Business

Snowflake Earnings Forecast Raises Hopes Amid AI Demand

LOS ANGELES, California — Snowflake Inc. is set to release its fourth-quarter fiscal 2025 results on February 26, prompting a wave of optimism among analysts due to growing demand for its artificial intelligence (AI) offerings.

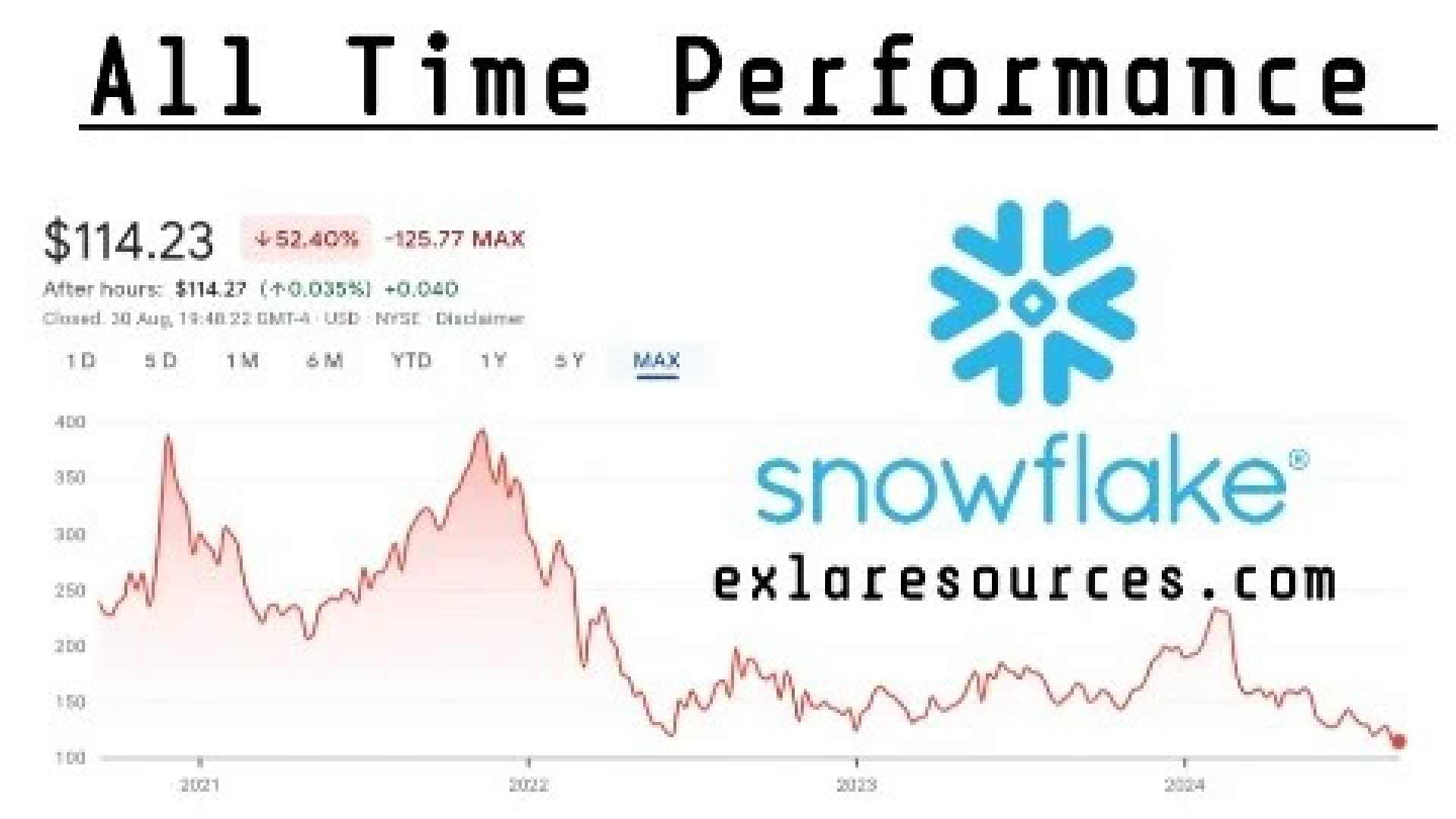

The cloud-based data warehousing and analytics company will report earnings after the market closes on Wednesday. So far in 2025, Snowflake’s stock (SNOW) has appreciated by 11% as analysts predict a 23.4% year-over-year revenue increase to approximately $956.75 million.

Despite these projections, analysts also anticipate a more than 48% year-over-year decline in profits, as rising GPU-related expenses and continued investments in growth may offset the uptick in revenue.

DA Davidson analyst Gil Luria has reaffirmed a Buy rating for Snowflake, setting a price target of $200. He cited consistent momentum in the company’s core data warehouse products and the recent AI and machine learning releases as driving factors. “Our proprietary developer datasets indicate sustained demand among developers,” Luria noted.

In contrast, Bernstein analyst Mark Moerdler, while maintaining a Hold rating, raised the price target from $154 to $161. Moerdler suggests that investors should feel secure with SNOW stock heading into Q4 but warns that high valuation could hinder future upside. He observed that key business metrics, such as net retention ratio (NRR) and current remaining performance obligations (CRPO), are stabilizing, which could lead to favorable Q4 results.

Additionally, Moerdler remains cautious about labeling recent momentum as a definitive successful pivot, crediting the last fiscal quarter’s performance alone as insufficient evidence for long-term stability.

Using TipRanks‘ Options tool, expectations for Snowflake’s stock movement post-earnings announcement suggest a significant shift is anticipated, with some analysts observing a potential move of 10% in either direction. Presently, Wall Street holds a Strong Buy consensus rating for Snowflake, comprising 24 Buys and four Holds. The average price target of $203.35 suggests a promising 19% upside from current levels.

Recent sentiments from Stocktwits indicate mixed feelings among retail investors, settling in a neutral range of 50 out of 100. While some display skepticism, a number of users are hopeful for an unexpected positive earnings announcement.

In the lead-up to the Q4 results, analysts from TD Cowen and Jefferies have also raised their price targets for Snowflake, highlighting a robust demand backdrop. TD Cowen increased its target from $190 to $210 while asserting its Buy rating, pointing to stable consumption trends and potential AI-driven growth. Jefferies notably raised its target from $200 to $220 due to expectations of healthy demand but acknowledged rising competition as a challenge.

As the earnings date approaches, investors will be closely monitoring outcomes in light of the expectations that have built up surrounding the company’s performance in the burgeoning AI sector.