Business

Occidental Petroleum Stock Sees Mixed Analyst Views and Institutional Investment Activity

Occidental Petroleum (NYSE: OXY) has been the subject of various analyst updates and significant institutional investment activities in recent days. On November 12, 2024, analysts at Jefferies Financial Group raised their target price for Occidental Petroleum from $53.00 to $54.00, maintaining a “hold” rating on the stock. This new price objective suggests a potential upside of 6.74% from the stock’s previous close.

In addition to Jefferies’ update, other analysts have also weighed in on Occidental Petroleum. Evercore ISI lowered their price target from $67.00 to $63.00 and set an “underperform” rating, while Barclays decreased their target price from $67.00 to $58.00 with an “equal weight” rating. Conversely, Wolfe Research increased their price objective from $73.00 to $75.00 and gave the company a “buy” rating.

Institutional investors have also been active in the stock. WealthPlan Investment Management LLC acquired a new stake in Occidental Petroleum, purchasing 23,739 shares valued at approximately $1,223,000 in the third quarter. Other investors, such as Fortitude Family Office LLC, New Covenant Trust Company N.A., and Van ECK Associates Corp, have also increased their holdings in the company during the same period.

Occidental Petroleum is set to release its third-quarter 2024 financial results on November 13, 2024, with a conference call scheduled for 1 p.m. Eastern Time. The earnings release and financial schedules are available on the company’s Investor Relations website and the SEC‘s website.

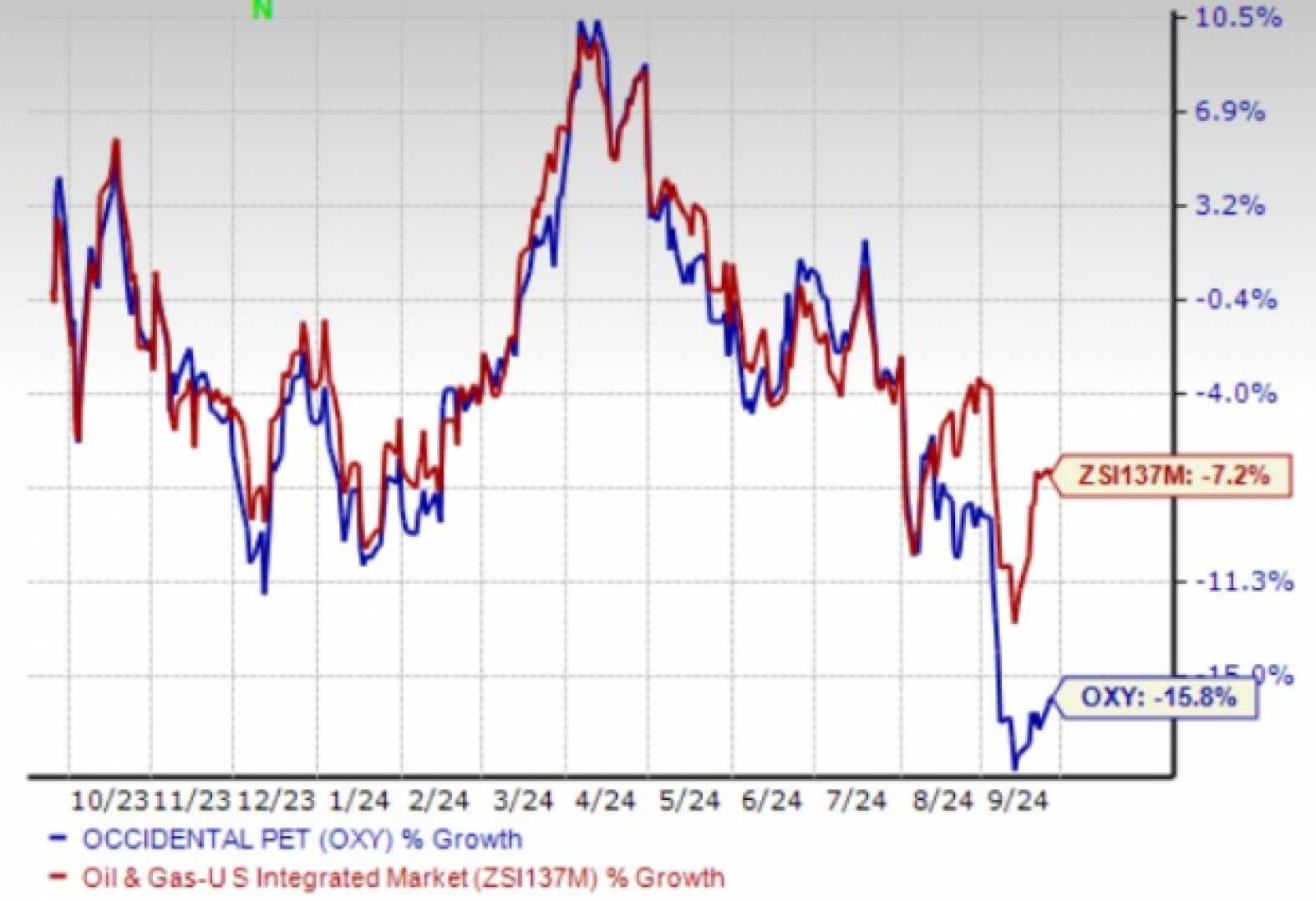

The stock traded down $0.22 during trading hours on Tuesday, hitting $50.59, with a trading volume of 6,651,071 shares. Occidental Petroleum has a market capitalization of $45.82 billion and a 52-week range of $49.51 to $71.18.