Business

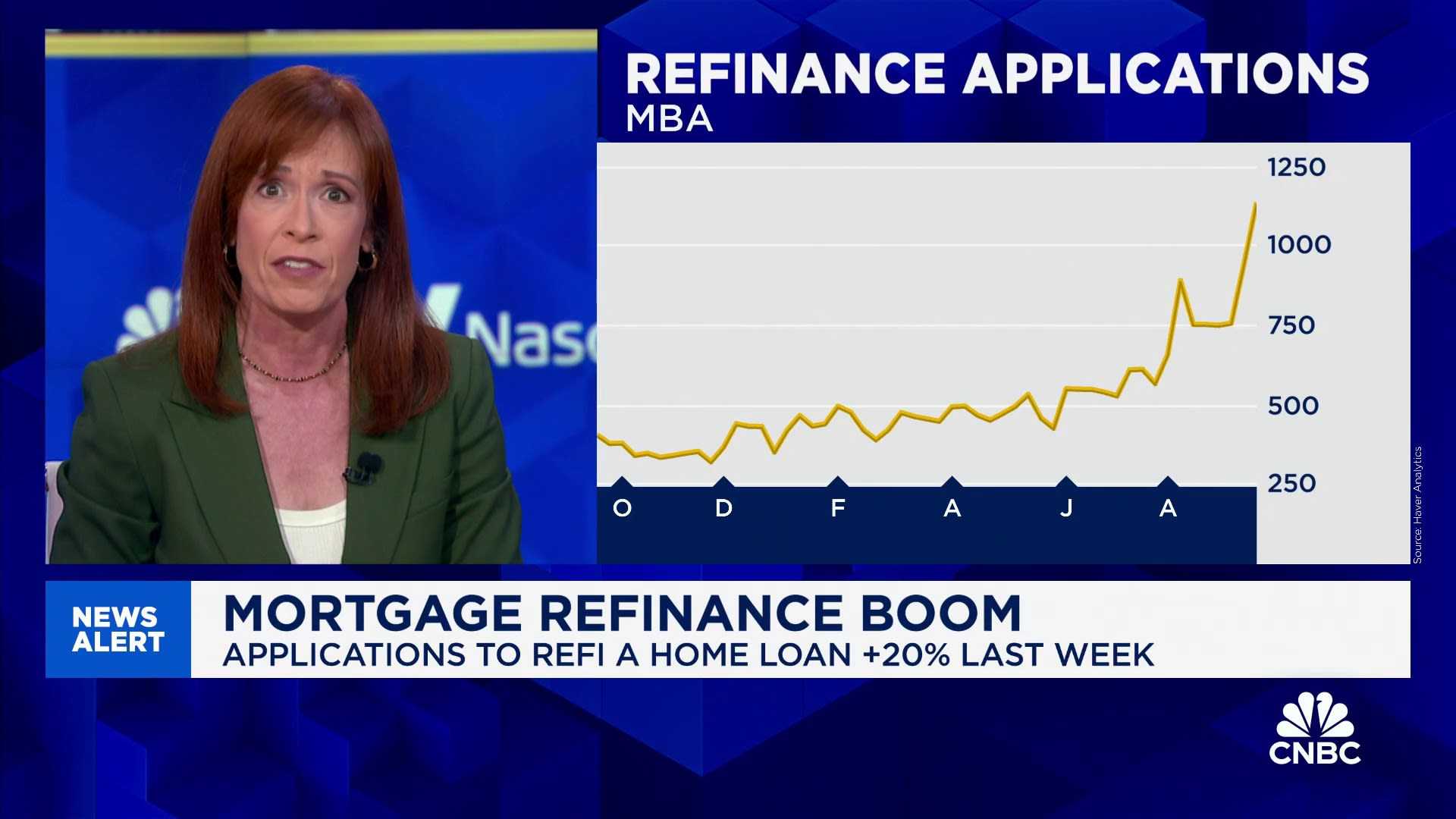

Refinance Applications Soar As Mortgage Rates Remain Steady

WASHINGTON, D.C. — Americans are increasingly refinancing their mortgages, according to new data from the Mortgage Bankers Association announced on July 2. For the week ending June 27, refinance applications rose by 7%, coinciding with a drop in home loan rates to their lowest point since April.

The popular 30-year fixed-rate mortgage averaged 6.79% nationwide during this period. This marks a significant 40% increase in refinance applications compared to the same week last year. In contrast, applications for new purchase mortgages remained unchanged.

Kara Ng, a senior economist at Zillow, commented on the unexpected rise, noting, “Despite the small decline, mortgage rates continue to hover in the same 6%-7% range seen over the past year.” Ng explained that the mixed signals from the economy contribute to the current mortgage rate stability, with signs of a cooling economy pushing for lower rates, while persistent inflation exerts upward pressure.

Dan Richards, President of Flyhomes Mortgage, elaborated on the trend, stating, “Homeowners are looking for any chance to save money on their housing costs, and even small savings can make a difference right now.” He added that many homeowners who bought in the last few years have been waiting for rates to dip below 6% to refinance. However, he suggests that the 6-7% range is becoming the ‘new normal.’

Economists predict that mortgage rates will remain stable in the near future. Traders in mortgage futures anticipate that the average 30-year fixed-rate mortgage will sit around 6.7% in November.