Business

Risky Funds Face Historic Losses Amid Trade War Turmoil

London, England — Investors faced significant losses in leveraged exchange traded funds (ETFs) late last week, with a staggering $25.7 billion evaporating in value. This unprecedented drop, said to be the largest on record, coincided with mounting market volatility linked to Donald Trump’s ongoing trade war.

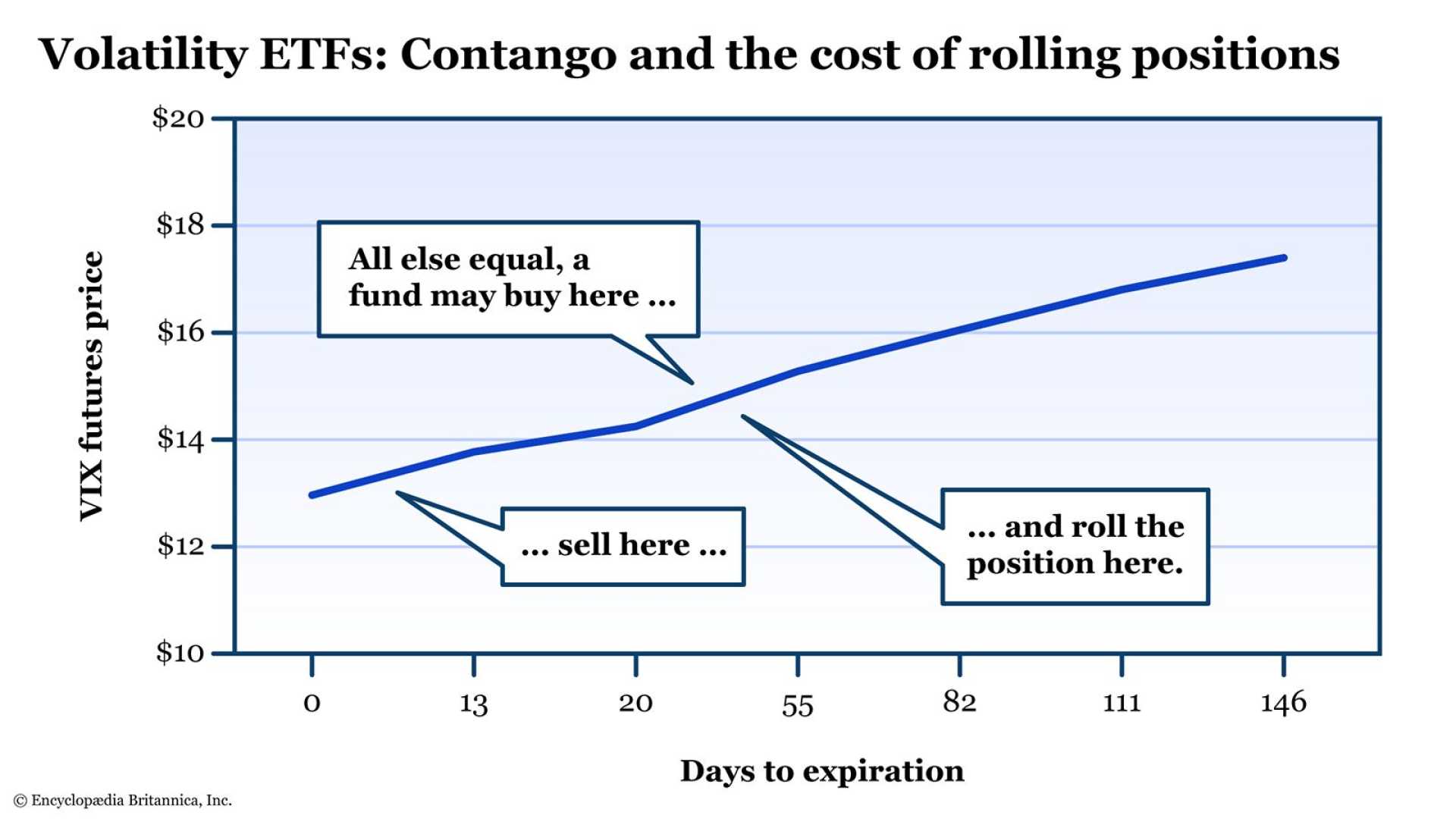

On Thursday and Friday, these high-risk funds, which amplify daily returns of stocks or indices by up to five times, collectively lost nearly a quarter of their value. According to data from FactSet, the losses surpassed previous record downturns documented during the early days of the Covid-19 pandemic in March 2020, and the infamous “Volmageddon” in February 2018.

The turmoil in the markets began after the U.S. government announced a series of reciprocal tariffs against numerous trading partners, slated to commence on Wednesday. This came alongside a universal tariff of 10 percent unveiled on Trump’s so-called “liberation day” the previous week. The resulting market reaction led to a three-day decline in global stock indices.

“These products are very sharp knives,” stated Elisabeth Kashner, director of global fund analytics at FactSet. “They are to be used for very specific purposes, and the people that use them have to know what they are doing.”

Among the hardest hit was the Leverage Shares 4x Long Semiconductors ETP, which plummeted by 59.1 percent over the two-day period. Other significant losers included the 5x Long Magnificent 7, 3x Boeing, and 3x Arm ETFs, each losing over 50 percent of their value.

In dollar terms, the ProShares UltraPro QQQ, a $20 billion leveraged ETF based on the tech-heavy Nasdaq index, experienced the largest loss, shedding approximately $6.3 billion. Kashner remarked, “It’s really all about semiconductors and tech, and the biggest percentage losses are in single stock ETFs. Some did a magnificent job of losing money.”

While the U.S. remains the largest market for leveraged ETFs, regulations cap leverage at three times, meant to limit potential losses. Despite these caps, analysts caution that retail investors remain vulnerable to sharp declines. Kenneth Lamont, principal of research at Morningstar, commented on the risk posed to everyday investors using these high-risk financial products. “They don’t have all the advantages of a big institution and the chances are that they don’t have an edge, so having a product that allows them to triple down on their bet maybe isn’t the best idea,” he said.