Business

SoFi Technologies Set to Release Earnings Next Week Amid Positive Trends

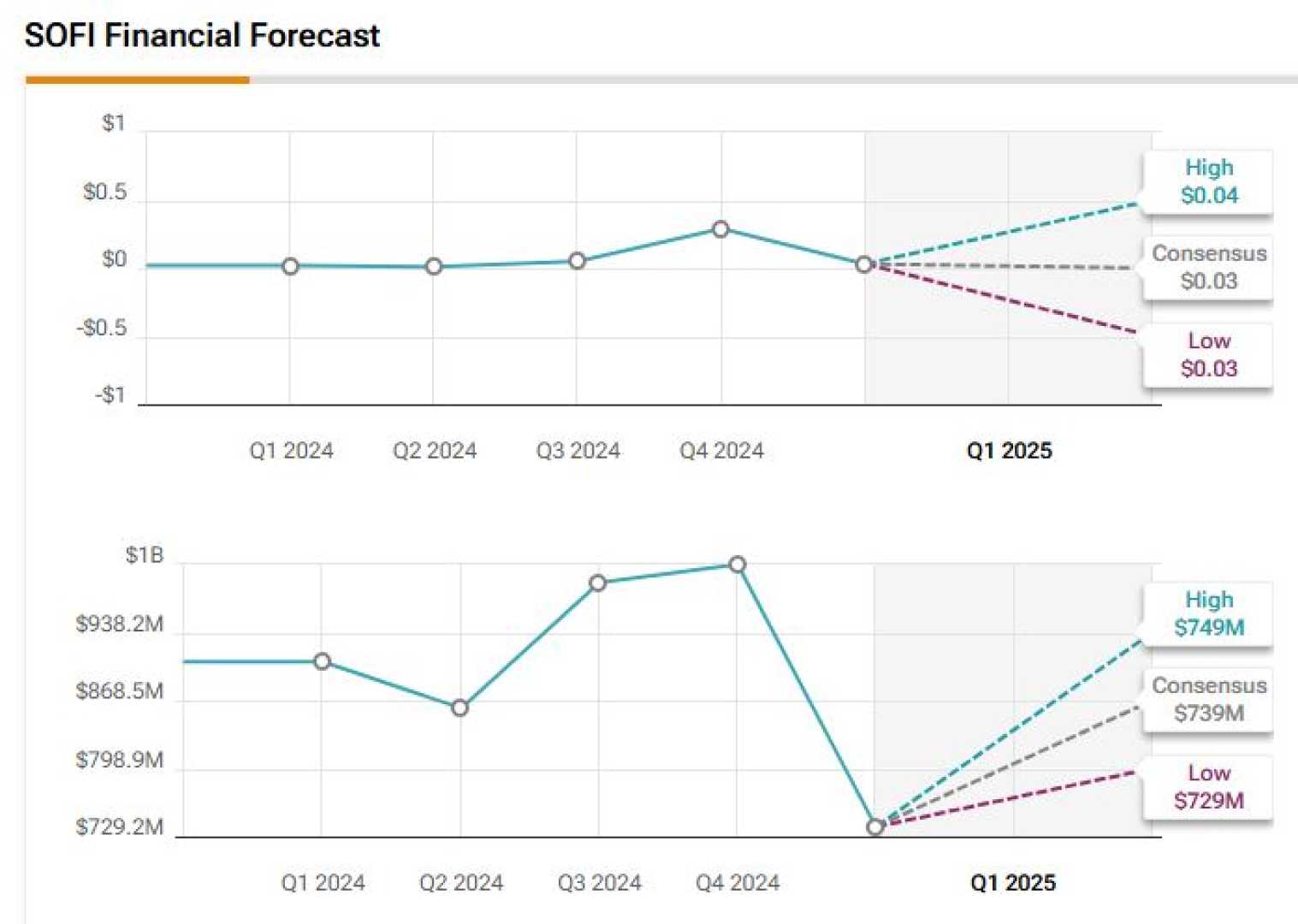

San Francisco, CA – SoFi Technologies, Inc. is scheduled to release its earnings report on Tuesday, April 29, 2025. Analysts expect the company to report earnings of $0.03 per share, with projected revenues around $739 million, marking a significant 27% increase from the previous year.

This anticipated revenue growth is attributed to higher fee-based services fueled by an expanding member base, which reached 10.1 million in the last quarter. Historical data shows that SoFi’s stock has yielded positive one-day returns following earnings announcements in 67% of instances over the past five years.

Those returns have averaged 8.9%, reaching as high as 28.4%. This volatility around earnings reflects the market’s anticipation of the company’s performance and future prospects. For traders, understanding these trends can inform better strategies both before and after the earnings announcement.

The financial services segment, crucial to the company’s overall performance, is expected to contribute approximately $293.7 million in revenues, indicating a remarkable 95% year-over-year growth. Meanwhile, revenue from lending is projected at $372.2 million, reflecting a 12.6% year-over-year increase.

However, the stock’s performance this year has been underwhelming, with a 20% decline compared to the 15% drop in the peer group. Current market analysis indicates that SoFi’s stock is overvalued, trading at a forward P/E ratio of 37.79, significantly above the industry average of 15.4.

SoFi’s Galileo platform, which supports its technology and banking services, has positioned the company favorably against traditional banks like JPMorgan, Bank of America, and Wells Fargo, who are also enhancing their digital services.

As the demand for integrated financial solutions rises, SoFi aims to capture more market share through its innovative offerings. While there are significant growth opportunities, analysts advise existing investors to hold, citing risks associated with overvaluation and potential competition.

The combination of a negative earnings ESP and a Zacks Hold rating suggests that earnings might fall short of expectations, despite upward revenue trends. Investors may want to wait for post-earnings clarity to reassess their positions.