Business

RiverPark Fund Reports Strong Growth Amid Market Rally

NEW YORK, N.Y. — RiverPark, an investment advisory firm and sponsor of the RiverPark family of mutual funds, has released its fourth quarter 2024 investor letter for the RiverPark Large Growth Fund, which highlights a robust performance amid continued market gains.

For the fourth quarter, the Russell 1000 Growth Index (RLG) and the S&P 500 index saw returns of 7.1% and 2.4%, respectively. The RiverPark Large Growth Fund (RPX) returned 5.11%, contributing to a strong overall performance for 2024 with the S&P 500 and RLG returning 25.0% and 33.4%, respectively; RPX returned 22.6%.

The letter elaborated that U.S. stock market performance was bolstered by rising investor sentiment and sound fundamentals. “Our investments reflect the underlying strength within the market,” the letter stated.

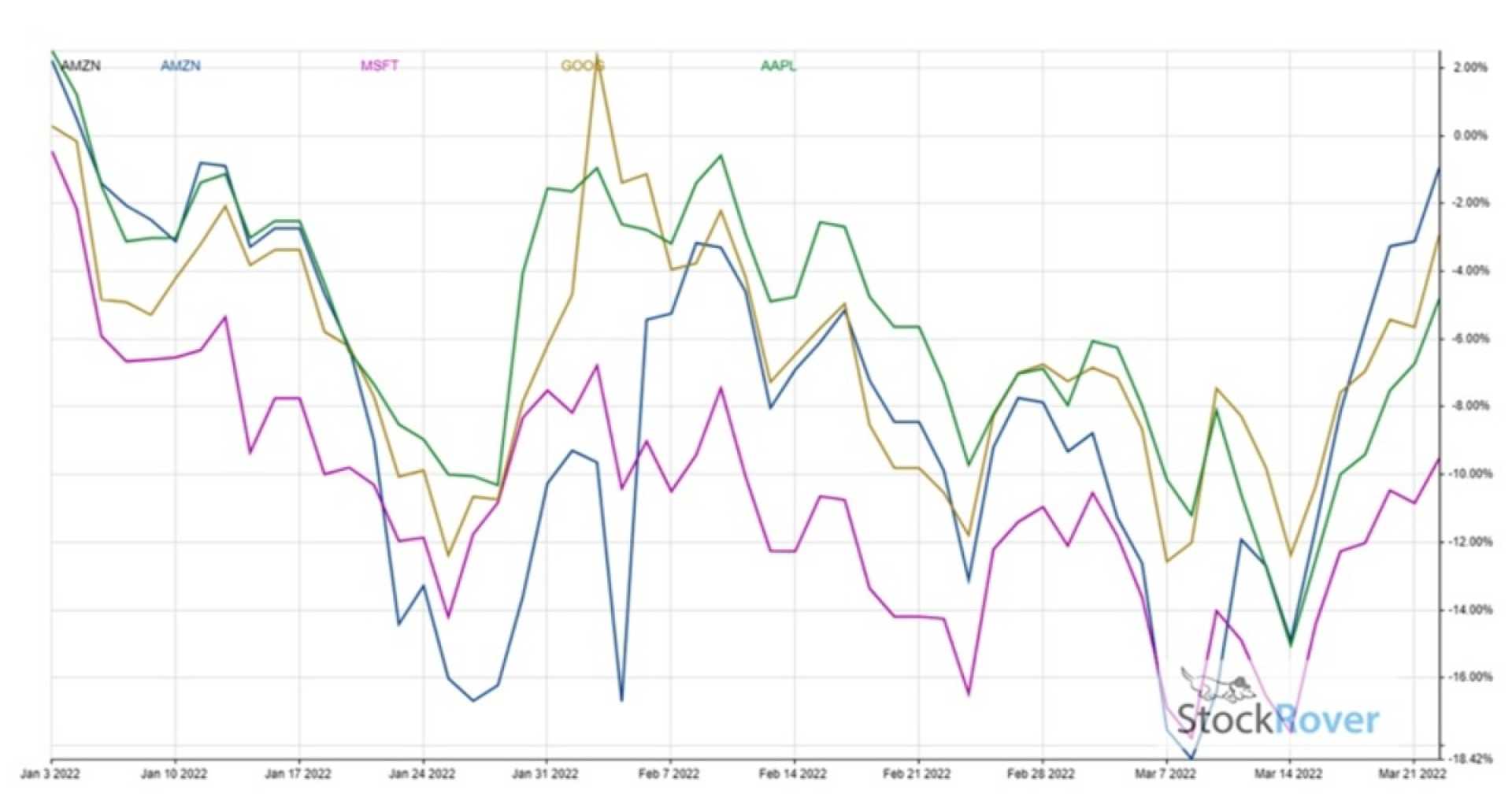

Among its top holdings, RiverPark highlighted Amazon.com, Inc. (NASDAQ: AMZN), emphasizing its strategic importance in the growth portfolio. Despite a -14.54% one-month return, Amazon’s stock price rebounded significantly over the last year, rising 15.87% and closing at $199.25 per share with a market capitalization of $2.112 trillion on March 7, 2025.

RiverPark’s analysis pointed out, “Amazon was our top contributor in the fourth quarter following third quarter results of slightly better than expected revenue and much stronger than expected operating income.” They noted that Amazon’s 3Q operating income of $17.4 billion exceeded previous company guidance and market expectations, driven by margin expansion across its segments.

Amazon experienced a notable acceleration in e-commerce demand both domestically and internationally, alongside significant growth in Prime memberships. The firm projected a 4Q operating income of approximately $18 billion, contributing to its strong market share in e-commerce, web services, and online advertising.

“With its ability to continue its market share gains in its three leading businesses, we believe Amazon remains one of the best-positioned global growth companies in the world,” the letter concluded.

RiverPark noted that at the end of the fourth quarter, 339 hedge fund portfolios held shares of Amazon, up from 286 in the previous quarter. The firm’s report revealed that Amazon achieved global revenue of $187.8 billion in Q4 2024, marking an 11% year-over-year growth when excluding foreign exchange impacts.

As 2024 comes to a close, investor interest persists in AI stocks, which some analysts argue may offer even higher returns compared to established giants like Amazon. RiverPark remains positive on their current portfolio while suggesting that emerging AI companies represent promising investment opportunities.

The RiverPark Large Growth Fund continues to monitor its top holdings and adapt to market trends, ensuring that investor sentiment aligns with performance expectations for 2025 and beyond.