Business

Riot Platforms Mining Production Decreases in April 2025

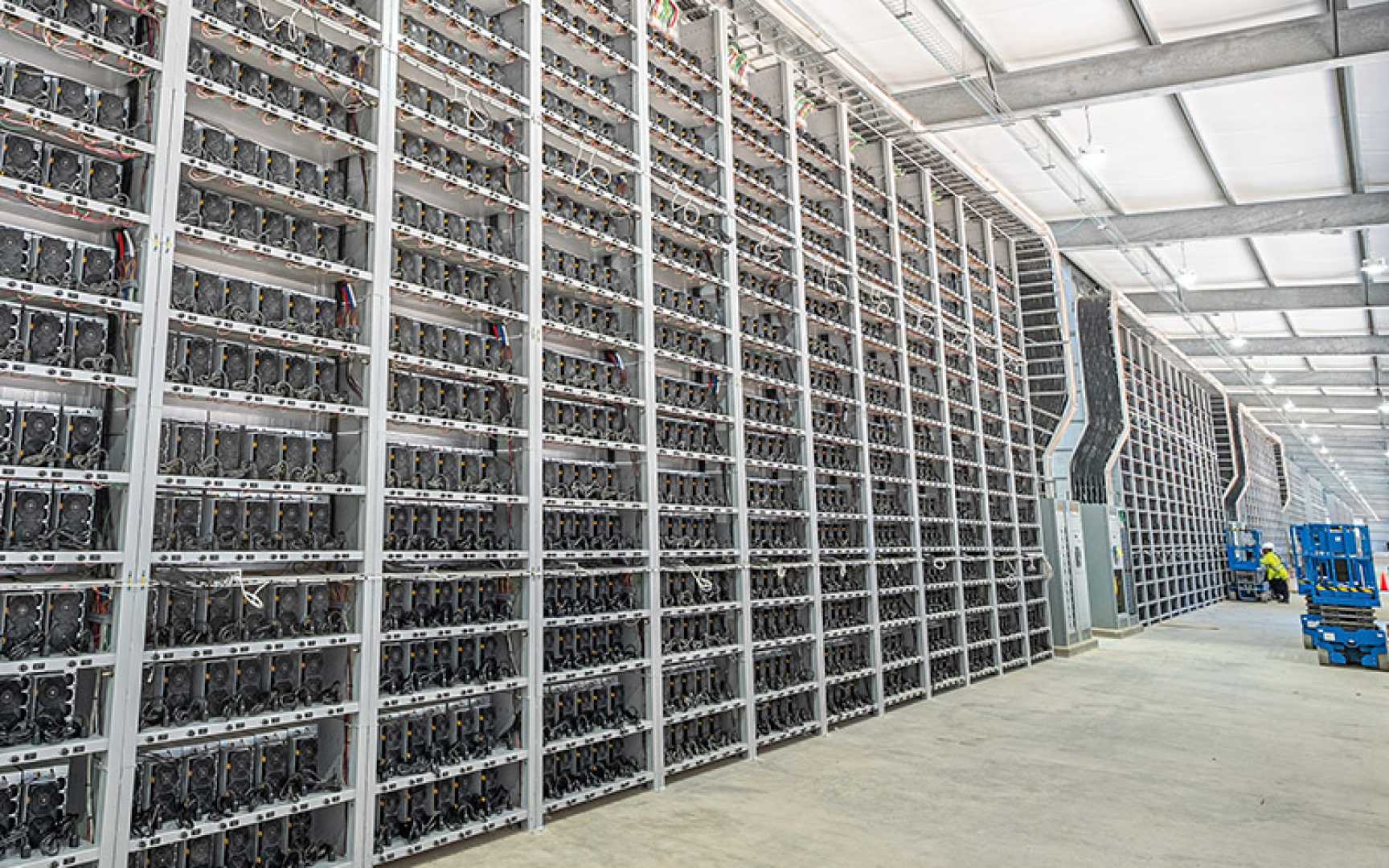

CASTLE ROCK, Colo., May 5, 2025 — Riot Platforms, Inc. (NASDAQ: RIOT), a leader in Bitcoin mining, reported an unaudited production update for April 2025, revealing they mined 463 Bitcoin, down 13% from March.

Despite the drop in output from March’s 533 Bitcoins, the company’s production saw a 23% year-over-year increase from 375 Bitcoin mined in April 2024. This month’s production was affected by two difficulty adjustments in the Bitcoin network, emphasizing the challenges miners face.

Jason Les, CEO of Riot, stated, “April was a significant month for Riot as we closed on the acquisition of all of the tangible assets of Rhodium at our Rockdale Facility.” He noted that this acquisition included 125 MW of power capacity and ended all outstanding litigation, allowing Riot to fully exit the Bitcoin mining hosting business.

Riot’s strategy in April included selling 475 Bitcoin at an average price of $81,731, generating net proceeds of $38.8 million. Les explained, “These sales reduce the need for equity fundraising, limiting the amount of dilution in our stock.”

The company reported holding 19,211 Bitcoin as of the end of April, a stable figure compared to the previous month. Riot’s hash rate capacity remained strong at 33.7 EH/s, an increase of 168% year-over-year.

In terms of power management, Riot achieved total power credits of $2.0 million in April, a 131% rise from March, showcasing the financial benefits of efficient energy use.

As Riot moves forward with its self-mining focus, it remains committed to strengthening its position in the Bitcoin market while also pursuing growth in other sectors.