Business

SAP SE Reports Strong Q3 Earnings, Drives European Tech Growth Amid Global Market Volatility

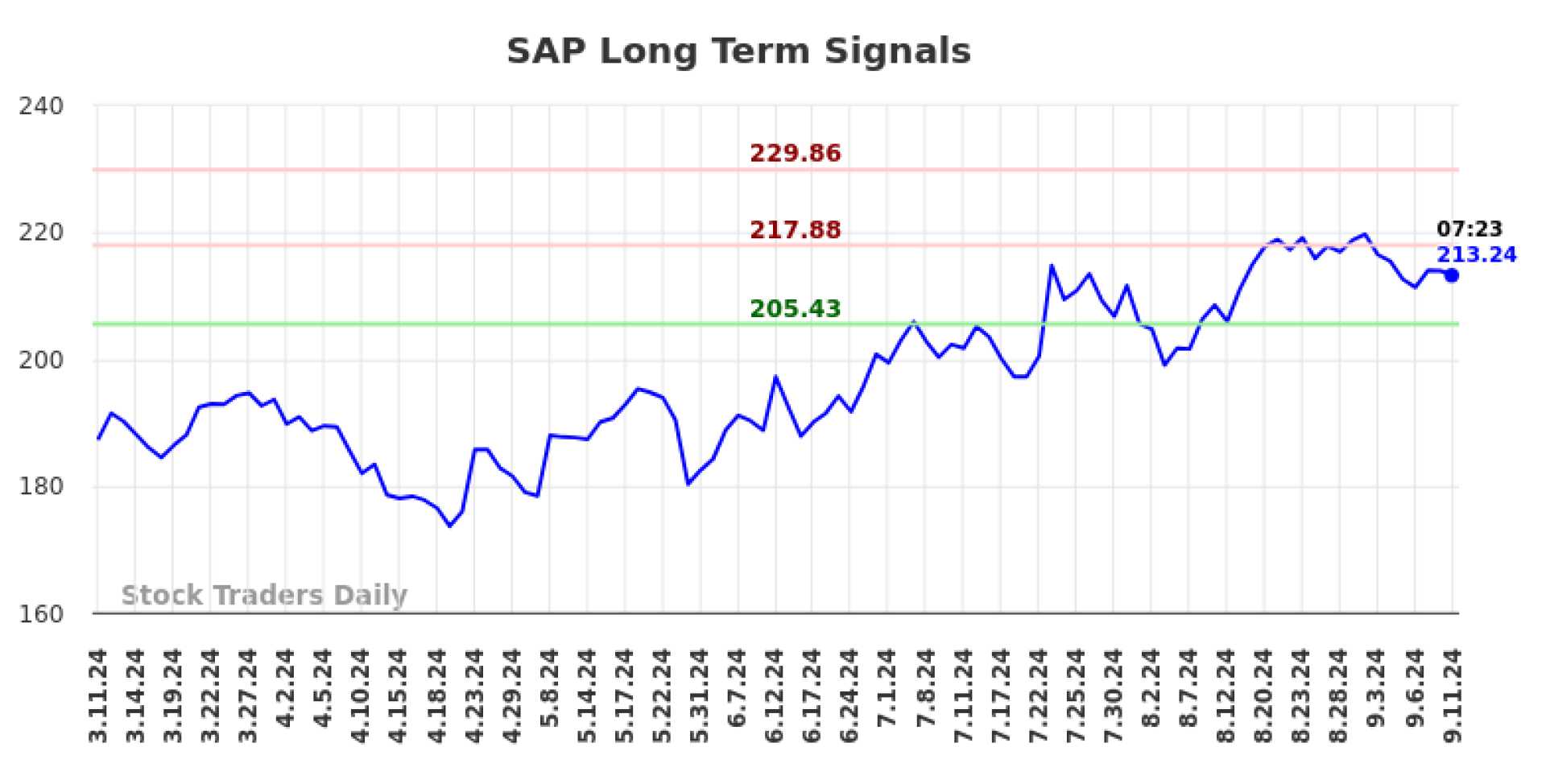

SAP SE, Europe‘s leading software firm, has reported its third-quarter earnings, showcasing significant growth in its cloud and business-planning software divisions. This strong performance has driven SAP’s stock price up by 53% this year, making it a standout in the European tech sector despite the volatility in global markets.

The company’s earnings release is particularly noteworthy as it accounts for 15% of the DAX index on Deutsche Boerse, with a substantial market capitalization of 261 billion euros ($284 billion). Wall Street expects SAP to report quarterly earnings of $1.33 per share on revenue of $9.29 billion, according to data from Benzinga Pro.

However, SAP is also facing scrutiny from U.S. authorities over potential price-fixing in government contracts, an investigation that has been ongoing since at least 2022. This issue, while significant, is not expected to be addressed in the current earnings release.

The broader market context is complex, with global factors such as China‘s recent rate cuts and the U.S. presidential election influencing market sentiment. The euro has dropped over 3% in the past three weeks, and the U.S. dollar has been appreciating due to expectations of high interest rates under a potential Trump administration.

Other key events that may impact the markets include data releases on German producer price inflation and UK house prices, as well as speeches from Fed and ECB officials at the IMF-World Bank Annual Meetings.