Business

US PPI Data and Federal Budget Deficit in Focus Today

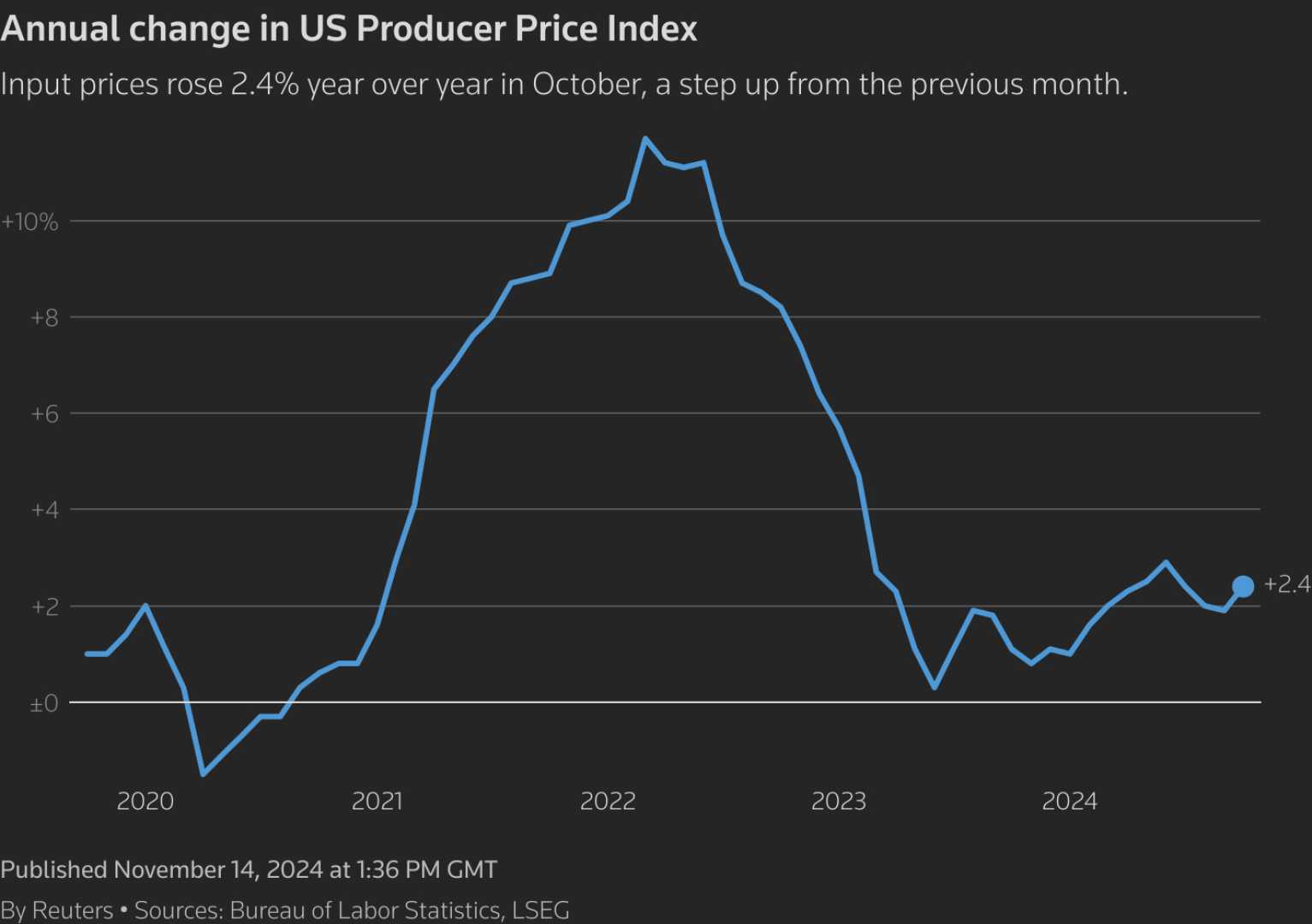

WASHINGTON, D.C. — The U.S. Producer Price Index (PPI) for December 2024, released Tuesday at 8:30 a.m. ET, showed a modest rise of 0.3%, following a 0.1% decline in the same period last year. Economists are closely monitoring the data for signs of inflationary pressures as the Federal Reserve prepares for its next policy decision.

The PPI, which measures the average change in selling prices received by domestic producers, is a key indicator of inflation trends. The December figures come amid concerns over rising costs in manufacturing and energy sectors. Analysts predict a further increase of 0.6% in January 2025, though some caution that these numbers may not fully reflect underlying economic trends.

Later in the day, at 2 p.m. ET, the federal budget for December will be released. Estimates suggest a deficit of $75 billion, a significant improvement from November’s $367 billion shortfall. The reduction is attributed to increased tax revenues and decreased government spending during the holiday season.

Federal Reserve officials are scheduled to speak throughout the day, with markets eagerly awaiting insights into future monetary policy. The combination of PPI data and Fedspeak is expected to influence investor sentiment and market movements.

“The PPI numbers are a mixed bag,” said Jane Doe, chief economist at Global Insights. “While the monthly increase is encouraging, the year-over-year trend remains concerning. The Fed will need to tread carefully in balancing inflation control with economic growth.”

Investors are also keeping an eye on the federal budget deficit, which has been a persistent issue in recent years. “The December numbers are a positive sign, but we need to see sustained improvement to address the long-term fiscal challenges,” said John Smith, a senior analyst at Fiscal Watch.