Business

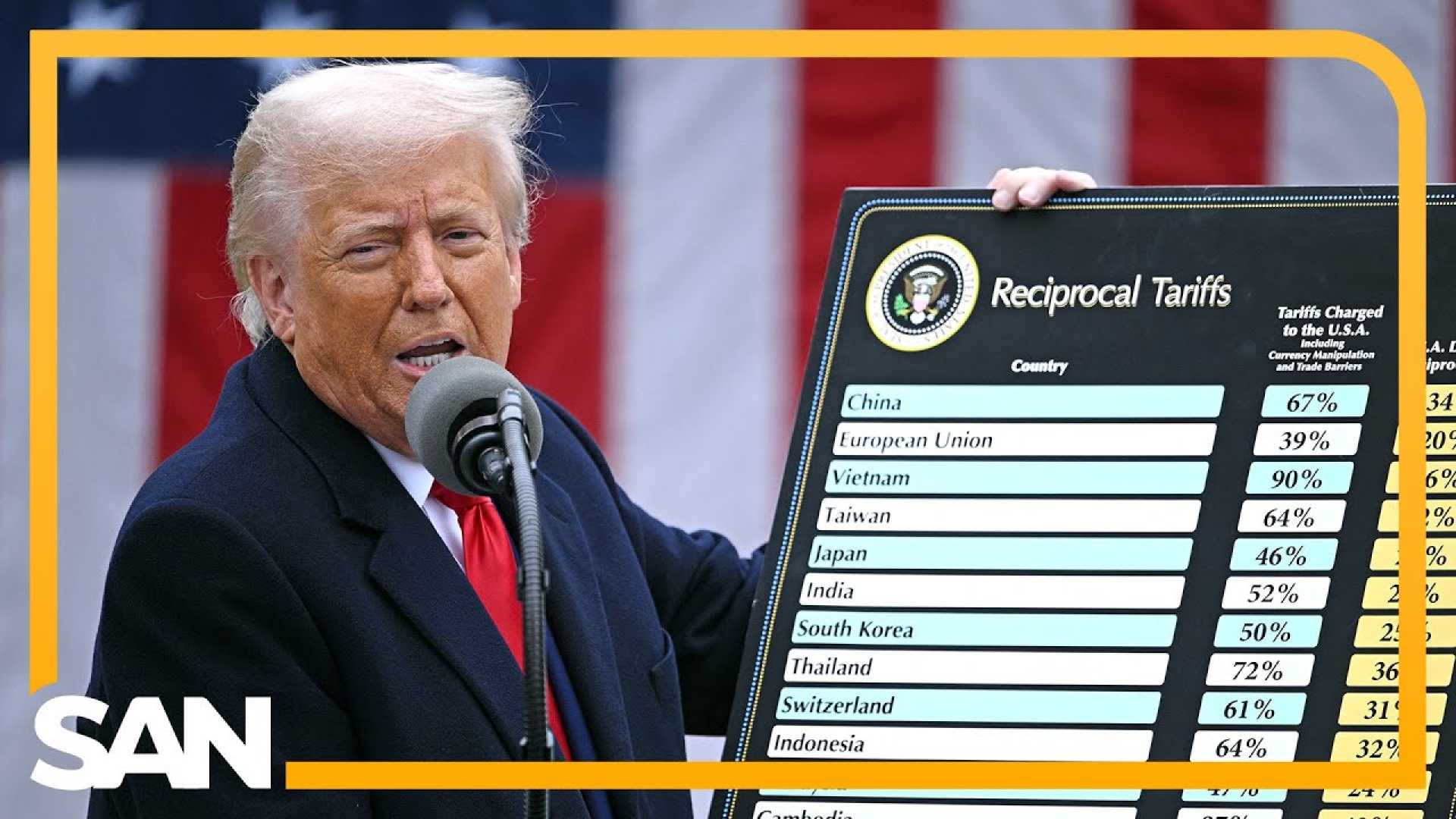

U.S. Reciprocal Tariff Calculations Spark Debate on Trade Policies

WASHINGTON, D.C. — The calculation of reciprocal tariffs by the U.S. aims to address persistent bilateral trade deficits with partner countries. This approach contemplates a tariff rate necessary to balance trade, assuming that trade discrepancies are propelled by both tariff and non-tariff barriers.

According to recent findings, reciprocal tariff rates can fluctuate dramatically, with a range from 0 percent to 99 percent, yielding unweighted and import-weighted averages of 20 percent and 41 percent respectively. The broad calculation reflects attempts to rectify a trend of trade deficits that have persisted over several decades.

The United States has encountered current account deficits for nearly fifty years, contradicting assumptions inherent in traditional international trade models. Factors contributing to unbalanced trade include regulatory challenges, environmental regulations, differential tax rates, currency manipulation, and various compliance costs keeping U.S. products at a disadvantage.

As a result, U.S. consumer demand has been diverted abroad, leading to significant economic losses, including the closure of over 90,000 factories since 1997 and a decline of 6.6 million manufacturing jobs. These statistics indicate a troubling trend for the American workforce, with over a third of manufacturing jobs lost since their peak.

The methodology for calculating reciprocal tariffs entails identifying the tariff that would mitigate trade deficits to zero. While assessing the complex impacts of numerous policies across various nations is intricate, modeling a reciprocal tariff offers a workable solution aimed at promoting equitable trade.

In models where the U.S. applies a tariff rate (τ_i) on a trading partner (i), various economic parameters come into play, including the elasticity of imports to price changes and the responsiveness of import prices to tariff adjustments. The net effect on imports, impacted by tariff changes, can guide policymakers toward a balanced trade goal.

Data from the U.S. Census Bureau has been utilized to derive necessary tariff rates for 2024. The price elasticity of import demand was positioned at 4 for the calculations, reflecting a cautious stance given varying estimates in recent research, which cites lower elasticity values in the long-run.

Preliminary findings suggest that while the simple formulation yields a broad spectrum of potential tariffs, higher minimum rates may be required to address variations in rate applications across countries. Notably, the average tariff rate across countries running a trade deficit stands at approximately 50 percent.

Significant discussions are now arising around the implications of these findings. Economic experts have begun to challenge the current administration’s understanding of trade and tariffs, as recent tariffs imposed under previous leadership have prompted questions about the validity of the methodologies used in their calculations.

As the debate unfolds on the best course of action for U.S. trade policy moving forward, experts emphasize the need for clarity and sound economic reasoning. The overarching sentiment remains that any policy approach should be grounded in accurate data and a thorough understanding of international trade dynamics.