Business

Robinhood Stocks Soar to 52-Week High Amid Crypto-Friendly Regulatory Outlook and Expansion Efforts

Robinhood Markets, Inc. (HOOD) has seen a significant surge in its stock price, reaching a 52-week high of $30.63. This upward trend is largely attributed to the favorable stance of the new U.S. presidential administration toward cryptocurrencies, following the recent election victory of Donald Trump.

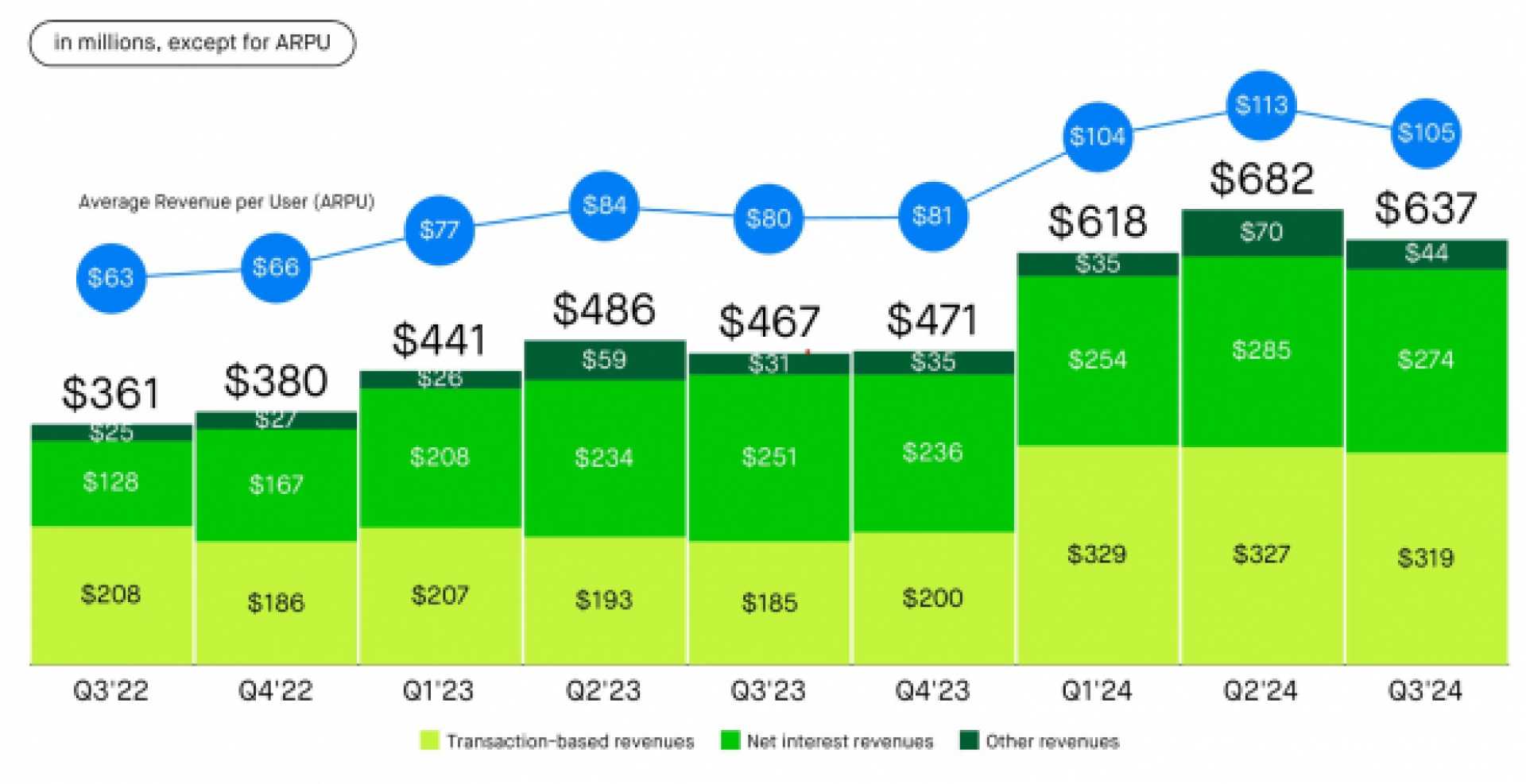

The crypto-friendly policies of the incoming administration have boosted Bitcoin to an all-time high, which in turn is expected to increase Robinhood’s cryptocurrency revenues. During the first nine months of 2024, Robinhood’s cryptocurrency revenues were $268 million, accounting for 13.8% of its total net revenues. This segment has seen a 94.2% compound annual growth rate (CAGR) over the last four years.

In addition to the crypto market boost, Robinhood’s transaction-based revenues are also expected to rise due to higher equity market participation. The company’s total net revenues have witnessed a 61% CAGR over the last four years, with transaction-based revenues growing at a 46.4% CAGR during the same period.

Robinhood has been expanding its services beyond traditional brokerage, including the acquisition of Pluto Capital Inc. in July 2024 and the planned acquisition of Bitstamp. These moves are aimed at enhancing its crypto offerings and providing a more diversified investment experience for its users. The company has also launched its trading app in the U.K. and introduced its first-ever credit card this March.

Despite regulatory challenges, including a settlement with the California Department of Justice and a Wells notice from the U.S. Securities and Exchange Commission, Robinhood remains on solid financial ground with significant cash reserves of $4.6 billion as of September 30, 2024. The company has also announced a share buyback program authorizing up to $1 billion in repurchases.

The recent introduction of Dogecoin (DOGE) transfers on Robinhood, along with a 1% deposit bonus, is another strategic move to reinvigorate its reputation in the cryptocurrency market. This move aims to improve user trust and engagement following earlier regulatory turbulence.

Overall, Robinhood’s stock surge reflects investor optimism about the company’s growth potential, driven by favorable regulatory outlooks, business diversification efforts, and strong financial performance.