Business

Occidental Petroleum Stock Dips as Market Gains Ahead of Earnings

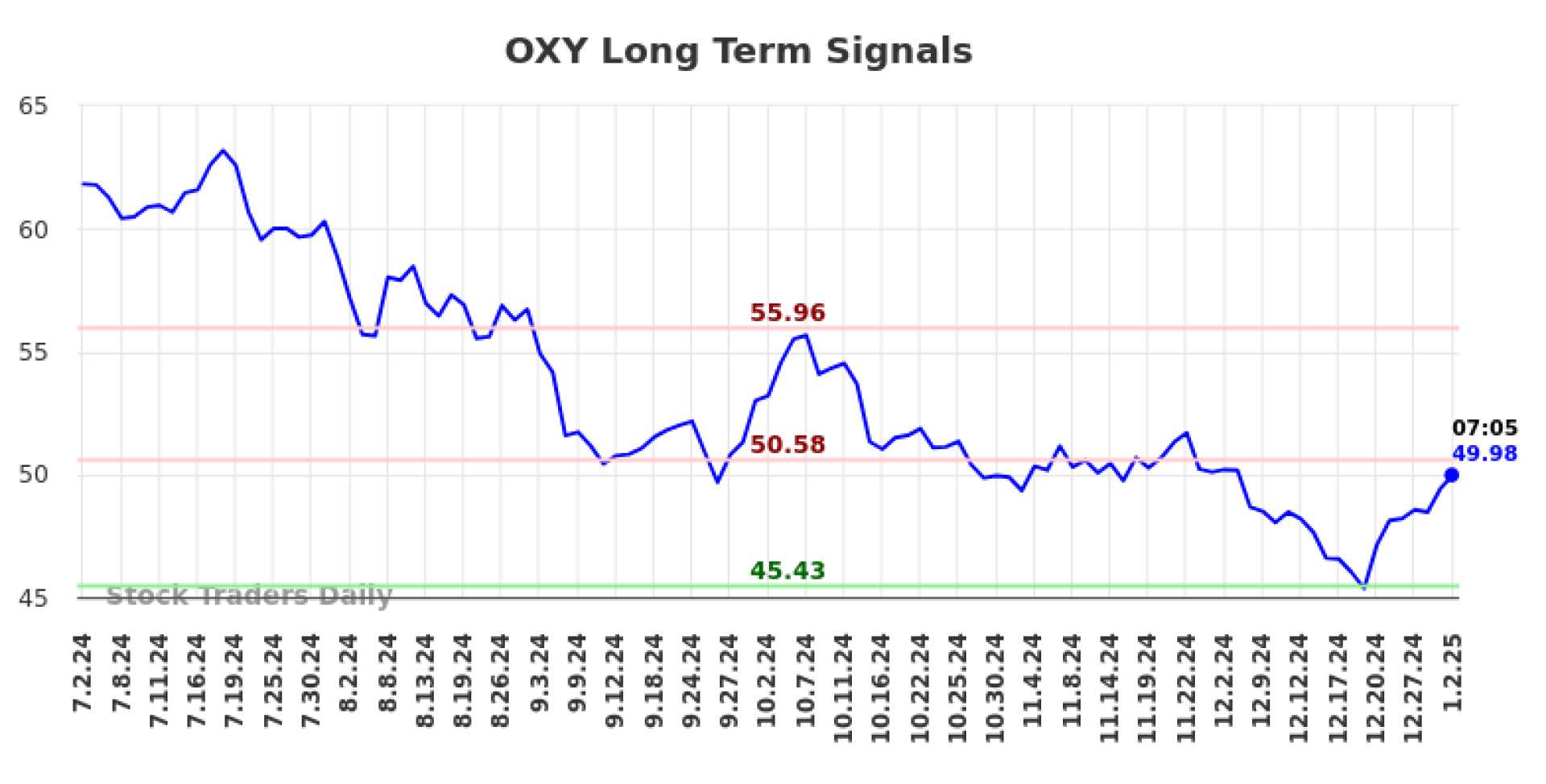

Occidental Petroleum (OXY) shares fell 0.7% to $51.19 in the latest trading session on Thursday, January 9, 2025, underperforming the broader market. The S&P 500 gained 0.16%, while the Dow Jones Industrial Average rose 0.25%. The tech-heavy Nasdaq, however, dipped 0.06%.

Despite the recent dip, Occidental Petroleum’s stock has shown resilience over the past month, gaining 5.61%. This performance outpaced the Oils-Energy sector, which declined 11.11%, and the S&P 500, which fell 2.7% during the same period. Investors are now turning their attention to the company’s upcoming earnings report, scheduled for release on February 18, 2025.

Analysts project Occidental Petroleum’s earnings per share (EPS) to be $0.64, marking a 13.51% decline compared to the same quarter last year. Revenue is expected to drop 5.36% to $7.13 billion. These projections reflect ongoing challenges in the energy sector, including fluctuating oil prices and shifting market dynamics.

Recent changes in analyst estimates for Occidental Petroleum have also drawn attention. Such revisions often signal shifts in near-term business trends. Positive estimate adjustments typically indicate optimism about a company’s financial health and profitability. According to Zacks Investment Research, these estimate changes are closely correlated with short-term stock price movements.

Occidental Petroleum currently holds a Zacks Rank of #3 (Hold), reflecting a neutral outlook. The company’s Forward P/E ratio of 15.84 is slightly higher than the industry average of 14.28, suggesting a premium valuation. The Oil and Gas – Integrated – United States industry, part of the broader Oils-Energy sector, ranks 78 out of 250+ industries, placing it in the top 32%.

Investors are advised to monitor upcoming earnings and any further revisions to analyst estimates, as these factors could significantly influence Occidental Petroleum’s stock performance in the coming weeks.