Business

Silver Prices Surge Amid Economic Uncertainty

NEW YORK, NY — As of 8:45 a.m. Eastern Time on October 6, 2025, silver is valued at $48.22 per ounce, signaling a notable increase of 12 cents from the previous day, and a significant rise of approximately $16.54 over the past year.

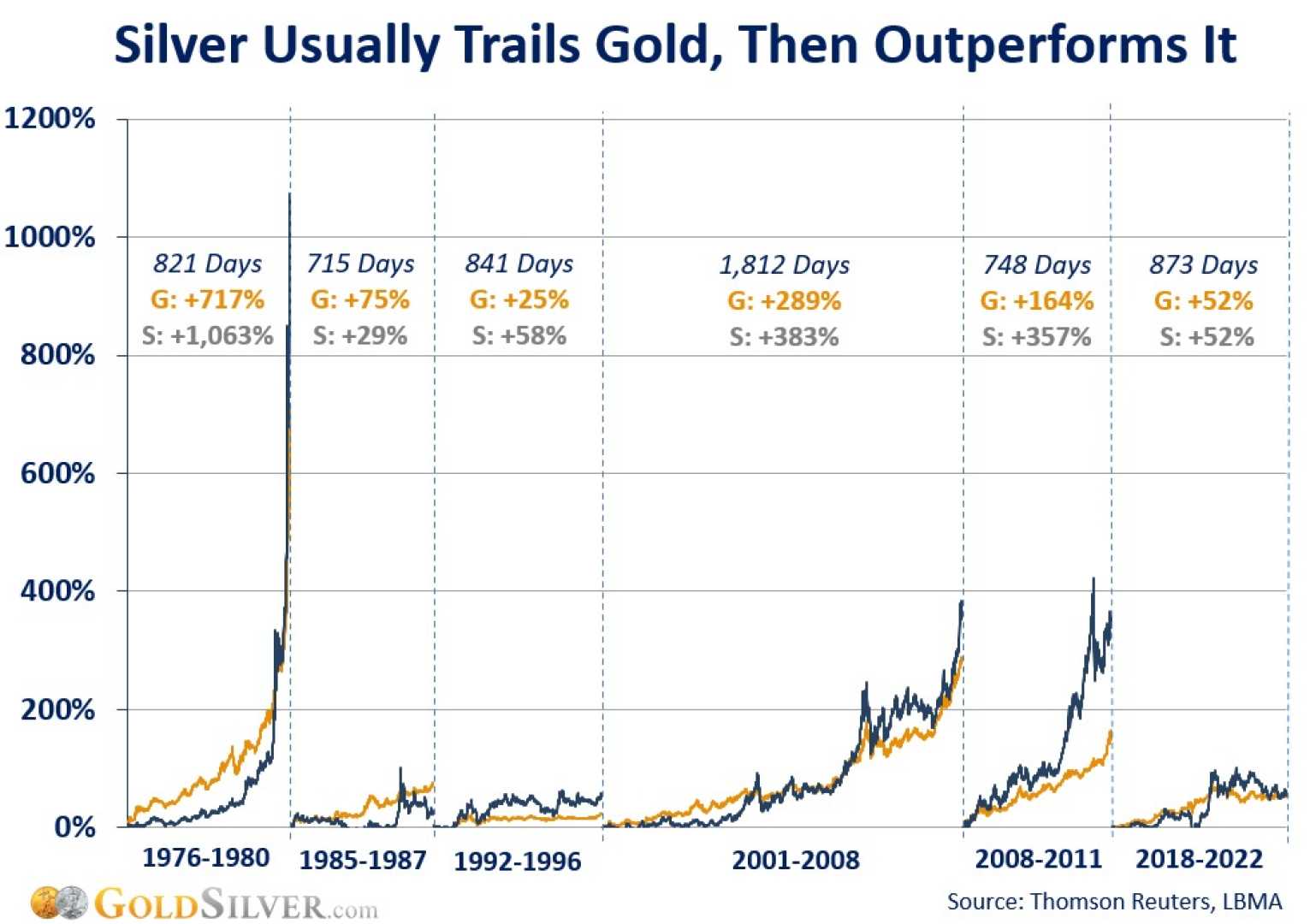

Silver is not considered a rapid investment option, historically underperforming traditional stocks. Since 1921, silver has fallen about 96% against the S&P 500. Nevertheless, it is recognized as a reliable asset that can safeguard the value of money. Often described as a “store of value,” silver tends to maintain its worth during inflationary periods.

Unlike gold, which is primarily regarded as a safe-haven asset, silver is subject to more volatility due to its industrial uses in electronics and healthcare. Thus, its value is more directly influenced by market demand and supply.

The “spot silver” price indicates the immediate rate at which silver can be bought or sold. Buyers typically pay above the spot price due to additional costs such as shipping and insurance. The price spread, the difference between buying and selling prices, indicates demand; a narrower spread suggests stronger interest in silver.

Investors can choose between collecting physical silver or investing via silver exchange-traded funds (ETFs), which allow ownership without the responsibilities of storage or insurance. Popular forms of silver investment must meet a 99.9% purity standard on trading platforms.

In 2025, silver prices have surged nearly 25%, reaching their highest levels in over a decade. The decision to invest now depends on individual perspectives regarding market conditions. Experts suggest that if inflation is a concern, incorporating precious metals into one’s portfolio may be advantageous.

The current prices for precious metals include gold at $3,931.89 per ounce and platinum at $1,613.55 per ounce, alongside silver. These rising values are particularly relevant amidst the ongoing economic uncertainties, including inflation fears and shifting geopolitical landscapes.

Experts also recommend that investors allocate 10% to 15% of their portfolios to silver, and not exceed a total of 20% in precious metals. Additionally, IRA-approved silver products must be 99.9% pure and stored with an IRS-approved custodian, implying certain limitations on what can be included in a silver IRA.

The combination of scarcity and strong industrial demand fuels silver’s price increase. Industry shifts towards green technologies are expected to further boost silver’s value in the near future.