Business

Shanghai Composite Index Sees Gains Amid Global Market Fluctuations

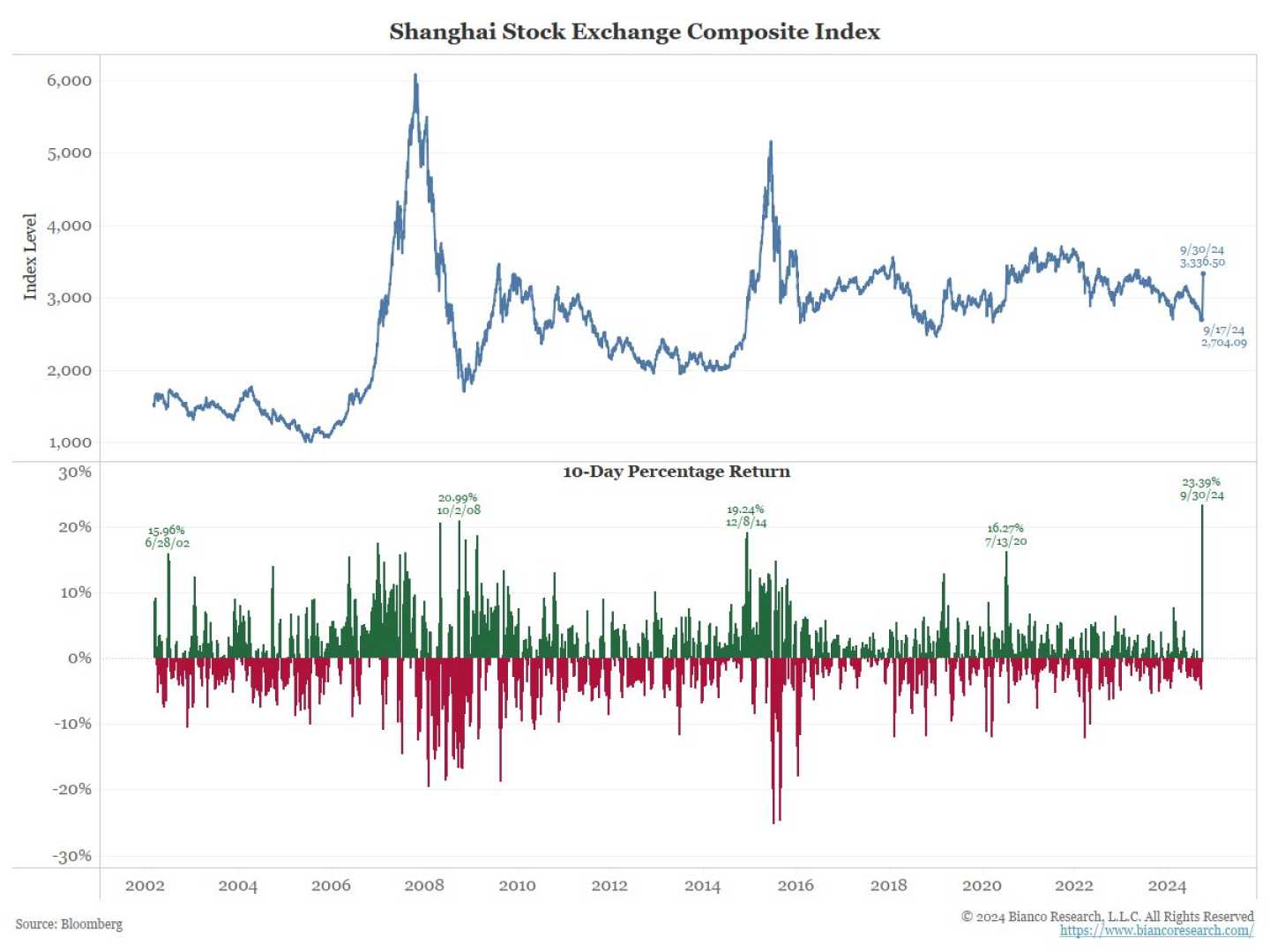

The Shanghai Composite Index has shown a positive trend in recent trading, despite the broader challenges faced by Chinese equities. On Monday, October 14, the index opened at 3,241.43 points, marking an increase of 23.69 points or 0.74 percent.

This uptick comes as the global markets continue to experience fluctuations. The Shanghai Composite Index and the CSI 300 have recently seen declines due to uncertainties surrounding Beijing‘s economic support measures. However, some sectors and companies are demonstrating resilience and growth potential.

Notable performers include companies like Shanghai Hongda New Material and Shenzhen Forms Syntron Information Ltd. Shanghai Hongda New Material, specializing in silicone rubber products, has managed to turn a profit despite industry contractions and reported losses in the first half of 2024. Shenzhen Forms Syntron, operating in the software and information services sector, has maintained a debt-free balance sheet and shown significant earnings growth.

Looking ahead, forecasts for the Shanghai Composite Index suggest a mixed outlook. Predictions for the coming months indicate potential volatility, with forecasts ranging from a maximum value of 3163 to a minimum of 2749 by the end of December 2024. For 2025, the index is expected to see gradual increases, with average values projected to rise steadily through the year.

In addition to the Shanghai Composite Index, other Asian markets also saw movements. The Shenzhen Component Index opened up 0.57 percent, while the Hang Seng Index in Hong Kong dipped slightly by 0.11 percent.