Business

Snap’s Stock Declines Amid Innovations and User Growth

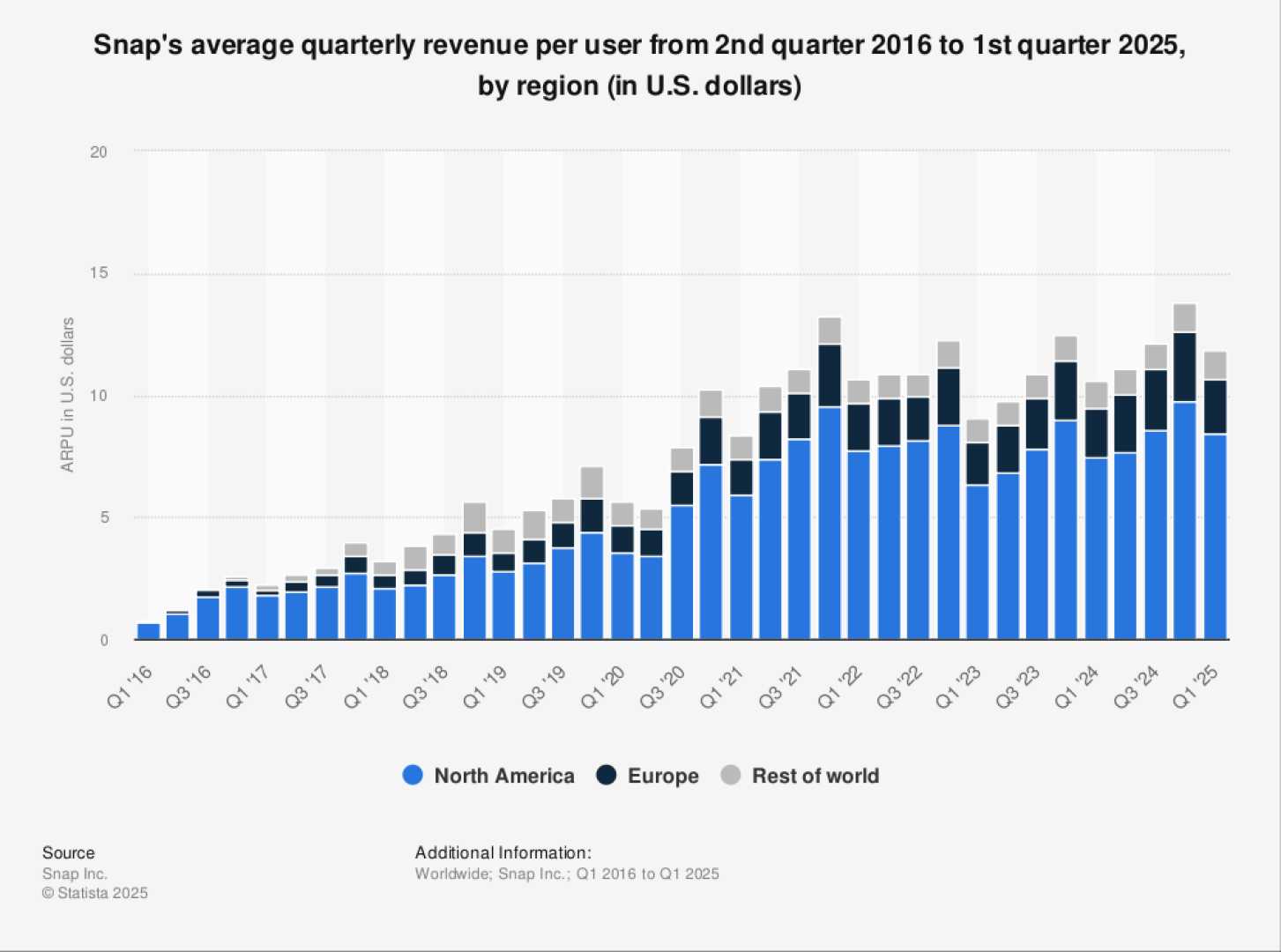

LOS ANGELES, CA — Snap Inc., the parent company of Snapchat, has seen its stock drop significantly since peaking at $83 in 2021. As of June 10, 2025, Snap’s market capitalization stands at $14 billion, with shares trading at $8.43, a 90% decrease over the past four years. This decline is largely attributed to unstable revenue and profit figures following changes in privacy regulations affecting targeted advertising.

In an effort to recover, Snap has invested in innovations such as machine learning (ML) advertising technology and augmented reality (AR) tools. The company’s ML technology has led to a 30% increase in app install conversions from Apple devices in the first quarter of 2025 compared to the prior year.

Additionally, Snap introduced an automated bidding system for advertisers, resulting in an average 32% reduction in their cost-per-action during the same period, while their return on ad spend increased by 16%. These efforts indicate Snap’s commitment to enhancing its advertising platform.

Another major advancement came with the launch of Sponsored AI Lenses, which allow users to visualize clothing and accessories via their smartphone cameras. This feature is expected to drive user engagement and create shareable moments on the platform.

Snap also improved its My AI chatbot, leveraging Alphabet‘s Gemini technology. This integration has resulted in a 55% growth in daily active users of the chatbot year-over-year in the first quarter of 2025.

Despite its struggles, Snap reported a 14% year-over-year revenue increase to $1.36 billion for the first quarter, reflecting its resilience. To further diversify revenue sources, Snap launched Snapchat+, a subscription service that has gained nearly 15 million subscribers, up 59% from the previous year.

While the company reported a net loss of $139.6 million, it marked a significant improvement from a loss of $305.1 million in the same quarter of the previous year. Snap is focusing on careful management of expenses, which grew only 2%.

As the stock trades at its lowest price-to-sales ratio of 2.5, many investors see potential in Snap’s growth trajectory. The platform boasts a record 460 million daily active users, providing a steady flow of opportunity for advertisers.

As the company continues to develop its advertising technology and expand its user base, Snap remains a company to watch for potential recovery over the coming years.