Business

Snap Inc. Sees Mixed Analyst Ratings Amid Revenue Growth

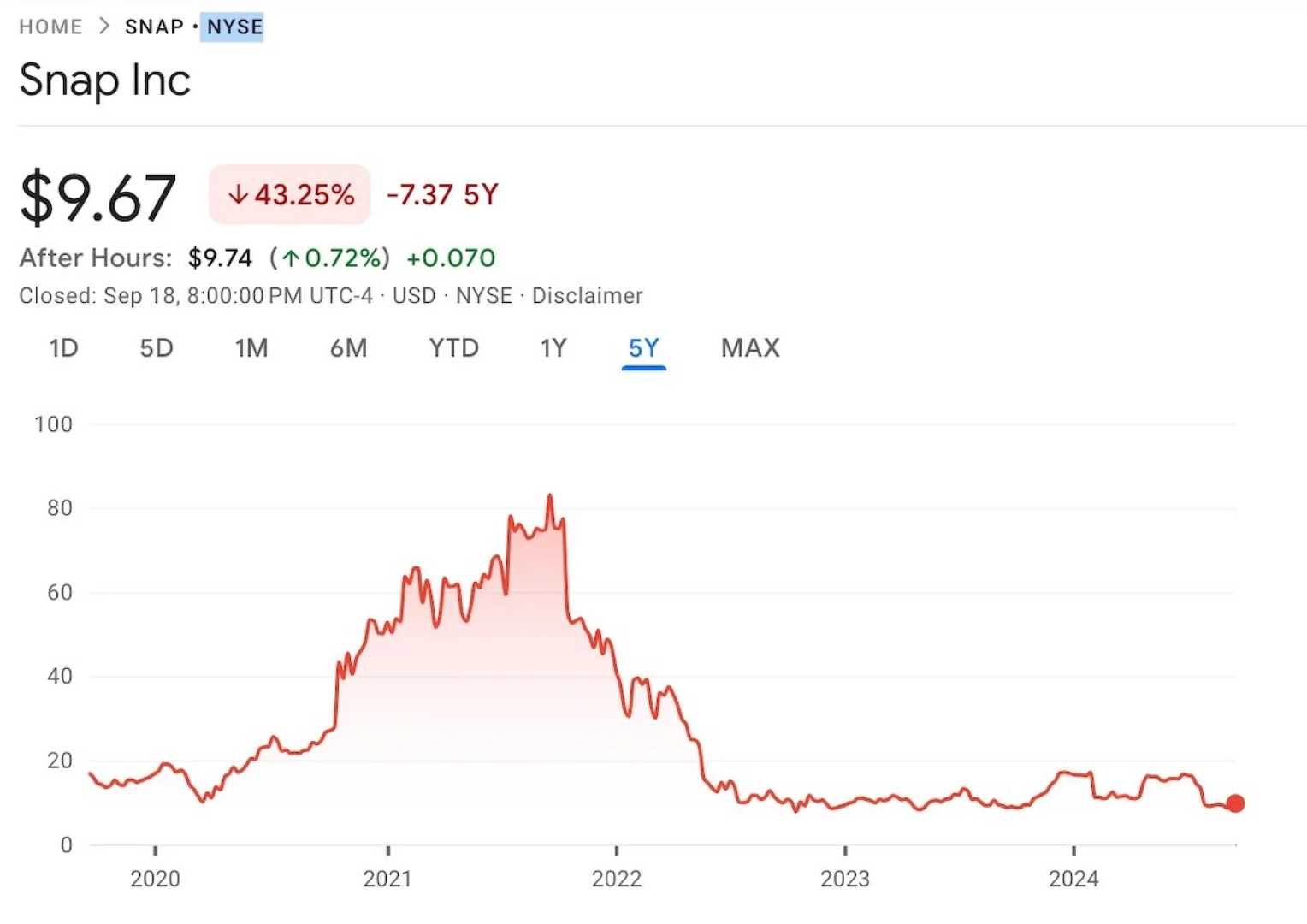

LOS ANGELES, Calif. — Over the past three months, 18 analysts have evaluated Snap Inc. (NYSE: SNAP), offering a range of opinions from bullish to bearish. The company, best known for its Snapchat app, has seen its stock price target average rise to $14.09, reflecting a 7.39% increase from the previous $13.12 average.

Analysts’ 12-month price targets for Snap vary widely, with a high estimate of $17.00 and a low of $9.00. The evaluations highlight a mix of optimism and caution, with 11 analysts rating the stock as “indifferent,” five as “somewhat bullish,” and two as “bullish.” No analysts have issued bearish ratings in the past three months.

Key analysts, including Brian Pitz of BMO Capital and Ken Gawrelski of Wells Fargo, have adjusted their ratings and price targets. Pitz lowered his target from $18.00 to $16.00 but maintained an “outperform” rating, while Gawrelski raised his target from $14.00 to $15.00, upgrading to “overweight.”

Snap’s financial performance has shown notable growth, with a 15.48% revenue increase as of September 30, 2024. However, the company’s net margin of -11.16% and return on equity (ROE) of -7.17% indicate ongoing challenges in profitability and capital efficiency. Its debt-to-equity ratio of 1.92 also raises concerns about financial stability.

Snapchat, the company’s flagship app, continues to innovate with augmented reality (AR) lenses, creator content, and local event updates. While advertising remains its primary revenue source, the company also sells AR Spectacles, though these contribute minimally to overall sales.

Analysts base their evaluations on factors such as revenue predictions, risk assessments, and company updates. Their insights are crucial for investors navigating Snap’s volatile market position. As the company balances growth with financial challenges, its stock remains a focal point for Wall Street observers.