Politics

Senate Unanimously Passes No Tax on Tips Act, Aims to Benefit Service Workers

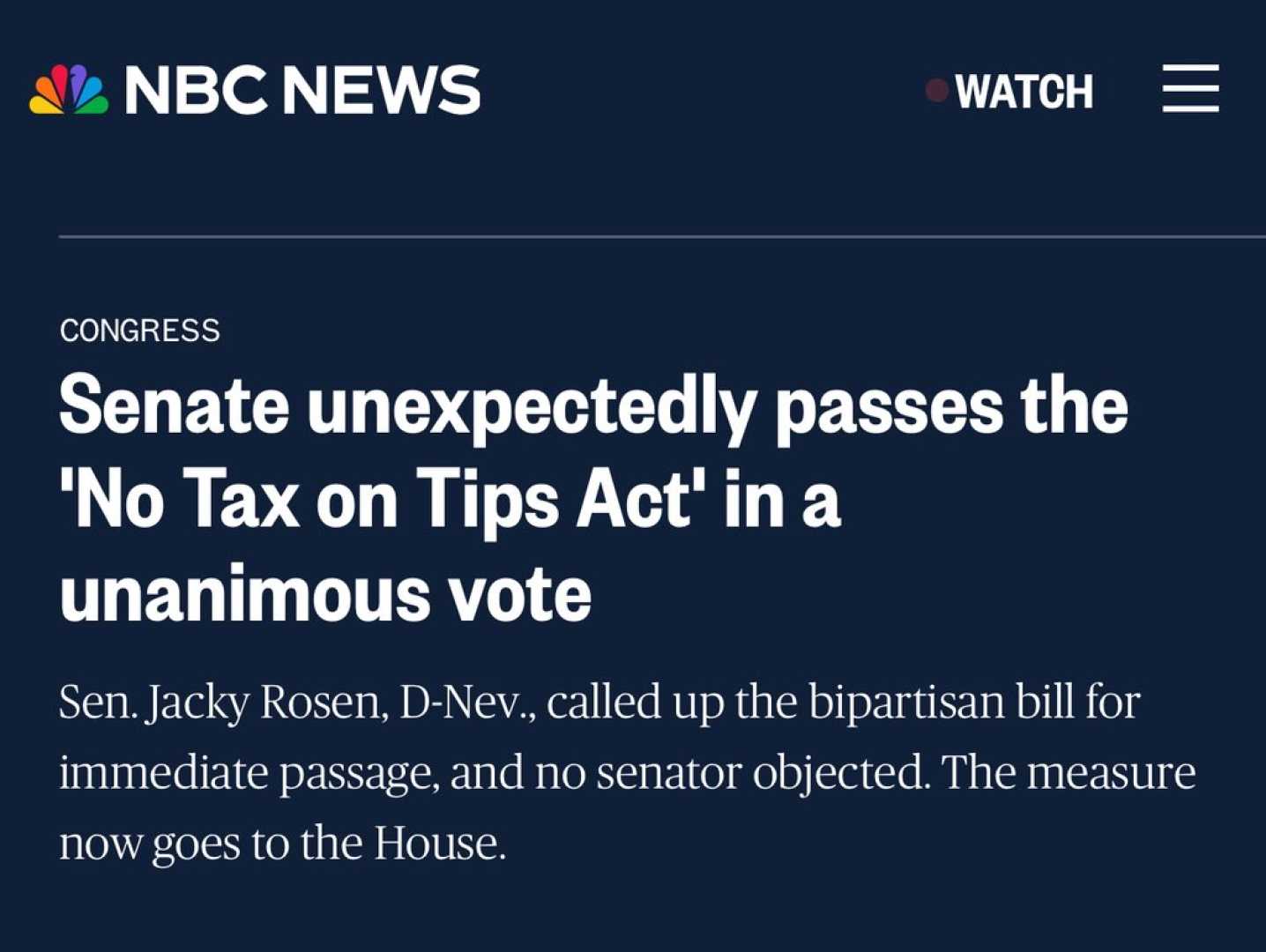

NEW YORK (AP) — Millions of American service workers are closer to keeping their tips tax-free after the Senate unanimously passed the No Tax on Tips Act on May 20, 2025.

This bipartisan proposal, a signature campaign promise of President Donald Trump, would allow workers to exempt up to $25,000 in tips from federal income taxes if signed into law. The bill now heads to the Republican-controlled House, where it has garnered broad support.

Senate Minority Leader Chuck Schumer expressed optimism after the vote, stating, “We are one step closer to eliminating taxes on tipped wages for hardworking Americans.” He emphasized the bill’s importance for individuals in various service roles including servers, bartenders, and delivery drivers.

The legislation aims to revise the IRS Code, allowing employees who typically receive tips to avoid federal taxes on those earnings, provided they earn less than $160,000 in 2024-2025. Eligible workers must have traditionally received tips prior to December 31, 2023, and a list of qualifying occupations will be published by the U.S. Treasury Secretary within 90 days of passage.

However, less than 5% of U.S. workers fall into the category of tipped employees, with estimates showing around 4 million individuals employed in these occupations. Critics are concerned that the proposal may inadvertently harm low-income workers, as many already earn insufficient wages. Anxieties have been raised about employer practices changing to encourage tipping while potentially reducing base wages.

The National Restaurant Association has publicly supported the bill, asserting it would put more cash into workers’ pockets and aid employers in recruiting staff. “Tax policy plays a major role in the success of the restaurant industry,” said Sean Kennedy, executive vice president of public affairs. “We’ll continue to work with Congress on sensible tax policies.”

Despite its support, the proposal has faced criticism from labor advocates and economists who argue that it primarily benefits higher earners. “If your goal is to help the poorest service workers, this is probably not the way to do it,” said Michael Lynn, a professor at Cornell University. Critics argue that a significant number of tipped employees earn too little to benefit from the tax break.

The No Tax on Tips Act is projected to increase the federal deficit substantially, with estimates of $40 billion through 2028. As discussions continue in the House, advocates urge lawmakers to consider a broader approach to support all service workers, not just those benefiting from this proposed tax change.