Business

Robinhood Surpasses Earnings Expectations, Stock Hits New Highs

Menlo Park, California — Robinhood Markets Inc. reported impressive earnings and revenue numbers for the fourth quarter of 2024, significantly exceeding analyst expectations. The company released its financial results after the market closed on Wednesday, revealing a record-breaking performance that has led to a surge in its stock price.

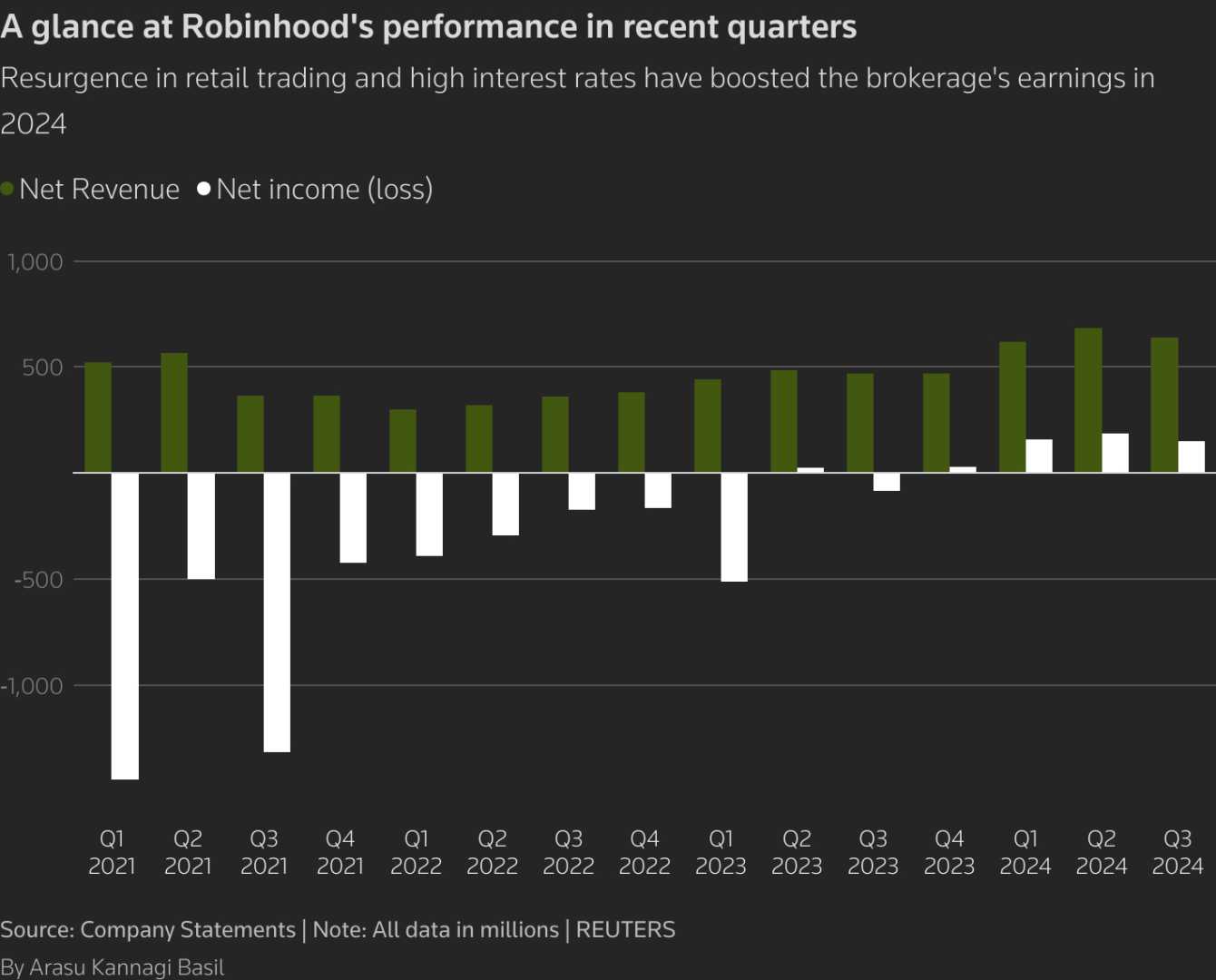

For Q4, Robinhood reported earnings per share (EPS) of $1.01, significantly higher than the FactSet consensus estimate of 42 cents. Revenue for the quarter reached $1.01 billion, easily surpassing projections of $945.8 million. This performance marks a substantial recovery for the online brokerage, which successfully transitioned to profitability after reporting a loss in 2023.

“Q4 was a record-breaking quarter that caps off a record-setting year in 2024,” said Robinhood CFO Jason Warnick in an earnings release. Year-over-year comparisons reveal staggering growth, with earnings soaring more than 3,200% and revenue increasing by 115%. Transaction-based revenues climbed 200% to $672 million, fueled by strong performances across different asset classes.

The breakdown of transaction revenues showed that Robinhood’s cryptocurrency business generated $358 million, soaring over 700% year-over-year. Options trading contributed $222 million, up 83%, while equities trading brought in $61 million, reflecting a 144% increase. Additionally, net interest revenues rose 25% to $296 million.

Looking ahead, Robinhood forecasted its first full-year profit for 2024, reporting earnings of $1.56 per share, surpassing analyst expectations of 95 cents. This contrasts sharply with a reported net loss of 61 cents per share in the prior year. However, the company did not provide guidance for operating expenses in 2025, leading to speculation among analysts.

Based on current projections, analysts anticipate a potential decline in earnings for 2025, expecting a drop of about 14% to $1.34 per share, which might be attributed to tougher year-over-year comparisons. Despite this cautious outlook, Robinhood stock surged nearly 15% on Thursday, reaching new highs.

In the wake of the earnings announcement, ten analysts raised their price targets for Robinhood stock, while none decreased their estimates. According to FactSet, Robinhood’s growth is driven by several factors, particularly its cryptocurrency operations. The company is poised to benefit from President Donald Trump’s pro-crypto policies and the expanding market for bitcoin exchange-traded funds (ETFs).

The market response was further buoyed by a rally in cryptocurrency values sparked by Trump’s anticipated election win in November, contributing to a remarkable 365% increase in Robinhood stock prices over the past year. Additionally, a recent survey from Mizuho suggested growing interest in sports betting among Robinhood app users, indicating potential avenues for future growth.

Coinbase Global also saw a positive reaction on Thursday, with its stock jumping more than 6% ahead of its earnings report scheduled for later in the day. Conversely, Charles Schwab shares dipped further below a previously established buy point, while CBOE Global Markets was observed nearing a buy point despite missing earnings expectations earlier this month.