Business

Nvidia’s Blackwell GPUs Drive Optimistic Wall Street Forecasts

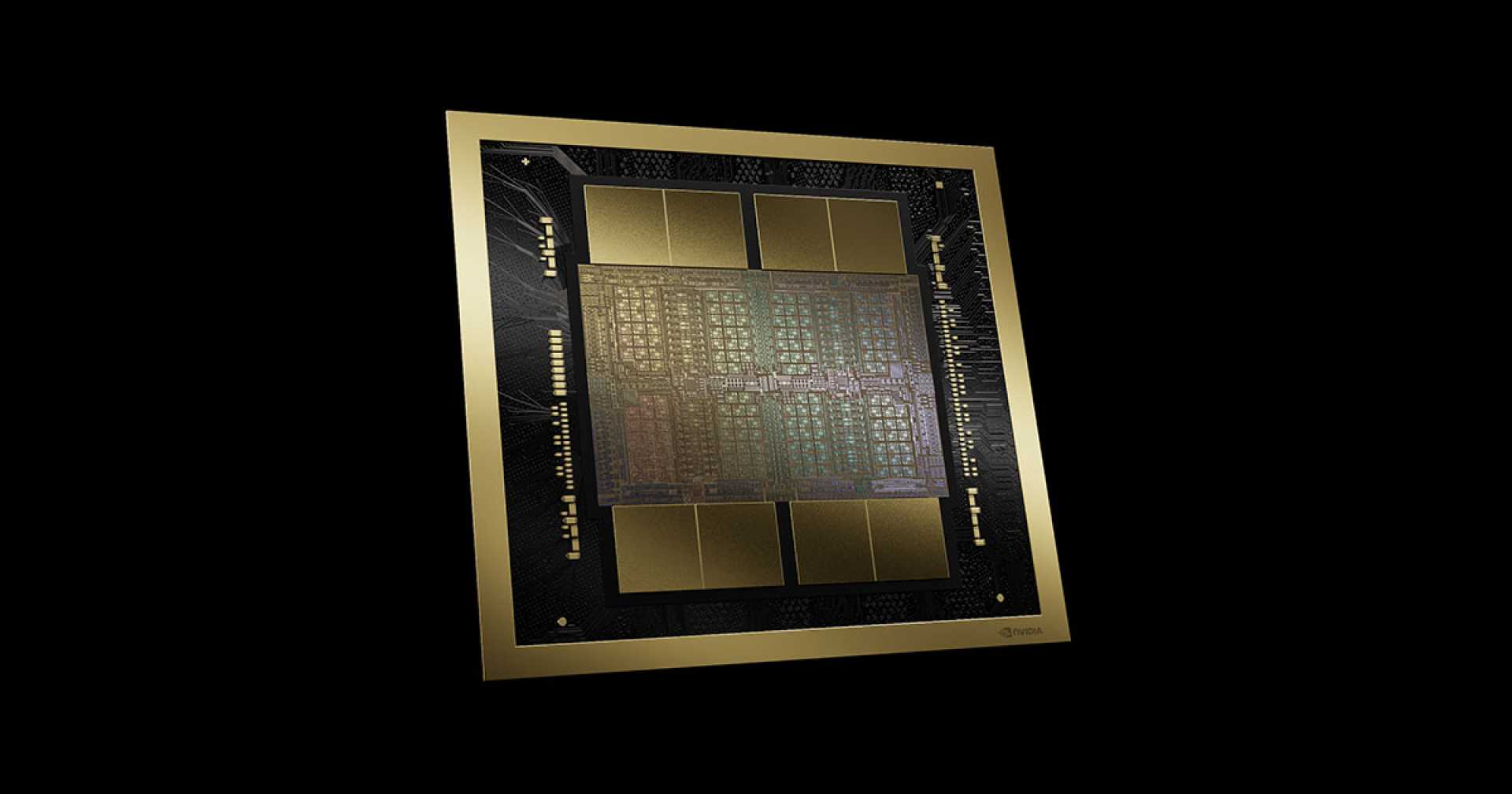

SANTA CLARA, Calif. — Nvidia, the semiconductor giant, continues to dominate the tech market as its shares surged 840% since December 2022, fueled by skyrocketing demand for its graphics processing units (GPUs). The company, now valued at $3.3 trillion, is poised for further growth with its next-generation Blackwell GPUs and robotics computing solutions, according to Wall Street analysts.

Tom O'Malley, an analyst at Barclays, recently raised Nvidia’s target price to $175 per share, up from $160, citing the Blackwell GPUs’ potential to significantly boost sales. “Blackwell GPUs are expected to drive a meaningful increase in sales growth,” O’Malley said. The new architecture, which outperforms its predecessor, Hopper, by handling tasks up to 30 times faster, is projected to add $15 billion in sales this quarter, with potential for even greater gains in the next.

Barclays isn’t alone in its optimism. Data from LSEG shows that the average estimate for Nvidia’s fourth-quarter earnings in fiscal 2025 has risen 5% in the last 90 days, with fiscal 2026 estimates up 9%. Analysts attribute these upward revisions to confidence in the Blackwell GPUs’ performance and market demand.

Beth Kindig, lead technology analyst at the I/O Fund, predicts data center sales will grow by at least 50% in fiscal 2026, driven by Blackwell GPU sales exceeding $200 billion. “Nvidia’s market value could triple,” Kindig said, projecting a 200% upside from its current $3.3 trillion valuation.

Dan Ives of Wedbush highlighted the supply-demand imbalance, noting that Blackwell GPU demand currently outpaces supply by a factor of 15. “Nvidia can only supply one chip for every 15 chips customers want,” Ives said. This imbalance was echoed by Nvidia CFO Colette Kress, who stated during the third-quarter earnings call that “demand greatly exceeds supply.”

Ives also believes Wall Street underestimates Nvidia’s earnings growth by 30% over the next few years, attributing the shortfall to Blackwell GPU revenue and long-term opportunities in robotics and autonomous vehicles. Nvidia CEO Jensen Huang emphasized the potential of physical AI, which enables machines to interact with the real world, as the next frontier for the company. “Generative AI has been a success, but physical AI will drive the next wave of innovation,” Huang said.

Nvidia’s robotics platform, which includes supercomputing chips, networking gear, and software development tools, positions the company to capitalize on this emerging market. While automotive and robotics sales totaled just $449 million last quarter, compared to $30.7 billion in data center revenue, Huang believes these sectors will become among the largest computing industries globally.

Ives estimates Nvidia has a $1 trillion opportunity in autonomous vehicles and robotics, projecting the company’s market value could reach $5 trillion. “This represents 52% upside from its current valuation,” he said. For Nvidia shareholders, the future looks promising as the company continues to innovate and expand its market reach.