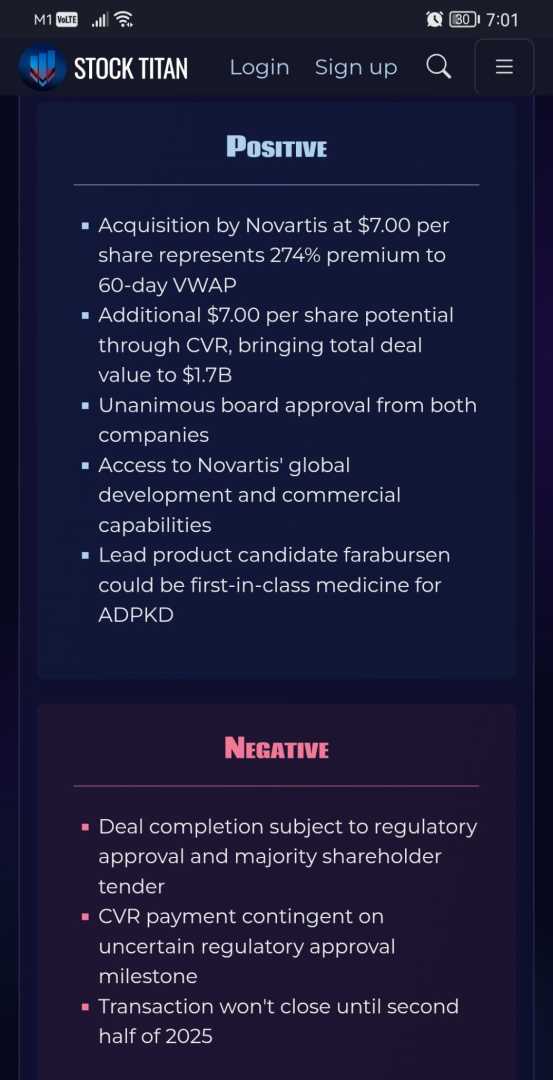

SAN DIEGO, April 30, 2025 /PRNewswire/ — Novartis AG has agreed to acquire Regulus Therapeutics Inc. for $7.00 per share in cash, totaling approximately $0.8 billion, with the potential for an additional $7.00 per share through a contingent value right (CVR). This brings the total equity value of the transaction to about $1.7 billion.

Regulus Therapeutics, based in San Diego, focuses on developing innovative medicines targeting microRNAs. The acquisition is set to close in the second half of 2025, pending customary conditions, including regulatory clearance and tendering of shares representing a majority of Regulus’ outstanding shares.

The initial $7.00 cash offer represents a premium of 274 percent over Regulus’ 60-day volume-weighted average stock price and 108 percent over its closing price from April 29, 2025. Shareholders of Regulus will benefit from the CVR, which is contingent upon the successful regulatory approval of their lead product candidate, farabursen.

Jay Hagan, CEO of Regulus, expressed excitement about the merger, stating, “We are excited to combine with Novartis to potentially bring farabursen to patients living with ADPKD, who currently have limited treatment options.” He added that Novartis’ global development resources will help advance this therapy, if approved.

Shreeram Aradhye, President of Development and Chief Medical Officer at Novartis, highlighted the significance of farabursen, noting, “Farabursen represents a potential first-in-class medicine with a profile that may provide enhanced efficacy, tolerability and safety versus standard of care for ADPKD. ADPKD is the most common genetic cause of renal failure worldwide.”

The completion of the transaction will also ensure that Regulus continues to operate independently until finalization. Evercore is serving as the exclusive financial advisor for Regulus, with Latham & Watkins LLP as their legal counsel.