Business

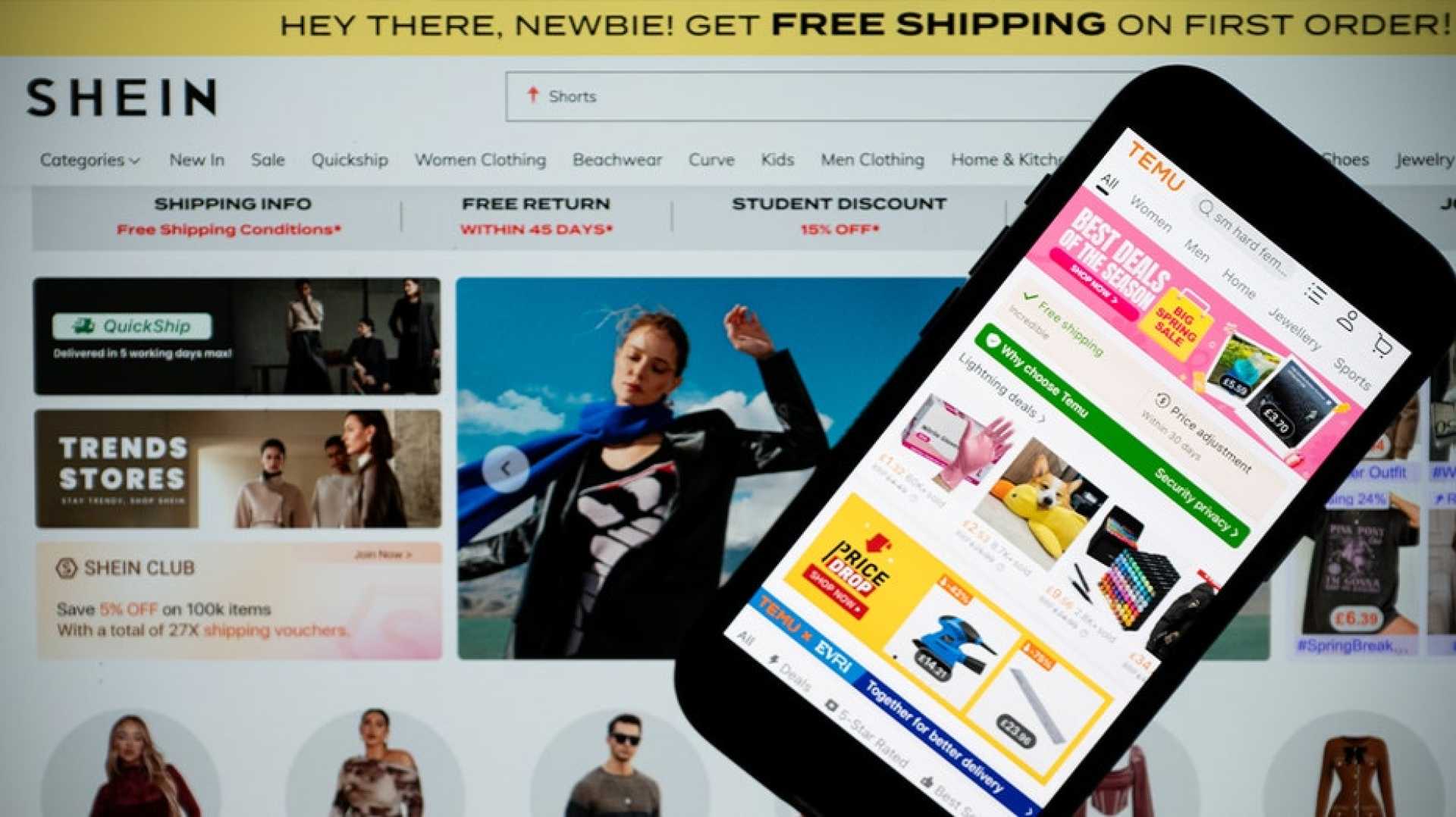

Shein and Temu Brace for Rising Prices Amid Tariff Crisis

NEW YORK, NY — Chinese e-commerce platforms Shein and Temu announced plans to increase prices for U.S. customers starting April 25, 2025, in response to significant new tariffs imposed by the Trump administration on Chinese imports. These tariffs, which reach as high as 145%, are part of a broader trade strategy aimed at rebalancing U.S.-China trade relations.

In nearly identical statements, the companies noted that their operating expenses have surged due to “recent changes in global trade rules and tariffs.” Both platforms have gained immense popularity in the U.S. market, largely due to their low-price offerings and aggressive digital marketing strategies.

“We are taking these steps reluctantly but are committed to ensuring that we can continue offering the products our customers love without compromising quality,” Shein said in its notice to shoppers. “We encourage customers to shop at current prices before the adjustments take effect,” Temu added.

While neither platform shared specific details about the upcoming price increases, the announcement follows President Trump’s declaration that tariffs could reach as high as 245% for certain goods when combined with existing rates. In addition, a duty-free threshold for goods valued under $800, which previously benefited both companies by allowing duty-free shipments, will be eliminated, further affecting their pricing structures.

The timing of these price adjustments comes amid an increasing competitive landscape, with Amazon launching a new low-cost platform to compete directly with Shein and Temu. The move reflects the pressure these Chinese retailers have placed on established American e-commerce entities, which are now responding by lowering prices and expanding offerings.

Data from market analysis firm Sensor Tower indicates that since the announcement of the new tariffs, both companies have significantly reduced their advertising expenditures in the U.S. Temu has discontinued all its Google Shopping ads, while the average daily ad spend on social media platforms has dropped by 31%. Similarly, Shein has cut its average ad spending by 19% over the same period.

“We’re doing everything we can to minimize the impact of these changes on our customers,” the companies said in their statements. Both firms have experienced declines in app rankings, indicating a challenging period ahead. As of mid-April, Temu’s app was ranked 75th for free downloads in the U.S. Apple Store, a sharp drop from its position in the top five just months prior.

The broader implications of these tariff policies might resonate beyond just the retail sector. Guests at the Economic Club of Chicago heard Federal Reserve Chair Jerome Powell warn on April 16 about the potential inflationary effects of the tariffs, cautioning that consumers could see more persistent increases in prices as businesses pass costs onto shoppers.

In 2024, both Shein and Temu capitalized on the so-called “de minimis provision,” enabling them to import low-value parcels into the U.S. duty-free, which significantly boosted their market entry. Lawmakers, however, have expressed concerns regarding the loophole, suggesting it enables not only competitive pricing but also a pathway for counterfeit and illicit goods.

As the new tariffs are implemented, analysts will closely monitor consumer behavior and the performance of Shein and Temu amid the changing landscape. Experts suggest that if these companies do not adjust effectively, they might lose ground to established players like Amazon and others in the U.S. market.

The U.S. has seen a surge in imports under the now-cancelled exemption, with an estimated 1.4 billion packages entering the country in the last year alone. Concerns about the integrity of these shipments have influenced U.S. policy shifts, particularly as manufacturers and lawmakers work together to reinforce trade regulations.

Shein and Temu are urging shoppers to take advantage of current prices before the upcoming changes take effect, as they brace for an uncertain economic landscape fueled by evolving international trade policies.