Business

Palo Alto Networks Set to Report Earnings Amid Market Uncertainty

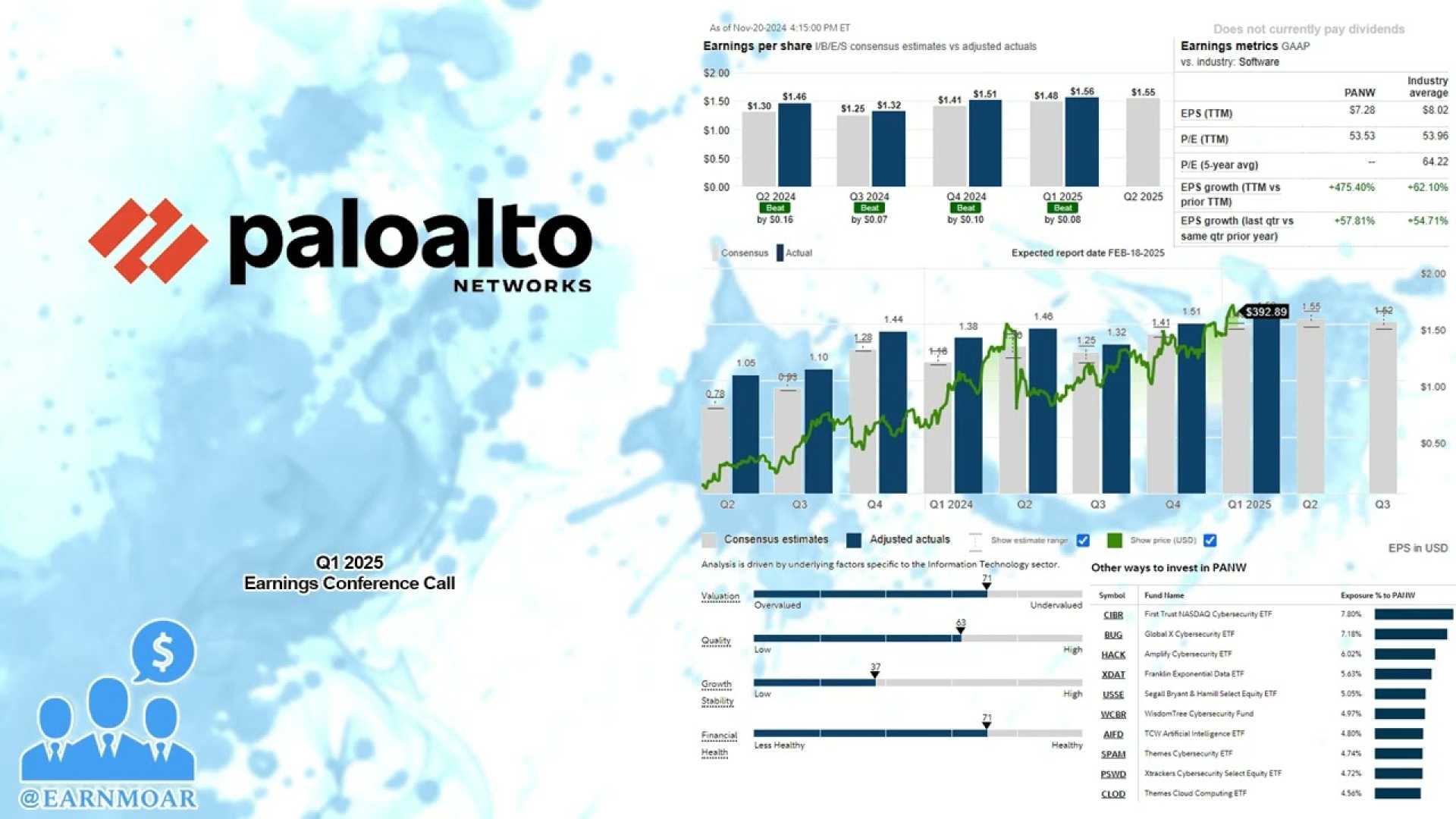

The cybersecurity firm Palo Alto Networks is scheduled to announce its first-quarter earnings on November 19, after the market closes. Analysts expect the company to report revenues of approximately $2.46 billion, a significant increase from last year’s figures of $2.14 billion.

While earnings per share (EPS) growth typically outpaces revenue growth, Palo Alto has a history of exceeding earnings estimates every quarter since the fourth quarter of 2021. This trend raises the possibility of EPS growth outpacing revenue growth, despite current projections.

The company’s revenue primarily derives from subscription services, which contribute to stable and predictable financial growth. Furthermore, Palo Alto’s consistent performance can be seen in the trends from previous years.

In addition to earnings expectations, options traders are anticipating significant movement in the stock price following the earnings report. TipRanks’ Options tool calculates the expected volatility based on market options, providing insights into investor sentiment.

Wall Street analysts currently hold a Strong Buy consensus rating for Palo Alto Networks stock (PANW), with 25 Buy ratings and three Holds in the past three months. The average price target sits at $237.52 per share, suggesting a potential upside of 18.4% based on current trading levels.

As the firm prepares for its earnings release, investors and analysts alike are eager to see if Palo Alto Networks can maintain its impressive growth trajectory amid a competitive landscape. The prevailing sentiment indicates a degree of optimism, with many anticipating continued success for the firm.