Business

October PPI Rises 0.2%, Fueling Fed Rate Cut Hopes Amid Steady Inflation and Jobs

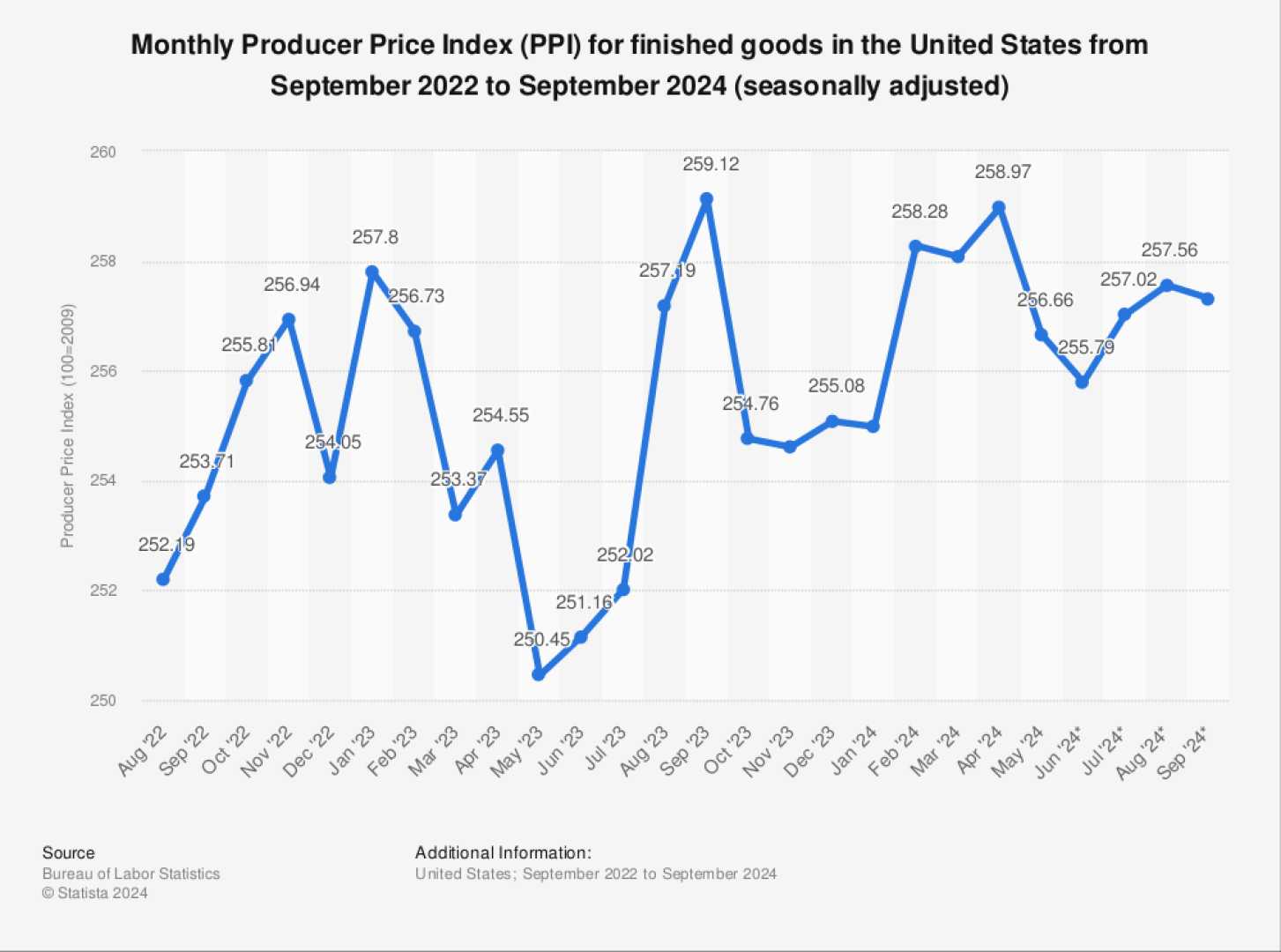

The latest Producer Price Index (PPI) report for October 2024 has shown a modest increase, rising by 0.2%. This slight uptick in producer prices is being closely watched by economists and investors as it provides insights into the broader inflation landscape and potential future monetary policy decisions by the Federal Reserve.

The October PPI figure, while indicating a continued presence of inflationary pressures, is relatively mild and does not significantly deviate from recent trends. The overall annual rate of PPI inflation stood at 2.4% in October, which is a manageable level considering the economic context.

The steady inflation data, combined with stable job market indicators, has reignited hopes for a potential rate cut by the Federal Reserve in the near future. Market participants are closely monitoring these economic indicators as they anticipate the Fed’s next moves, which could have significant implications for interest rates and the overall economy.

In addition to the PPI data, the financial markets are also awaiting key speeches from Federal Reserve officials, including Chairman Jerome Powell, as well as earnings reports from major companies like Disney. These events are expected to provide further clarity on the economic outlook and influence market sentiment.