Business

Oklo Inc. Stock Soars 95% Amid Clean Energy Boom

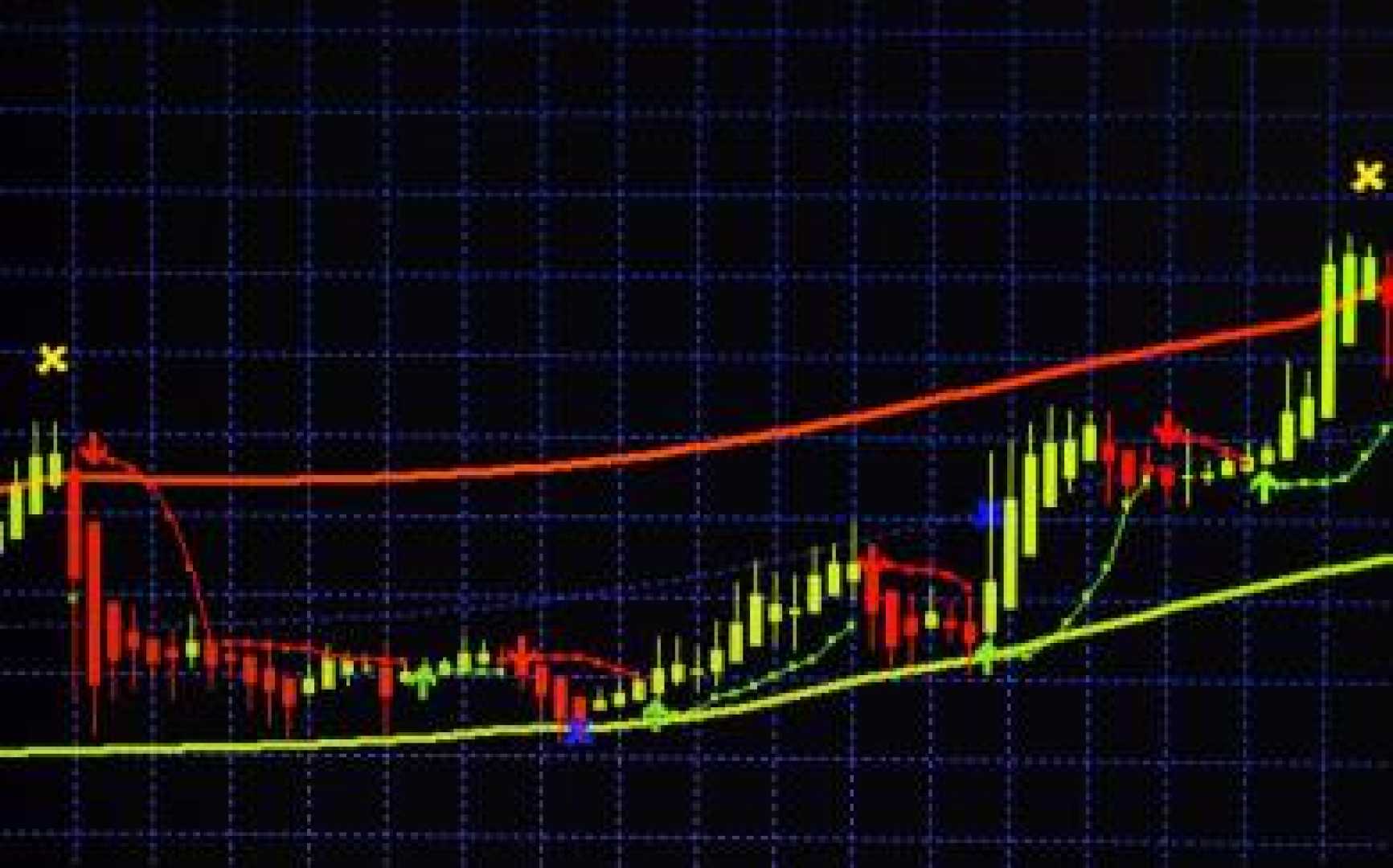

Shares of Oklo Inc. (OKLO) have surged 95.3% over the past three months, significantly outperforming the broader market and the alternative-energy sector. The stock’s rise is fueled by the company’s strategic partnerships, operational milestones, and the global push toward clean energy solutions.

In its third-quarter 2024 earnings report, Oklo announced the addition of two data center customers, expanding its customer pipeline to 2,100 megawatts—a 200% increase since July 2023. The company also signed a letter of intent to acquire Atomic Alchemy Inc., a manufacturer of radioisotopes, tapping into a market projected to reach $55.7 billion by 2026.

Oklo’s recent partnership with Switch, aimed at deploying 12 gigawatts of Aurora powerhouse projects through 2044, marks one of the largest corporate power agreements in history. The Aurora powerhouses, designed to produce 15-50 megawatts of electricity from recycled nuclear fuel, position Oklo as a key player in the growing nuclear power generation market.

Despite its impressive stock performance, Oklo has yet to generate revenue. The company’s first Aurora powerhouse is slated for deployment in 2027, meaning near-term financial performance remains uncertain. Operating expenses continue to weigh on its bottom line, with analysts revising earnings estimates downward.

Oklo’s return on equity (ROE) also lags behind industry averages, reflecting its current financial challenges. However, the company’s long-term growth prospects in the clean energy sector remain strong, driven by increasing global electricity demand and the U.S.’s leadership in nuclear power generation.

Investors considering Oklo stock should weigh its near-term financial risks against its long-term potential. While the stock holds a Zacks Rank #3 (Hold), its recent performance and strategic initiatives suggest it could be a compelling option for those with a higher risk tolerance.