Business

ServiceNow Stock Drops Following Morgan Stanley Downgrade

Shares of ServiceNow Inc. (NYSE: NOW) experienced a decline in premarket trading on Monday, October 21, 2024, following a downgrade by Morgan Stanley analysts. The stock fell more than 1.5% in response to the new rating, which changed from a previous more favorable stance to an “Equal Weight” rating.

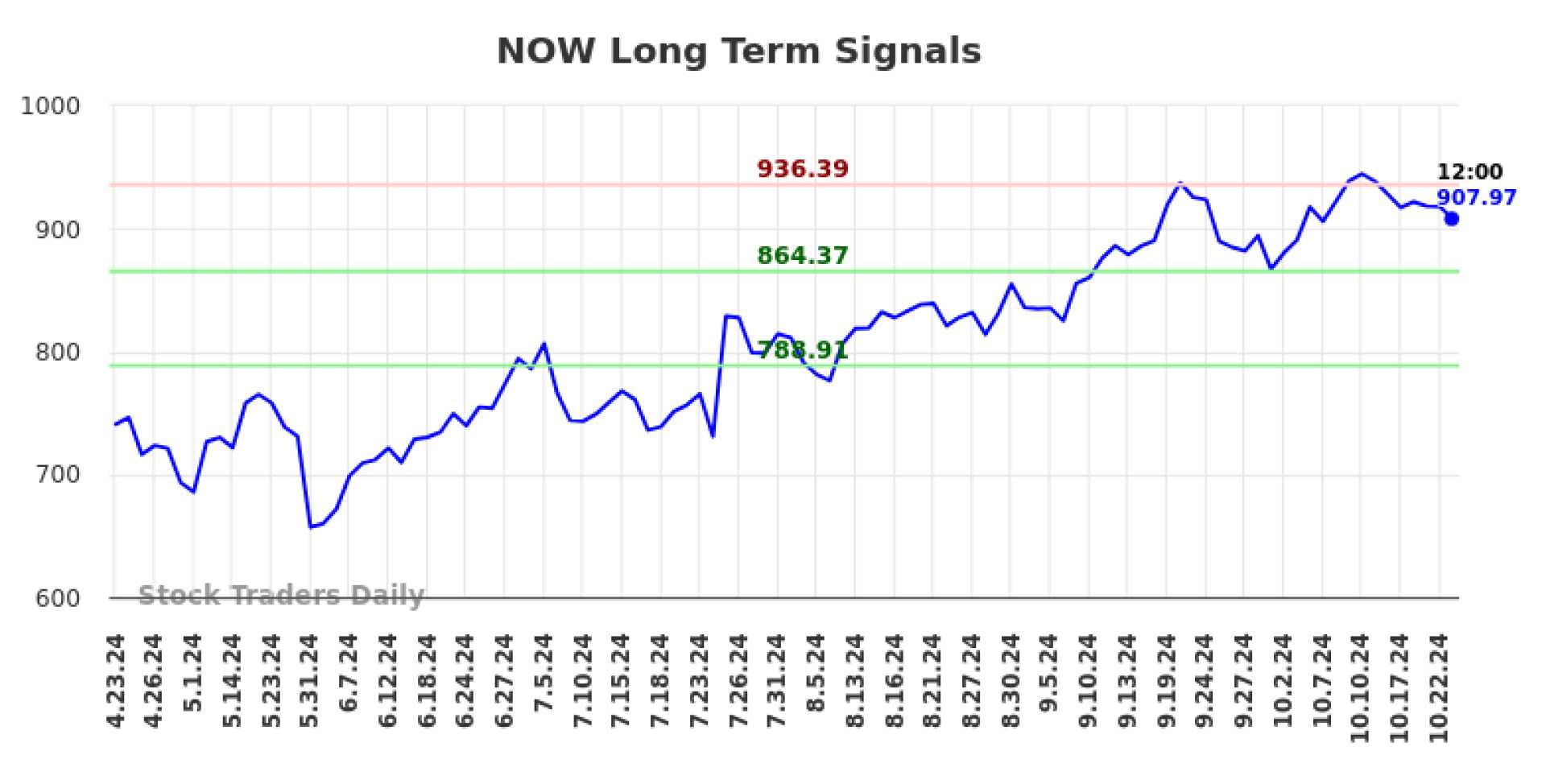

As of the latest trading data, ServiceNow’s stock price has been volatile, reflecting broader market sentiments and specific analyst actions. On October 22, 2024, the stock closed at $917.95 USD, with a minimal change in after-market trading. The stock has seen significant fluctuations, with a 52-week low of $527.24 and a 52-week high of $949.59.

The company’s market capitalization stands at approximately $189.18 billion, with over 206 million shares outstanding. The current price-to-earnings (P/E) ratio is around 166.00, based on the trailing twelve months (TTM) earnings per share (EPS) of $5.53.

ServiceNow’s financial performance and stock movements are closely watched by investors, given its significant presence in the software and cloud computing sector. The downgrade by Morgan Stanley could indicate a shift in market expectations or a reevaluation of the company’s growth prospects, although the long-term outlook remains positive with an expected EPS growth of 24.59% over the next 3-5 years.