Business

Nvidia Loses Key Position as Tech Stocks Show Mixed Performance

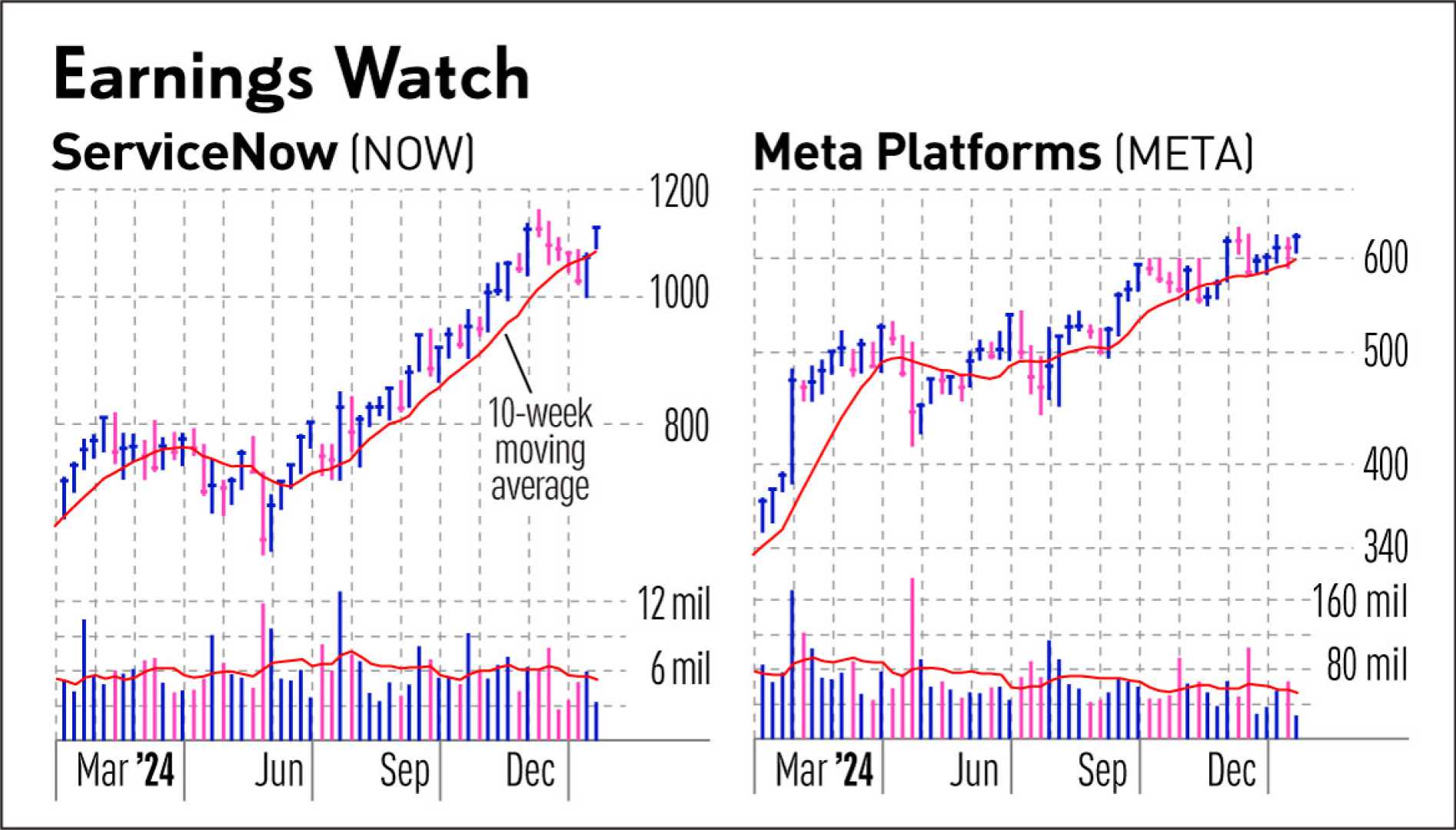

SANTA CLARA, Calif. — Nvidia (NVDA) has lost its key position in the market after failing to find support at a critical level, while other tech giants like Meta Platforms (META) and Alphabet (GOOGL) have shown resilience. However, Alphabet’s stock dipped late Tuesday following its Q4 earnings report, which revealed revenue slightly below expectations.

Alphabet, the parent company of Google, reported earnings that edged past estimates but fell short on revenue, causing its stock to tumble. Meanwhile, AppLovin (APP), a mobile technology company, is poised for a potential breakout, joining other notable stocks on the IBD Leaderboard watchlist.

Tesla (TSLA) and Axon Enterprise (AXON) are also in focus, with Axon nearing a breakout point. The Taser maker has formed a second-stage base with a potential buy point at $698.67. Tesla, however, retreated below its 50-day moving average after reporting mixed earnings and revenue, signaling a potential new base formation.

Other stocks on the IBD Leaderboard watchlist include Cava Group (CAVA) and On Holding (ONON), both of which are working on new setups. On Holding, in particular, is attempting to retake a prior buy point after falling over 7% below its entry level.

Netflix (NFLX) has also joined the IBD Leaderboard as the video streaming giant tests the upper limits of its buy range. The stock’s performance is closely watched as it navigates market volatility.

Investors are keeping a close eye on these developments, particularly as the tech sector continues to show mixed signals. The market’s reaction to earnings reports and technical indicators will likely shape the near-term trajectory of these stocks.