Business

Snap Stock Rallies Ahead of Q4 Earnings Amid TikTok Uncertainty

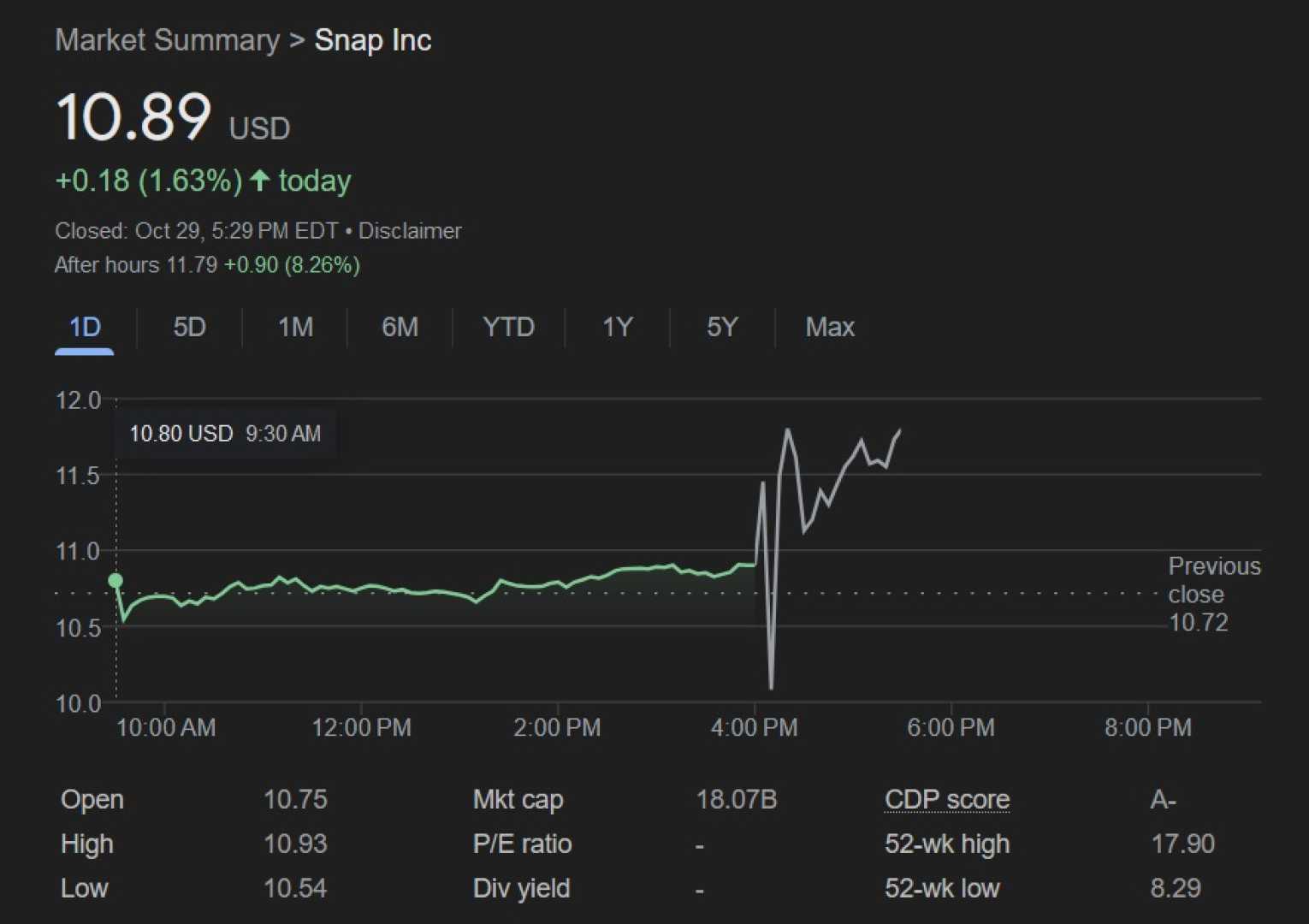

SANTA MONICA, Calif. — Snap Inc., the parent company of Snapchat, is set to report its fourth-quarter earnings Tuesday, with analysts closely watching the company’s performance amid a volatile year for the social media platform. Snap stock has rallied ahead of the report, gaining about 25% since its August low, but remains down 30% over the past 12 months.

Analysts polled by FactSet expect Snap to post a loss of 4 cents per share for the December quarter, an improvement from a loss of 15 cents per share in the same period last year. Revenue is projected to grow 13.7% year-over-year to $1.55 billion, while daily active users are expected to reach 451 million, a 9% increase.

Jefferies analyst James Heaney, who rates Snap stock a buy, highlighted several factors influencing investor sentiment. “Firstly, TikTok‘s U.S. ban and subsequent reinstatement likely benefited Snap’s brand ad business,” Heaney wrote in a client note. “Secondly, continued improvements to the direct-response business should help drive at least mid-teens direct-response revenue growth.”

Direct-response ads, which prompt users to take immediate actions like clicking on product pages, have been a key focus for Snap as it competes with Meta Platforms for digital ad revenue. However, Heaney noted potential headwinds, including softness in brand-focused advertising and disruptions from Snap’s plan to launch a streamlined version of its app, called Simple Snapchat.

Evercore ISI analyst Mark Mahaney expressed caution, citing concerns about Snap’s first-quarter revenue guidance. “With Snap, we see a stock that has materially outperformed intra-quarter but is at risk of providing Q1 revenue guidance below the Street,” Mahaney wrote in a Q4 earnings preview. He maintains an “in-line” rating on the stock.

Snap’s stock performance has been uneven since its pandemic-driven surge in 2021, which was followed by an 80% decline in 2022. Despite recent gains, the company’s IBD Composite Rating of 60 out of 99 and Relative Strength Rating of 19 out of 99 reflect ongoing challenges in the competitive social media landscape.

Investors will also be watching for updates on Snap’s efforts to capitalize on TikTok’s regulatory challenges. President Donald Trump‘s recent executive order delayed a potential ban on TikTok for 75 days, but the app remains unavailable for downloads in U.S. app stores, potentially creating opportunities for Snapchat to attract new users and advertisers.