Business

Retirees Concerned Over Low 2025 Social Security Increase

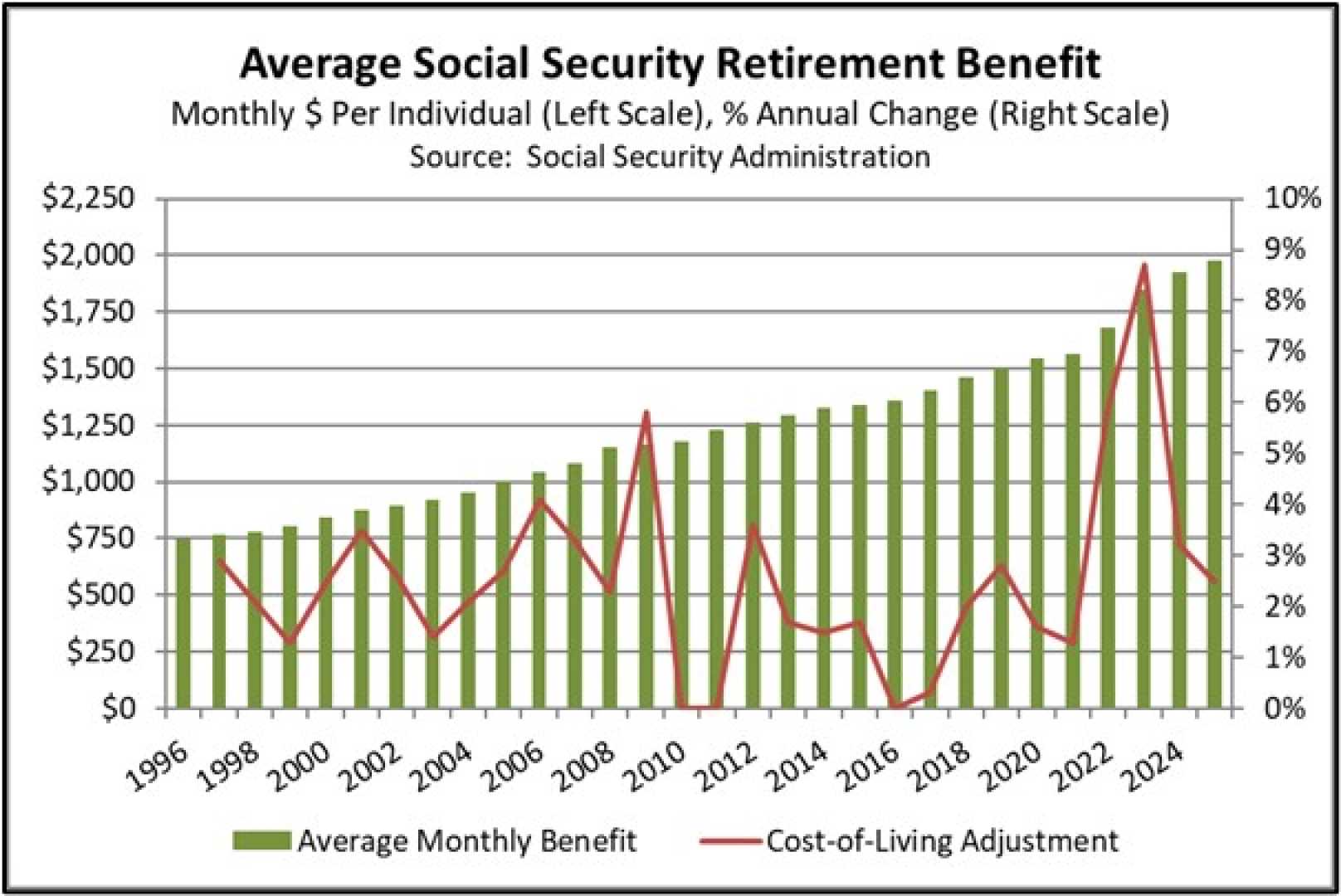

WASHINGTION, D.C. — Many retirees are expressing frustration over the Social Security Administration‘s 2.5% cost-of-living adjustment (COLA) for 2025, which translates to an average monthly increase of just $49. As costs continue to rise, this adjustment falls short for those relying on their benefits for a significant portion of their income.

The COLA increase was determined by comparing the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) data from the third quarter of the previous year with the current year. The measurement reflected an inflation rate that somewhat disappointed advocates for seniors, who were hoping for a more substantial rise.

“It’s incredibly frustrating to see such a small increase when our expenses, like groceries and healthcare, have risen significantly,” said Mary Johnson, a policy analyst at The Senior Citizens League (TSCL). “Retirees often depend on these benefits to cover essential costs, and a mere $49 increase doesn’t meet their needs.”

Looking ahead to 2026, projections for the COLA suggest a potential increase that might surpass earlier expectations. The latest estimates from TSCL indicate a possible rise of 2.3%. If this projection holds, it would bring the average monthly benefit from $1,979 in early 2025 to $2,025.

However, the method used to calculate COLAs raises questions about the actual financial relief they provide. The CPI-W is known to exclude data from retiree households, which can distort the reflection of real costs faced by seniors. Instead, a separate index, the Consumer Price Index for the Elderly (CPI-E), could provide a more accurate picture of inflation impacting this demographic.

Research shows that had the government utilized the CPI-E for adjustments, seniors would have received a larger COLA in seven out of the last ten years, due to differing spending patterns, particularly in healthcare. Johnson noted, “Seniors generally spend a higher proportion of their income on healthcare, so we’re pushing for the CPI-E to be considered for COLAs.”

Proposals to reform COLA calculations have been met with legislative inaction thus far, but with rising inflation concerns and an aging population, the conversation may gain traction. As the 2026 adjustments approach, monitoring third-quarter CPI-W data, which will have its last read on October 15, 2025, will be crucial.

“Seniors are left in limbo, hoping for the best but preparing for potential hardships,” Johnson concluded, as many await further developments regarding their financial futures. “Once we see the number, we’ll have to start planning budgets around it.”