Business

Popularity and Performance of Schwab U.S. Dividend Equity ETF

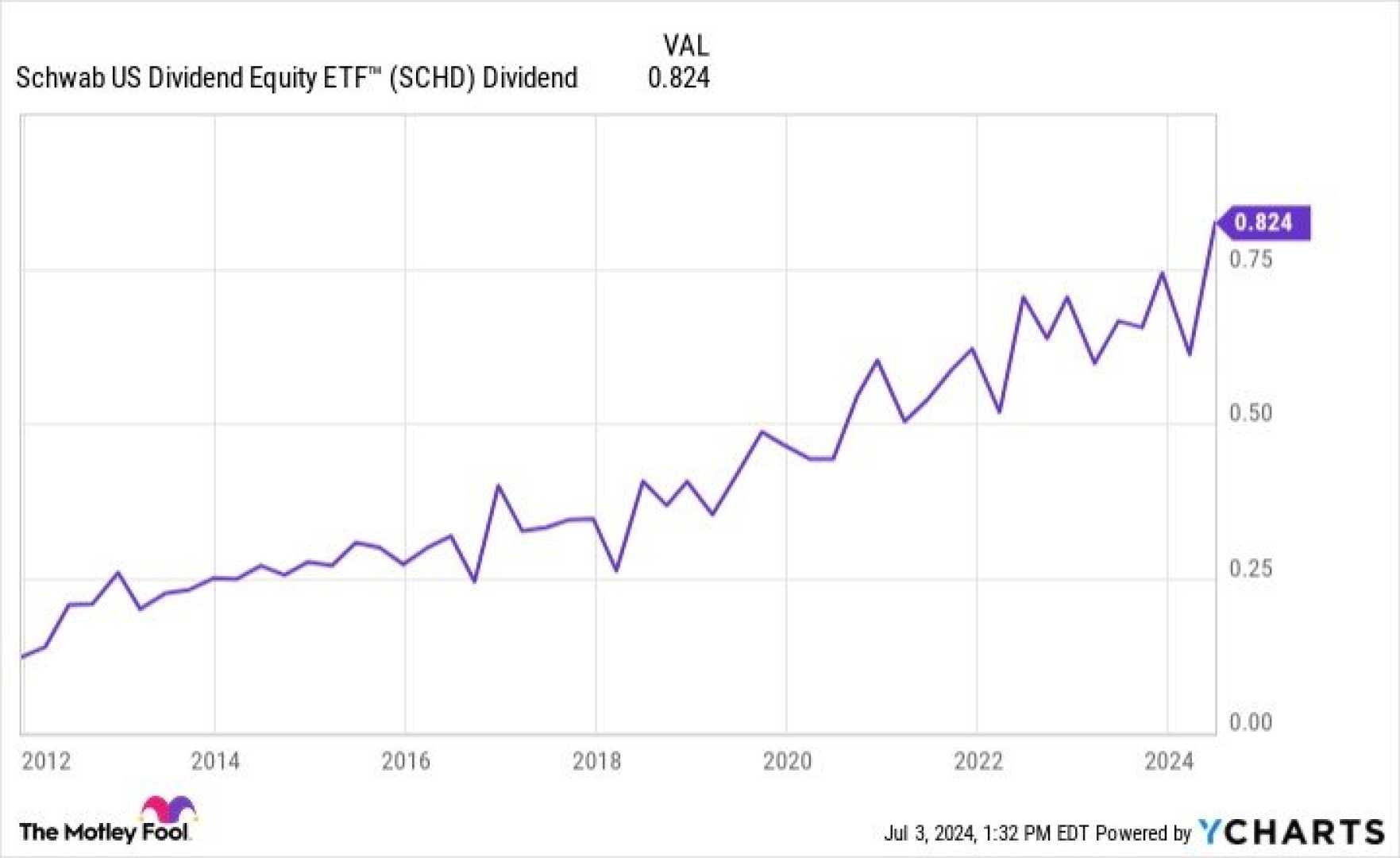

The Schwab U.S. Dividend Equity ETF, identified by its ticker symbol SCHD, has gained significant traction among investors focusing on dividend returns and total portfolio performance. The ETF, which has experienced a noteworthy track record of outperformance, has seen a decline since the year 2020 compared to the S&P 500 index.

Dale Roberts, known for his work on the Cut The Crap Investing blog, has highlighted the ETF’s potential for Canadians who are often subjected to high investment fees. According to Roberts, “Canadians currently pay some of the highest investment fees in the world,” and initiatives like SCHD offer an opportunity for more affordable investment strategies. Roberts has extensive experience as a former Investment Funds Advisor and Trainer at Tangerine Investments, and he continues to write on financial topics such as asset allocation and dividend investing.

Despite the ETF’s solid performance earlier, its recent trajectory has spurred discussions among analysts. An experienced Chief Financial Officer with a background in the oilfield and real estate industries mentioned that the ETF achieved an 11% total return since July, surpassing the S&P 500. This performance illustrates the current demand for dividend-focused investment vehicles.

Analysts, such as those writing for Seeking Alpha, often underline that past performance is not a guarantee of future results and advise investors to conduct thorough research or consult financial advisors. The opinions shared in articles are typically the personal views of the authors and may not always align with official stances, as noted by the disclosure policies of platforms like Seeking Alpha.