Business

Quantum Computing Stock Soars 1,000% Amid Hype, Analysts Warn of Overvaluation

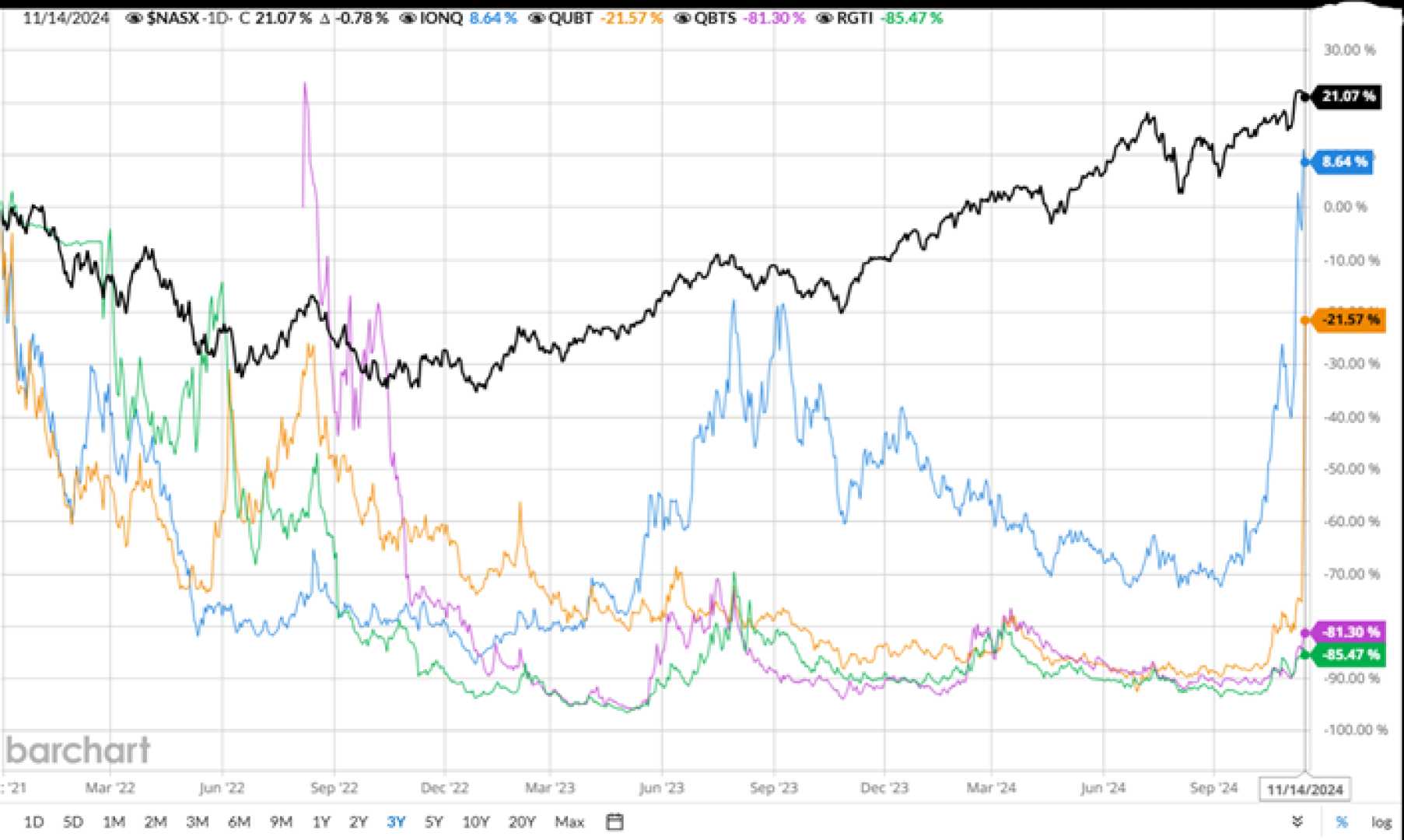

NEW YORK — Quantum Computing Inc. (QUBT) has seen its stock price skyrocket nearly 1,000% over the past year, but analysts are warning that the company’s valuation is severely overextended. Despite its promise in the emerging quantum computing sector, the company’s financials reveal a stark disconnect between its market capitalization and actual revenue.

Quantum Computing, which pivoted from a beverage company to a quantum computing firm in 2018, reported just $100,000 in revenue for Q3 FY24 and $400,000 over the past year. Meanwhile, its market capitalization stands at approximately $1.5 billion. The company has also burned through $5.1 million in each of the last two quarters, raising concerns about its financial sustainability.

“I’m bearish on Quantum Computing because the valuation metrics are overextended, and a large cohort of quantum computing companies will likely struggle to raise capital before the quantum revolution becomes a reality,” said one market analyst. “Consumers are excited about quantum computing, but investors are struggling to find value.”

The quantum computing industry is still in its infancy, with the market projected to grow from $1.3 billion in 2024 to $5.3 billion by 2029. However, the sector is crowded with over 200 startups since 2013, and many smaller companies may struggle to achieve profitability due to high development costs and intense competition from tech giants like IBM, Google, and Amazon.

IBM, for example, has committed $100 million to university partnerships and aims to build the world’s first 100,000-qubit quantum-centric supercomputer. In contrast, Quantum Computing’s technology remains in the developmental stages, with its ‘entropy quantum computer’ yet to achieve commercialization.

QUBT’s valuation metrics are staggering, with an enterprise value-to-sales ratio of 3,870x and a price-to-sales ratio of 2,550x, both significantly higher than the information technology sector median. The company’s price-to-book ratio of 18x is also 427% above the sector median. Despite these lofty valuations, Quantum Computing has only $3.1 million in cash against $7.8 million in debt.

Wall Street analysts remain cautious. Only one analyst, Edward Woo, has rated the stock over the past three months, labeling it a “Moderate Buy” but implying a 13.5% downside potential compared to current prices. “The current market cap suggests a faith in growth that is years, if not decades, away,” the analyst noted.

As the quantum computing industry matures, market consolidation is expected, with many smaller players likely to fail. For Quantum Computing, the near-term outlook remains bleak, with its astronomical valuation and speculative bull run appearing unsustainable.