Business

Novo Nordisk Lowers Growth Expectations Amid Rising Competition

Copenhagen, Denmark — Novo Nordisk, the Danish pharmaceutical giant, announced on Wednesday that it is reducing its growth projections for its obesity and diabetes treatments due to intensified competition and pricing pressures.

The company’s net profit for the quarter reached 20 billion Danish kroner ($3.1 billion), slightly below analysts’ expectations of 20.12 billion Danish kroner. While its diabetes and obesity care segments have shown growth, Novo Nordisk lowered its full-year sales growth forecast to between 8% and 11%, down from a previous range of 8% to 14%.

Mike Doustdar, president and CEO of Novo Nordisk, stated, “While we delivered robust sales growth in the first nine months of 2025, the lower growth expectations for our GLP-1 treatments have led to a narrowing of our guidance.” The company is also revising its operating profit growth expectations to between 4% and 7%.

Sales of Wegovy, Novo’s leading weight loss drug, rose by 18% year-on-year to 20.35 billion Danish kroner in the third quarter, but fell short of the anticipated 21.35 billion. Despite this growth, the company faces challenges as analysts express concerns about rising prescription trends and increased competition.

Throughout 2023, Novo Nordisk’s stock has dropped by over 50%, as multiple factors, including U.S. policy changes and competitive pressures from other pharmaceutical companies like Eli Lilly, have shaken investor confidence. Analysts from Jefferies downgraded Novo Nordisk’s rating to underperform, while Berenberg offers a more optimistic view, suggesting the company has reached a point of “peak uncertainty.”

In response to competition, Novo Nordisk announced last week its intention to acquire Akero Therapeutics Inc. but is facing allegations from Pfizer regarding potential anti-competitive behavior surrounding the acquisition. A spokesperson for Novo called Pfizer’s claims “false and without merit.”

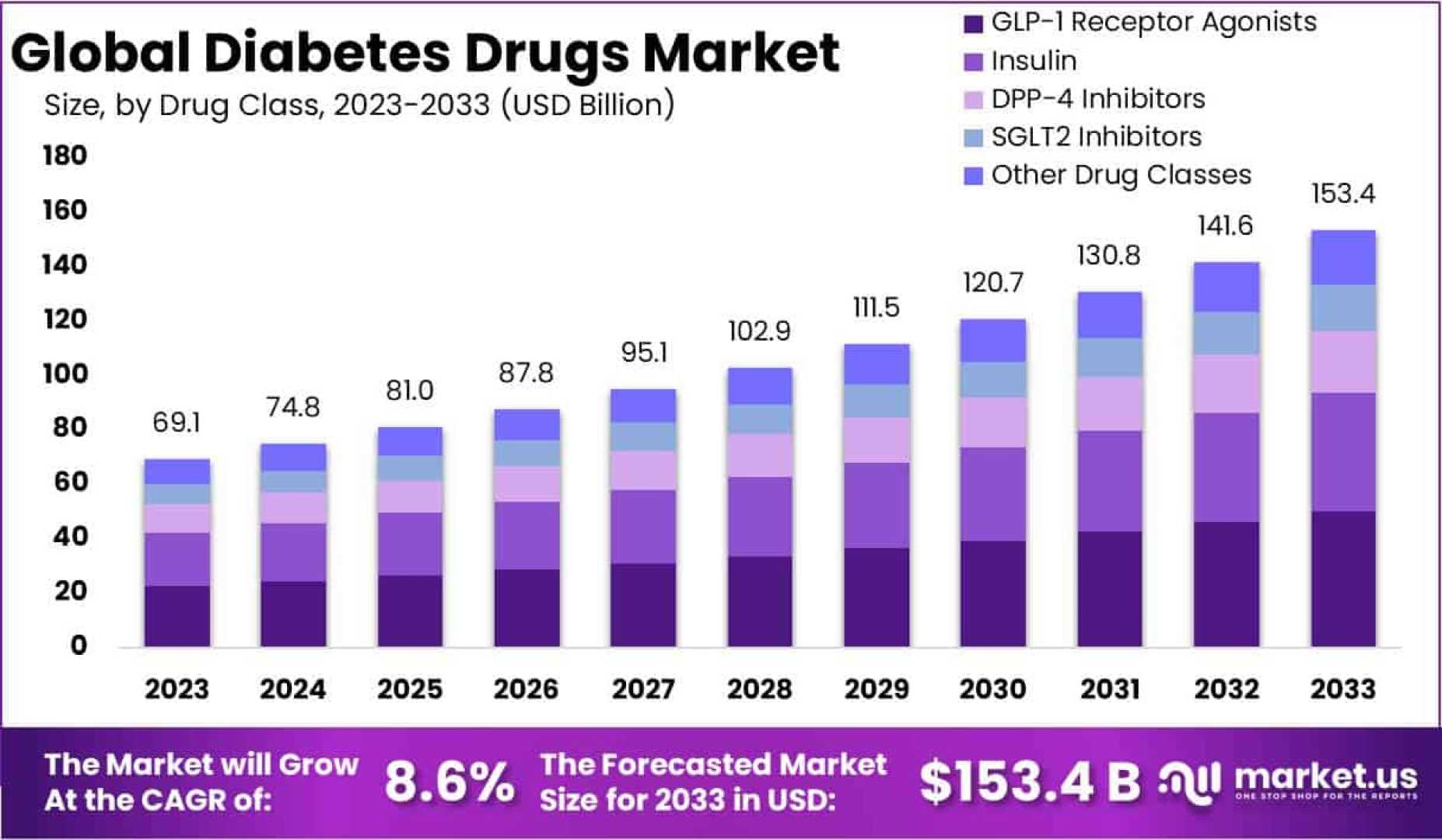

As demand for weight loss and diabetes drugs increases, both Novo Nordisk and Eli Lilly are expanding supply and exploring new treatment avenues, including oral medications to enhance patient access. Novo Nordisk’s potential oral semaglutide application for obesity could be a game-changer in the market.

With ongoing discussions about insurance coverage for GLP-1s and patient access issues, the landscape of the obesity medicine market is rapidly evolving. Novo Nordisk’s plans to streamline its operations and extensive testing of newer treatments may play a critical role in recapturing market share as it navigates this competitive environment.