Business

Robinhood Revolutionizes Investing for Beginners Amid Growing Concerns

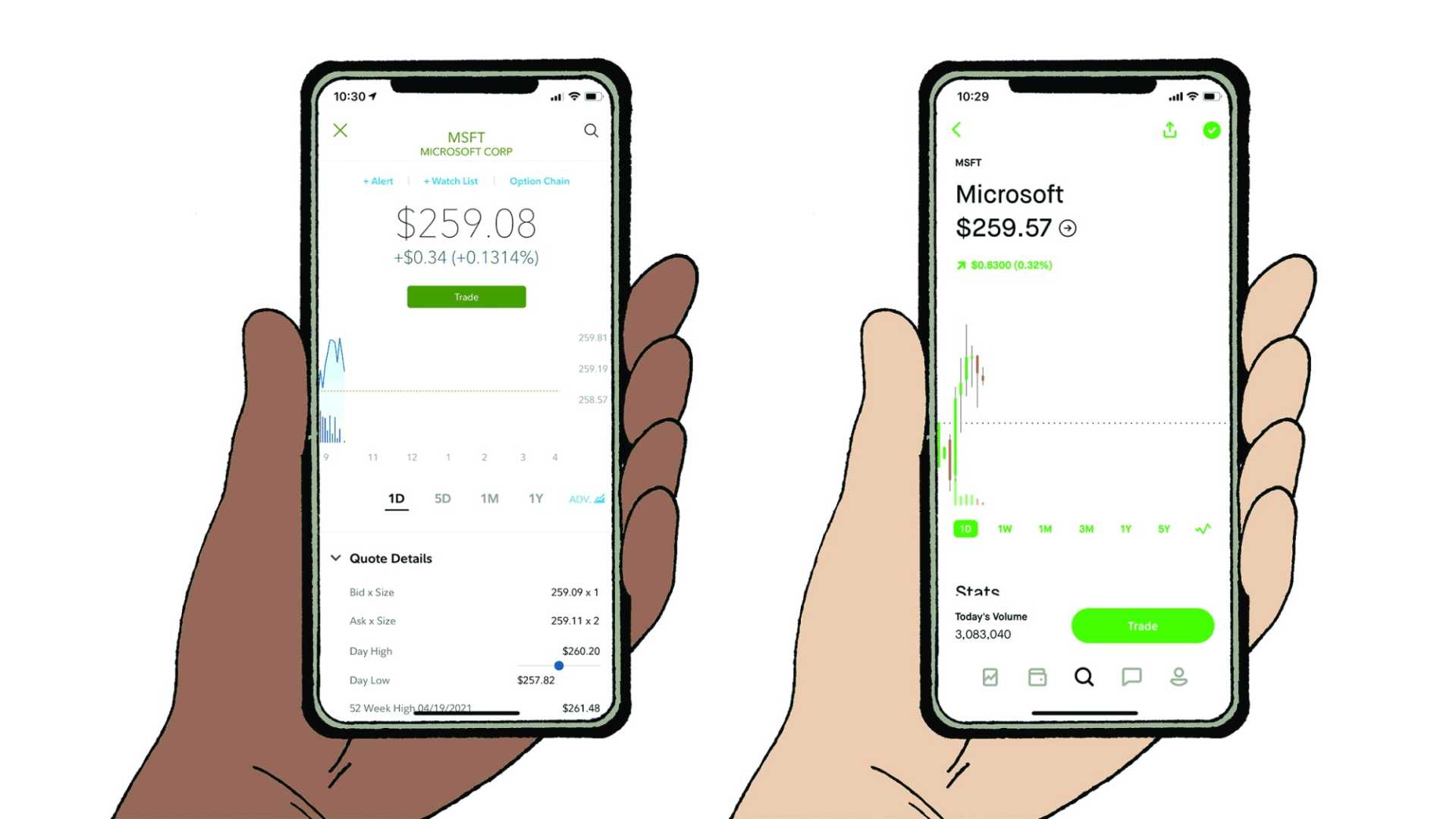

Menlo Park, California — Robinhood, the commission-free trading platform famous for democratizing investing, has attracted millions of users since its launch in 2015. With features like fractional shares and zero commissions, it aims to make investing accessible for everyone, but its simplicity may come at a cost.

Founded by Vladimir Tenev and Baiju Bhatt, Robinhood launched with the goal of empowering everyday investors by removing traditional barriers like high brokerage fees. As of now, the platform boasts over 23 million users who can trade stocks, exchange-traded funds (ETFs), options, and cryptocurrencies without paying commissions.

“We are committed to breaking down the barriers to investing,” Tenev stated in a recent company release. “We believe everyone should have access to the financial markets.”

Despite its user-friendliness and intuitive design, Robinhood has received criticism for its limited selection of investment options. Unlike traditional brokerages, it does not support mutual funds or bonds, key components for many investors looking for diversified portfolios.

Moreover, while the platform has integrated advanced features for options trading, it lacks comprehensive analysis tools that experienced traders often rely on. This shortfall has left some users seeking alternatives with more robust capabilities.

“The ease of onboarding is fantastic,” said one user, who cited that they registered on the app in under 10 minutes. “However, as I began trading more frequently, I realized the platform wasn’t equipped for the technical analysis I needed.”

Robinhood’s income model, based on payment for order flow (PFOF), has also raised eyebrows among some investors who question its transparency. Following past controversies regarding outages and security breaches, the company has begun to improve its communication and transparency efforts with users.

Return on investment is a central concern for any trader. Critics point out that while Robinhood saves users money on commissions, the long-term outcome of investments is not guaranteed. “Past performance doesn’t guarantee future results,” warns Robinhood’s own disclosure.

One of the platform’s key features is its ability to allow users to trade fractional shares, making it easier for newcomers to invest in high-priced stocks. “It’s a game changer for those who want to invest small amounts,” said another user, who appreciated being able to buy into companies without needing significant capital.

However, risk remains a significant factor. Options trading, while lucrative, introduces a complexity that can lead to substantial losses. Robinhood encourages investors to read up on the risks associated with options before engaging in trades.

In early 2023, Robinhood introduced a retirement investment option that offers a 3% match on contributions for users subscribing to Robinhood Gold, its premium subscription service. This feature further positions Robinhood as a serious contender in the investment world, aiming to attract more long-term investors.

“I think the IRA match is a smart move by Robinhood; it encourages habitual savings among younger investors,” commented an investment analyst. “The practice of automatically contributing funds can enhance their financial literacy.”

With its mobile app constantly evolving and improvements made to customer service, such as 24/7 live support for Robinhood Gold subscribers, the platform seeks to address concerns while maintaining its appeal as a beginner-friendly trading experience.

Overall, while Robinhood continues to offer a user-friendly platform that simplifies investing for novices, it must navigate the balance between providing essential features and addressing the needs of a more advanced trading audience. As the competitive landscape of online trading continues to evolve, Robinhood’s journey reflects the broader trends in the democratization of finance.