Business

Oklo Inc. Shares Surge 87% in 2023 Amid Growth Prospects

NEW YORK, NY — Shares of Oklo Inc. have soared by 87.1% this year, significantly outpacing the Zacks Alternative-Energy industry’s return of 14.8% and the broader Oils-Energy sector’s decline of 2.7%. In comparison, the S&P 500 has risen by only 0.7% during the same period.

Other energy industry players have also reported impressive growth. Constellation Energy Corporation and GEV Vernova have seen their shares climb by 31.4% and 35.7%, respectively, year to date. This robust performance may attract investors to Oklo, but experts advise caution and deeper analysis before making investment decisions.

Oklo’s strong stock performance can be attributed to its first-quarter 2025 results, strategic acquisitions, and industry agreements. The company reported a narrower loss per share than the Zacks Consensus Estimate and achieved significant year-over-year improvements, boosting investor confidence.

In February 2025, Oklo acquired Atomic Alchemy, aiming to enhance its abilities in nuclear fuel recycling and radioisotope production. This merger positions Oklo to meet the growing demand for radioisotopes in various sectors, including medicine and defense.

Furthermore, in March 2025, Oklo entered into an agreement with Idaho National Laboratory to adhere to environmental regulations and finalized a Memorandum of Agreement with the U.S. Department of Energy, which is part of its plan to deploy its first commercial powerhouse in Idaho.

Rising global electricity demand, driven by expanding data centers and economic growth in emerging markets, further solidifies Oklo’s position. As the U.S. accounts for about 30% of the world’s nuclear power generation, Oklo’s ongoing development of next-generation fast-fission power plants, particularly its Aurora powerhouse line, proves timely.

Despite the positive outlook, Oklo faces challenges. The company has yet to begin generating revenue, with its first Aurora powerhouse expected to launch in 2027. High operating expenses have pressured its bottom line, raising concerns for short-term investors.

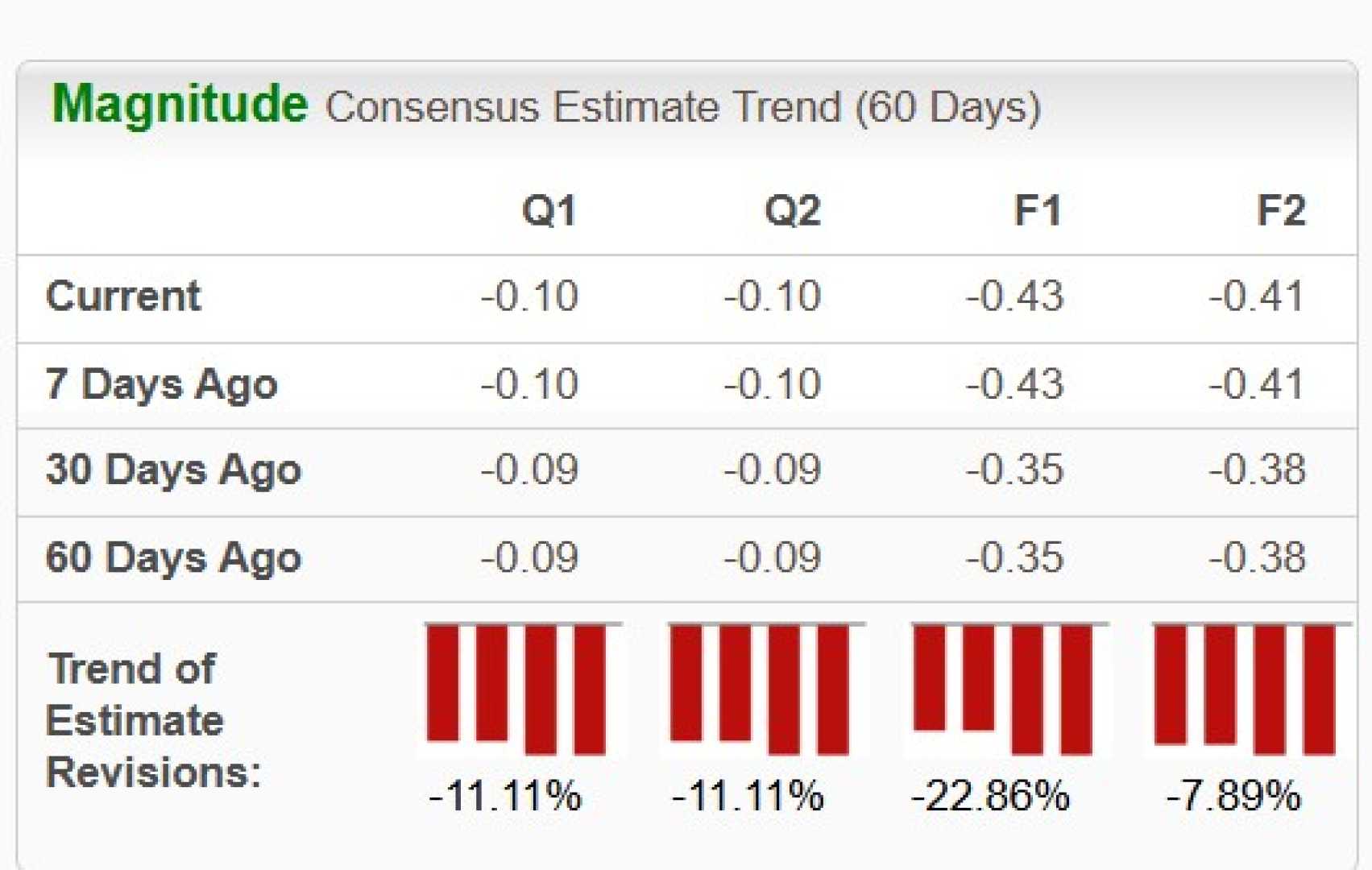

Analysts indicate mixed trends in Oklo’s near-term earnings estimates, with some expecting improvement in 2025 but deterioration in 2026. Recent downward revisions suggest a cautious sentiment regarding the company’s earnings potential.

Currently, Oklo shares trade at a premium, with a price-to-book ratio of 20.53 compared to the industry average of 4.68. Their peers, Constellation Energy and GEV Vernova, also trade at elevated valuations.

Investors eyeing Oklo may want to be cautious, considering the high valuation and declining earnings outlook. However, those who currently hold shares may continue, given the company’s impressive performance and progress in its strategic goals.