Business

US Retail Sales Rise Less Than Expected Amid Economic Concerns

WASHINGTON—US retail sales increased by 0.2% in February, falling short of expectations as consumer spending remained tepid, according to a report from the Commerce Department released Monday. The figure, while an improvement from January’s revised 1.2% decline, came in below the Dow Jones estimate for a 0.6% increase.

Excluding automotive sales, retail sales rose by 0.3%, aligning with analysts’ projections. This month’s sales report is seasonally adjusted but not adjusted for inflation. The Labor Department noted prices increased by 0.2%, suggesting that consumer spending matched inflation rates.

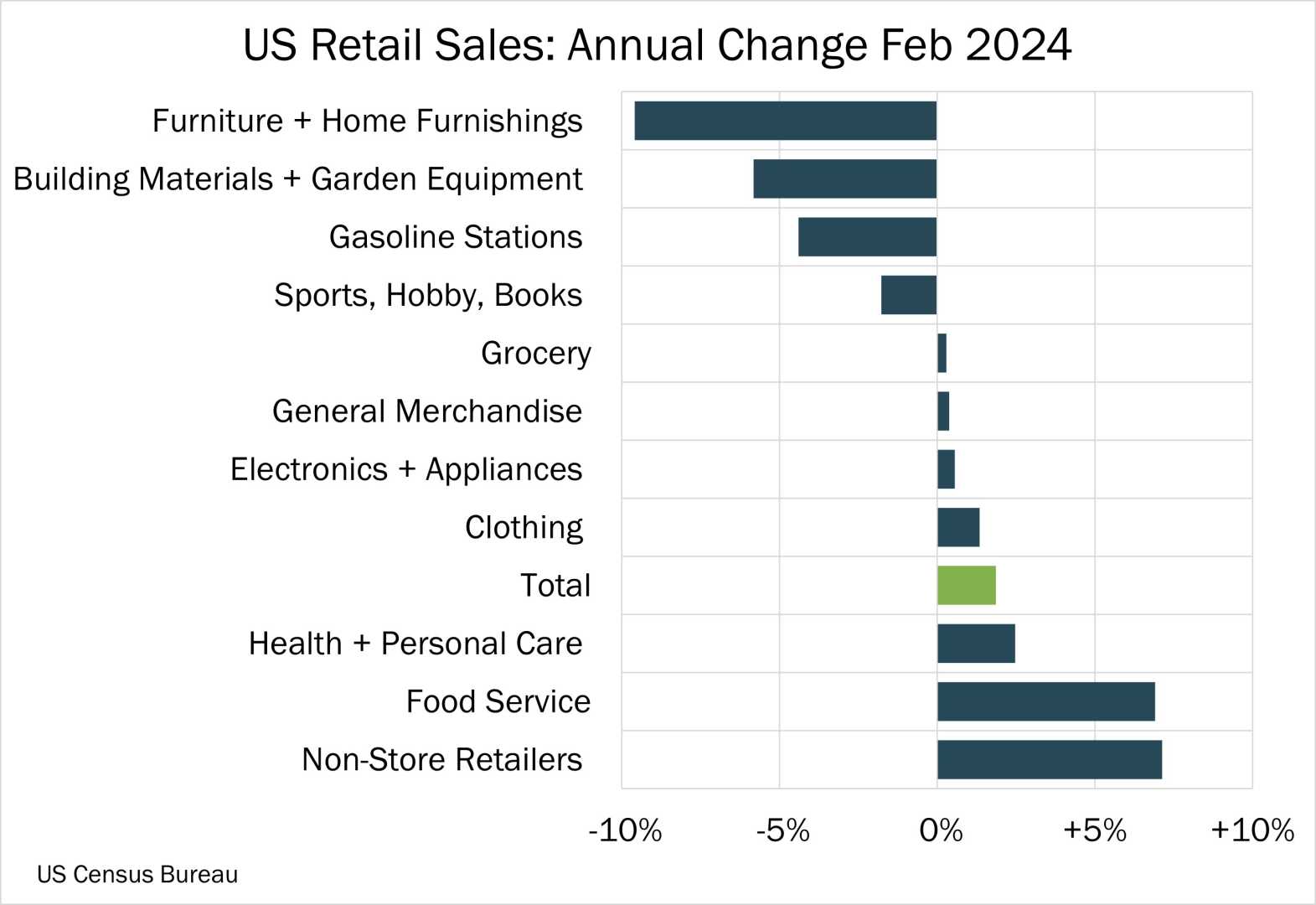

The control group, which excludes noncore sectors and is critical in gross domestic product calculations, saw a notable rise of 1%. The boost in online shopping was significant, with nonstore retailers reporting a 2.4% increase in sales. Health and personal care retail experienced a 1.7% gain, while food and beverage places rose by 0.4%. However, bars and restaurants saw a decline of 1.5%, and gas stations reported a 1% decrease as fuel prices continued to fall.

Year-over-year, retail sales increased by 3.1%, outpacing the 2.8% inflation rate measured by the Consumer Price Index. Nonetheless, one cautionary note from the latest report was the substantial revision of the January figures, which was initially recorded as a 0.9% decline.

The latest figures emerge against a backdrop of rising inflation concerns and economic uncertainty exacerbated by President Donald Trump’s tariff policies. Economists are worried that ongoing tariff disputes may lead to increased inflationary pressures and stall economic growth.

The Atlanta Federal Reserve’s GDPNow model is projecting negative growth as economic conditions worsen, though there is hope that the robust growth in control retail sales may lead to an upward revision in estimates later today.

In addition to the retail sales data, another report from the New York Federal Reserve indicated a marked decrease in manufacturing activity. The Empire State Manufacturing Survey fell to -20 in March, a significant drop from February’s 5.7 and well below the anticipated -1.8.

As analysts interpret these mixed signals, the Fed’s upcoming meetings are drawing heightened interest. With inflation trends and growth projections closely monitored, market expectations indicate that the Federal Reserve is unlikely to raise interest rates in the immediate future, amid discussions of potential rate cuts later in the year.

The release of the two economic indicators rounds out a critical period of observation for Federal Reserve officials, who are tasked with monitoring inflation while balancing growth concerns stoked by external tariff pressures.