Business

Silver Soars Past $50: Investors React to Dramatic Price Surge

London, England – Silver prices have surged past $50 per ounce on October 9, 2025, causing a wave of speculation among investors. The rise comes as gold also hits record highs, pushing many to question whether this is a safe-haven surge or a potential bubble.

In intraday trading, silver peaked at $51.23 per ounce, marking its highest price since the historic Hunt brothers’ squeeze in 1980. This significant milestone follows a massive rally in gold, which recently reached a staggering $4,000 per ounce.

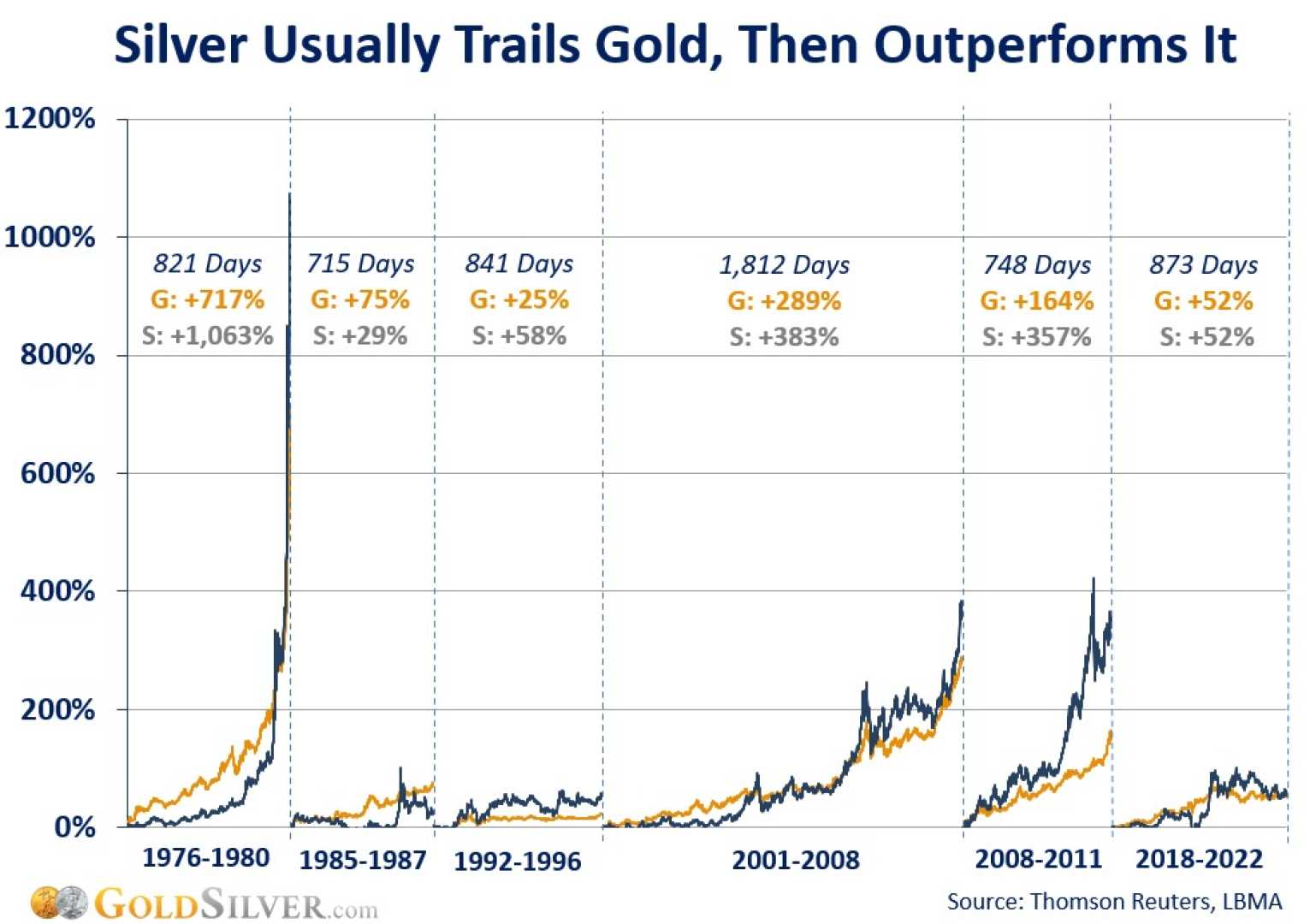

According to market analysts, silver has seen a 70% increase year-to-date, exceeding gold’s 55% gain. Some experts argue that silver’s recent price jump is a result of its longstanding undervaluation relative to gold and its dual role as both an industrial and investment asset. ‘Silver’s achievement was inevitable,’ analysts state, noting the pressure from gold’s breakout and technical momentum.

The unexpected rise has split investor opinion. While some believe the rally represents a long-awaited correction in pricing, others caution against potential speculative excesses. Market veterans are reminded of the infamous 1980 silver bubble when prices dropped over 50% following a failed market manipulation attempt.

On social media, retail investors are celebrating silver’s milestone, igniting viral interest in silver exchange-traded funds (ETFs) and physical bullion. However, financial advisors are urging caution, reminding investors to avoid jumping on the trend without a firm understanding of the associated risks.

Historically, silver’s all-time high of $49.95 was reached in January 1980 during an attempted market manipulation by the Hunt brothers. A similar spike occurred in 2011, with silver hitting $48.70 amidst inflation fears following a recession.

Analysts believe that if gold prices stabilize above $4,000, silver could continue its upward trend. Recommendations include monitoring supply data, watching for central bank policy changes, and practicing entry discipline when investing in silver.

While silver’s recent gains have revitalized market interest, uncertainty looms ahead. Some predict consolidation in the price range of $48 to $52, while others express concerns that a cooling inflation or rising interest rates could lead to a price correction.

For now, silver’s dramatic price surge has reignited discussions about the role of precious metals in modern investment portfolios, reminding investors that even traditionally stable assets can create unexpected volatility.