Business

Snowflake Reports Strong Q3 Results, But Faces Challenges in Revenue Growth and Valuation

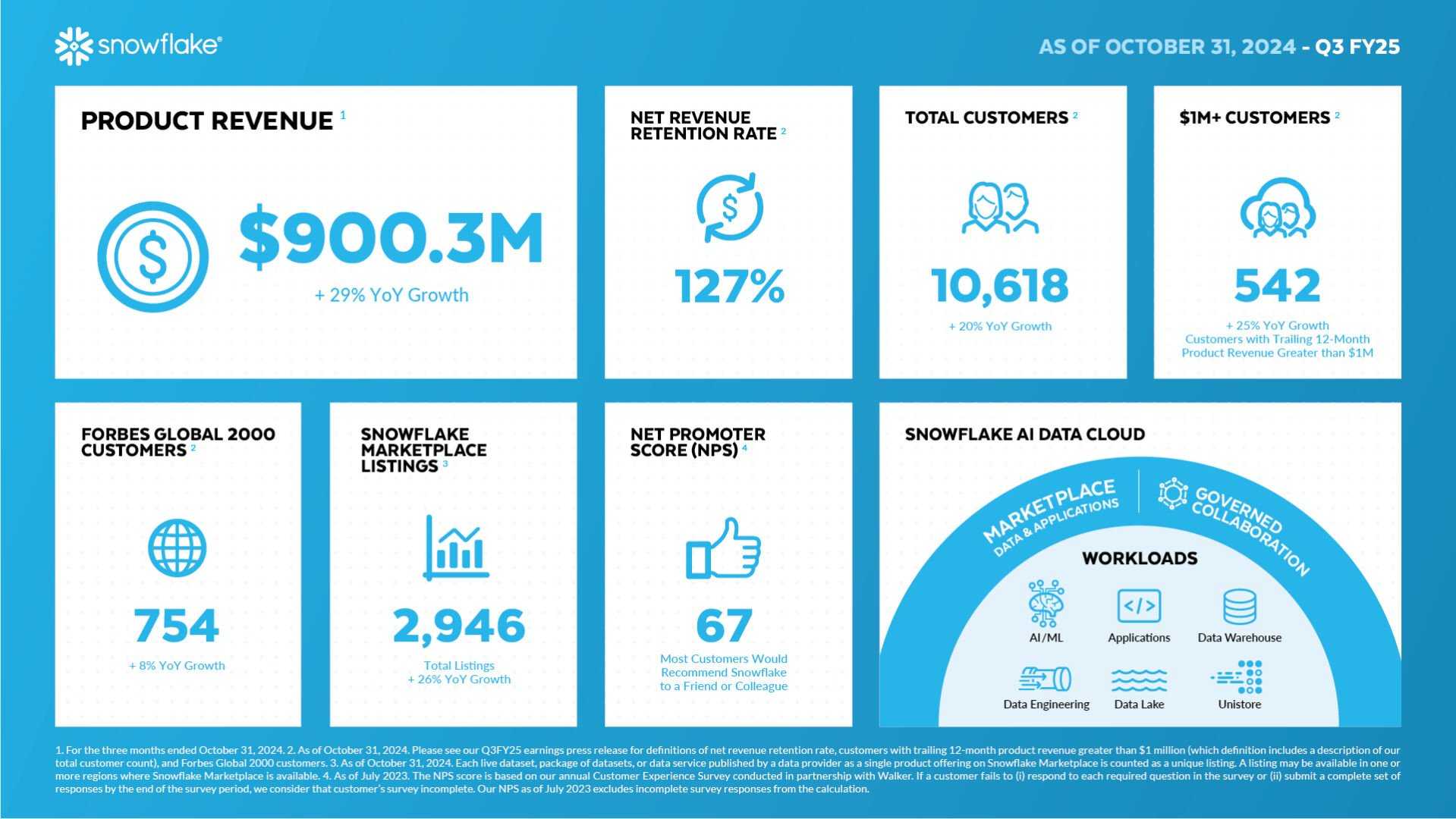

Snowflake Inc. (SNOW) has reported strong financial results for the third quarter of fiscal year 2025, despite ongoing concerns about decelerating revenue growth and high valuation. The company’s total revenue for Q3 FY2025 was $942.1 million, a 28% increase year-over-year, with product revenue reaching $900.3 million, up 29% from the same period last year.

The net revenue retention rate remained robust at 127%, and the number of customers with trailing 12-month product revenue exceeding $1 million grew to 542, representing a 25% increase. Remaining performance obligations also saw a significant 55% year-over-year increase to $5.7 billion.

Despite these positive metrics, Snowflake’s revenue growth has been slowing. The company reported a 28.9% revenue growth in Q2 FY2025, down from 32.89% in Q1 and significantly lower than the 69.41% and 105.95% growth rates seen in 2023 and 2022, respectively. Analysts expect Q3 FY2025 revenue growth to slow further to 23.42%.

The stock price has reflected these concerns, with SNOW shares down 34.55% year-to-date and 19.53% over the past 12 months. However, following the strong Q3 results, Snowflake’s shares surged 14% in after-hours trading.

Valuation remains a significant issue, with Snowflake’s forward price-to-earnings (P/E) ratio at a high 140.5 based on analyst consensus for Fiscal 2026 non-GAAP diluted EPS. This has led many analysts to rate the stock a Hold, despite its strong operating fundamentals and significant cash reserves of $3.2 billion as of July 31).

Snowflake’s commitment to artificial intelligence (AI) and its recent stock buyback program, which saw $1.02 billion worth of shares repurchased in Q3, are seen as positive long-term strategies. The company’s board has also approved an additional $2.5 billion for stock buybacks, extending the program’s expiration date to March 2027).