Business

Silver Prices Surge Amid Economic Uncertainty

NEW YORK, NY — As of 8:55 a.m. Eastern Time on October 2, 2025, silver was priced at $47.80 per ounce. This marks a $0.40 increase from the previous day and represents a $15.77 rise compared to last year.

The current silver price is up from $46.80 yesterday, and it signifies a notable climb over the past year, where it has increased by nearly 50% from $32.03 a year ago. Although this rise is substantial, experts caution that silver is not typically considered a high-growth investment.

Since 1921, silver has underperformed compared to the S&P 500 by approximately 96%. In practical terms, a person investing equally in both stocks and silver would find that the silver investment is worth significantly less today.

Despite this historical underperformance relative to the stock market, silver is viewed as a stable asset that can help preserve purchasing power over time, particularly during instances of inflation.

“Silver is often dubbed a ‘store of value’,” said financial analysts. “It generally retains purchasing power during inflationary periods.”

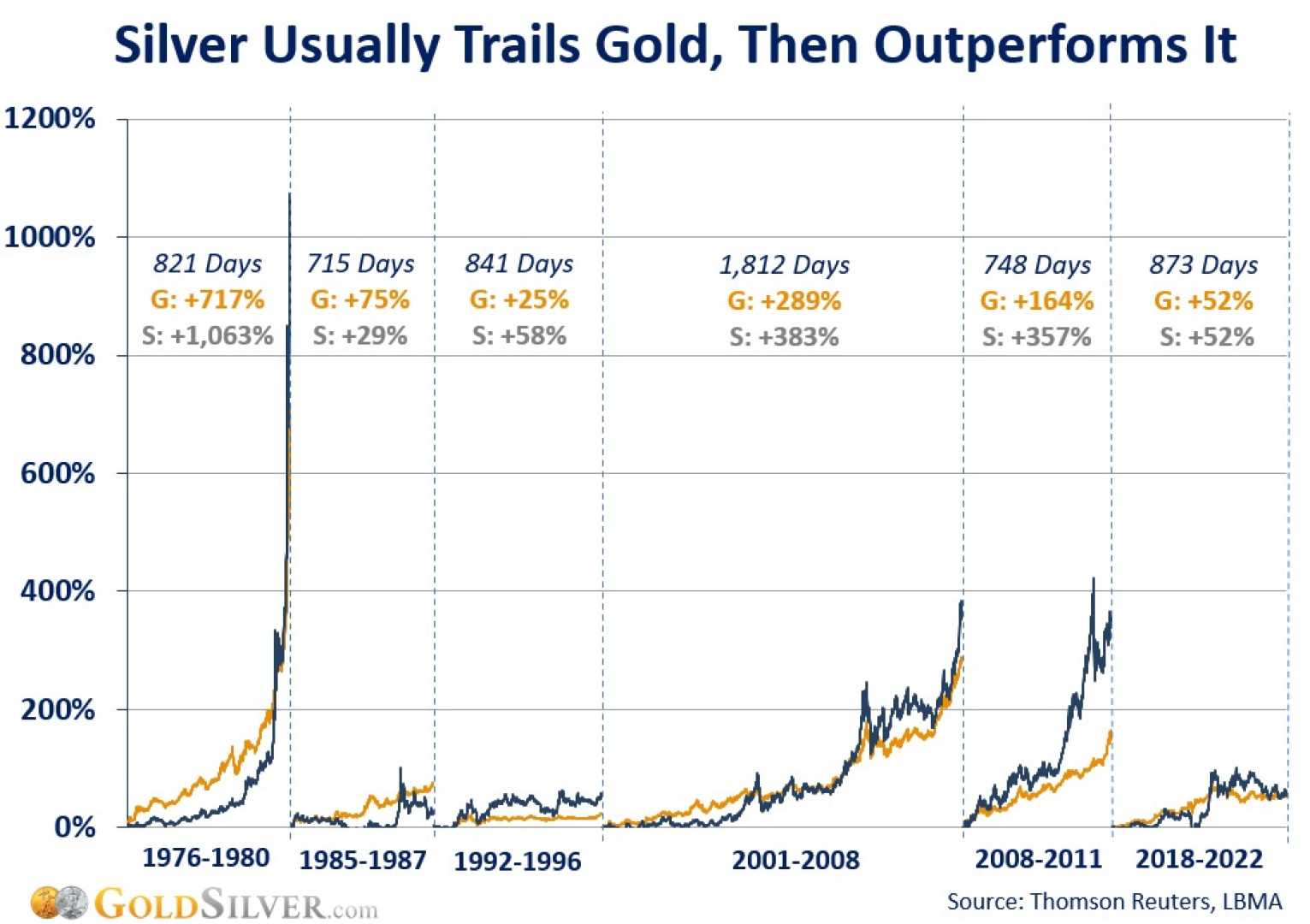

The volatility of silver is influenced by its industrial applications, which include electronics and healthcare devices. This dependency on industrial demand means that the price of silver can fluctuate more than that of gold, which primarily serves as a safe-haven asset.

As of this morning, the spot price of silver reflects the current market rate for instant trading. However, buyers typically pay above this spot price due to various costs such as shipping, insurance, and markups—a consideration for those looking to invest in silver.

Investors often monitor silver’s price spread, which indicates the difference between the bid and ask prices. A smaller spread indicates higher demand for silver in the market.

There are multiple ways to invest in silver, including physical ownership like bullion and coins or more commonly through silver exchange-traded funds (ETFs). ETFs allow investors to buy shares in a fund that holds silver, alleviating the need for personal storage.

This year, silver has seen a growth rate of nearly 25%, making it more appealing to investors looking for lower-cost alternatives to gold, which is commonly recommended for diversification in investment portfolios.

Many financial advisors suggest maintaining an allocation of no more than 10% to 15% of one’s investment portfolio in silver, with an overall cap of 20% for precious metal investments.

With persistent economic uncertainty and inflation affecting the market, silver remains a notable consideration for investors seeking stability and growth opportunities. The rising demand for silver due to industrial applications could lead to further price increases in the coming months.