Business

Rising Treasury Yields Spark Market Anxiety Amid Inflation Concerns

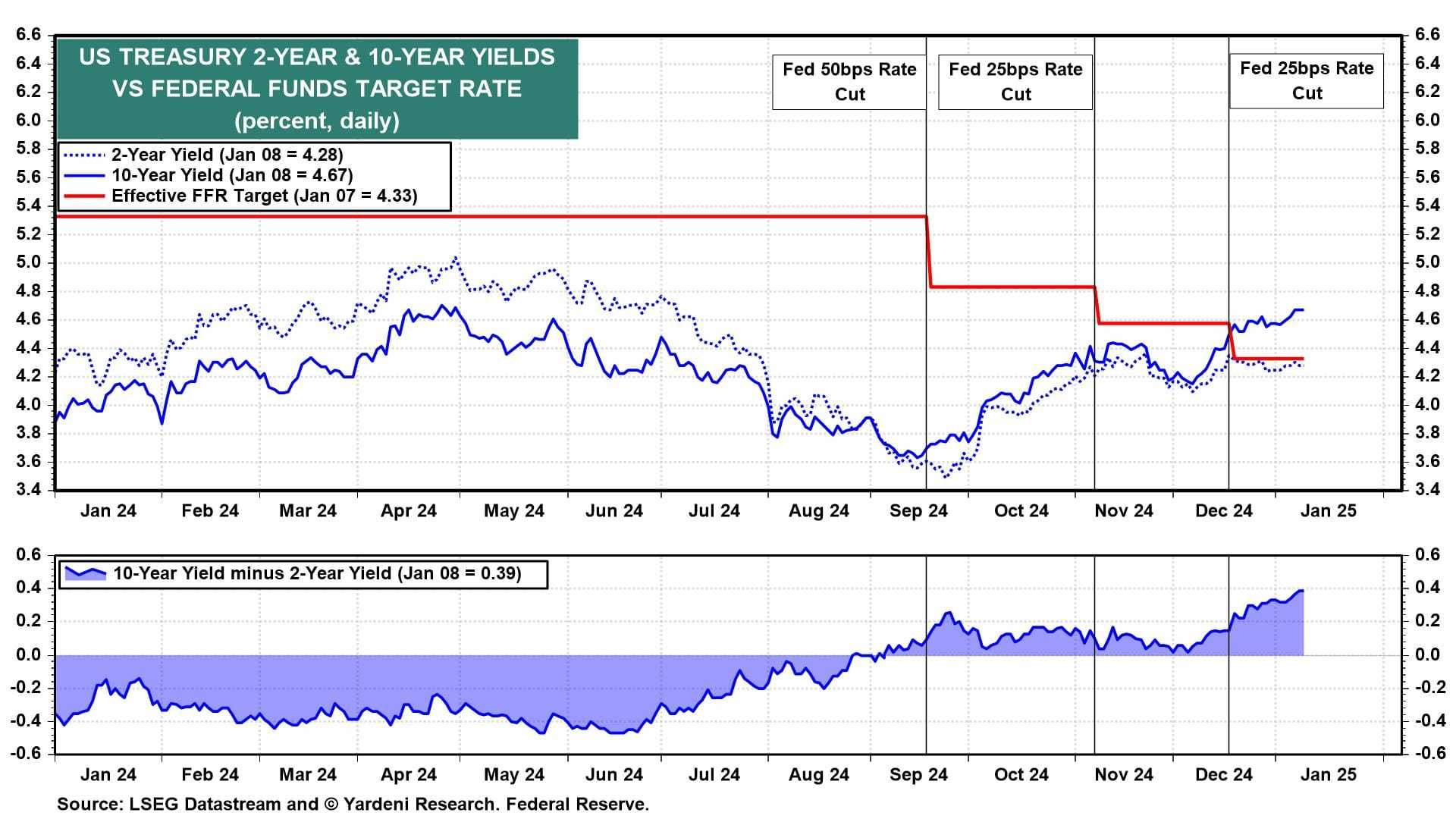

The 10-year Treasury yield has surged to near 4.7%, nearing late-2023 highs, as investors grow increasingly nervous about reaccelerating inflation and the potential impact of President Trump‘s fiscal policies. This rise in yields, coupled with recent data showing higher prices for services, has led markets to slash expectations for Federal Reserve rate cuts in 2025.

According to the Institute for Supply Management, prices paid for services have been ticking up, signaling persistent inflationary pressures. Jurrien Timmer, director of global macro at Fidelity Investments, expressed concern that inflation may not be fully under control. “If the economy accelerates without inflation being completely subdued, we could see inflation rise from the high twos to three and a half or four percent,” Timmer said. “This could prevent the Fed from cutting rates further.”

Markets are now grappling with the possibility that the 10-year yield could reach 5%, a level that could pose significant challenges for equities. The S&P 500 has already pulled back by 2.8% since its record close on December 8, 2024, while the 10-year yield has climbed more than 50 basis points in the same period.

Despite the uncertainty, some strategists remain optimistic about equities. Michael Arone, chief investment strategist at State Street Global Advisors, emphasized that earnings growth, rather than fiscal policy or Fed actions, will be the key driver for stocks this year. “Investors are wrongly obsessed with how many Fed rate cuts we’re going to get,” Arone said. “Earnings are growing, and that’s where the focus should be.”

The bond market’s recent volatility has also reignited debates about the long-term trend of falling yields. Stuart Kirk, a former portfolio manager, noted that the rise in yields could reflect both positive and negative factors. In the U.S., higher yields may signal confidence in President Trump’s pro-domestic agenda, which could boost economic growth. However, in the UK, rising gilt yields have raised concerns about inflation and the country’s ability to manage its debt.

Kirk remains optimistic about his portfolio, which is heavily weighted toward equities and shorter-dated securities. “If the pound weakens, it could actually benefit my funds priced in dollars,” he said. “I’m confident that if markets panic, central banks will step in to stabilize the situation.”

As investors navigate this uncertain environment, the focus remains on whether inflation can be tamed and how central banks will respond to evolving economic conditions. The coming months will be critical in determining whether the bond market’s recent turbulence is a temporary blip or the start of a more significant shift.