Politics

Potential Tax Changes and Economic Policies Under Labour Scrutiny Ahead of First Budget

With only a few weeks remaining before the Government’s first Budget under Labour, speculation is rife about possible economic changes, including tax policies that could significantly impact citizens’ financial planning. As part of Labour’s manifesto, officials have pledged to support “working people,” thereby ruling out any increases in income tax, National Insurance, and VAT. However, other tax areas do not appear to be similarly shielded from potential adjustments.

Sarah Coles, a personal finance analyst at Hargreaves Lansdown, commented: “Labour hasn’t ruled out raising capital gains tax. It would enable the Government to deliver on the promise not to raise taxes for ‘working people,’ because it’s a tax on wealth. However, it’s a tough balancing act, because it doesn’t sit well with its plans to be a government that helps people create wealth.”

Chris Rudden of Moneyfarm highlighted concerns regarding the stability of the capital gains tax rate, saying, “Labour pledged that it wouldn’t go after income tax or National Insurance, and I don’t think they would renege on that straight away. However, I have a sneaking suspicion that capital gains tax is not safe.”

Inheritance tax has also been a subject of intense debate within Labour’s circle. Darren Jones, the shadow chief secretary to the Treasury, has reportedly suggested using inheritance tax to redistribute wealth and address intergenerational inequality. This could involve modifying existing exemptions that allow families to reduce their inheritance tax obligations, leading to potential changes or eliminations of these reliefs.

The state of the UK’s pensions is another focus area. Labour is committed to maintaining the ‘triple lock’ for state pensions, which ensures they increase by the highest of inflation, wages, or 2.5%. However, there are concerns regarding broader pension policy changes. Alice Haine from BestInvest said: “Although Labour appears to have ditched a previous pledge to reinstate the pensions lifetime allowance, it is possible it may explore other avenues for changing the taxation of pensions.”

Furthermore, Labour may target the personal savings allowance and Isa limits as potential revenue streams. Currently, the personal savings allowance allows basic-rate taxpayers to earn £1,000 of interest tax-free, a figure that has effectively been reduced over time due to unchanged thresholds amidst rising saving rates.

Labour leader Sir Keir Starmer has not ruled out the possibility of council tax reform, aiming for a system that could reflect property values more accurately. This comes amid proposals from think tanks like the Fairer Share to introduce a proportional tax system, though impacts on households remain a concern.

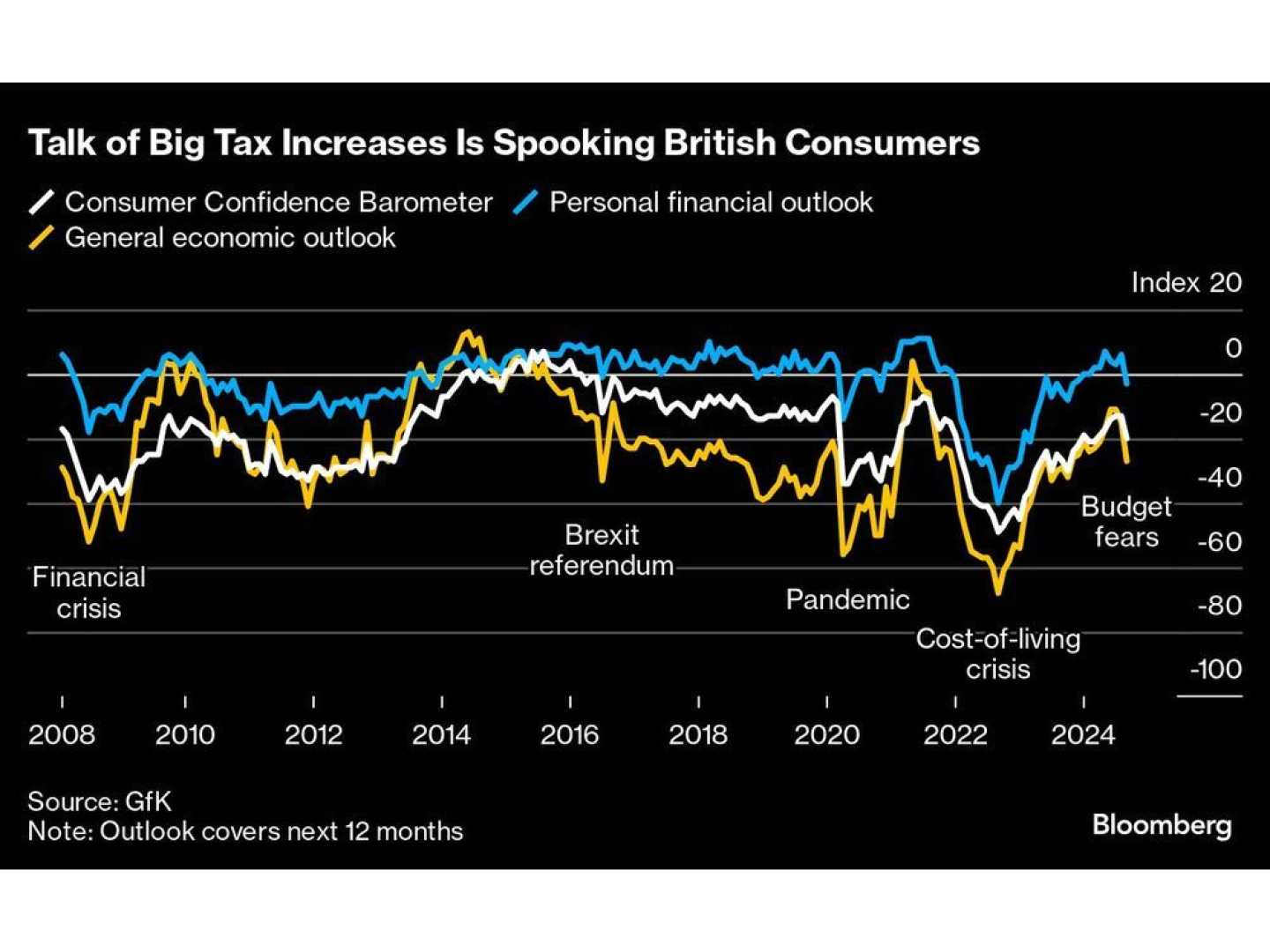

As Labour prepares for its Budget announcement, experts anticipate clashes over fiscal policies, especially as the party navigates implementing its envisioned economic changes while maintaining its public commitments. The party faces pressures from within, and external analysts underscore the complexities of balancing its spending ambitions with revenue generation.

Economist Sarah Coles further emphasized the financial challenges ahead, noting: “Labour made some expensive commitments during the campaign, including sticking with the pensions triple lock and ruling out rises in income tax, National Insurance, or VAT. However, money will be tight.”