Business

SoFi Technologies Surges 15% in 2025, Defying Fintech Sector Downturn

SAN FRANCISCO, Calif. — SoFi Technologies, a leading neobank, has continued its strong performance into 2025, with its stock surging approximately 15% year-to-date. This rally has pushed the stock to its highest levels in three years, defying a broader downturn in the fintech sector despite rising Treasury yields and reduced expectations for Federal Reserve rate cuts.

The company is set to report its fourth-quarter earnings on January 27, 2025, before the market opens. Investors are optimistic that SoFi will deliver strong results, building on its current momentum. J.P. Morgan analyst Reginald Smith remains upbeat about the company’s prospects, particularly highlighting the potential of its Loan Platform business.

“We are positive into the print, despite rising treasury yields, which could be a ~$100M headwind to loan fair values,” Smith noted. “We think SoFi’s Loan Platform business, which contributed over $50M in high-margin revenues in Q3 2024, could be a source of upside this quarter and a meaningful profit driver in 2025.”

SoFi’s Loan Platform business, which involves originating loans and transferring them to third parties for referral or origination fees, has been a significant growth driver. In the third quarter of 2024, the company originated approximately $1 billion in personal loans, generating $56 million in high-margin fees—a year-over-year increase of more than five times.

Smith added, “We like this business as it allows SoFi to monetize applicants that may have otherwise been rejected, without burdening its own balance sheet or capital ratios, which could ultimately boost return on equity and drive multiple expansion.”

Looking ahead, Smith expects SoFi to guide for low 20% revenue growth and around 30% EBITDA margins in 2025, in line with Street expectations. However, he advises caution, suggesting that investors wait for any post-earnings weakness before buying shares. Smith maintains a Neutral rating on the stock with a $16 price target, implying an 11% downside from current levels.

Other analysts are also cautious, with four maintaining a Neutral stance, six recommending Buys, and four advocating Sells. The consensus rating is Hold, with an average price target of $13.19, suggesting a potential 26% decline over the next year.

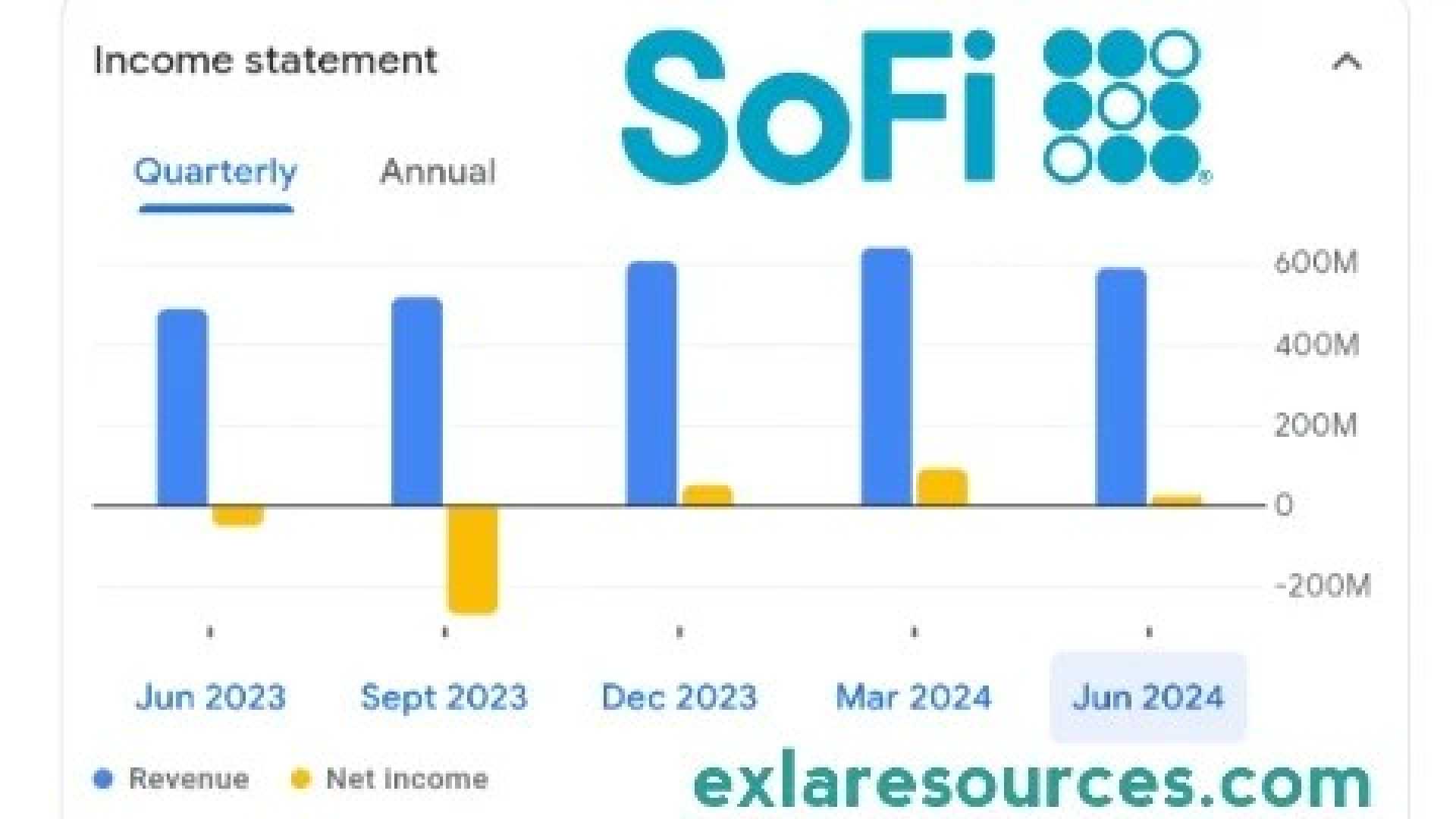

SoFi’s recent performance has been bolstered by strong demand for its personal loans, including a $525 million securitization agreement with PGIM Fixed Income. The company’s membership base also grew by 756,000 in the third quarter of 2024, marking its highest one-quarter new member additions ever. Revenue grew by 30% year-over-year, with net income reaching $214 million, compared to a $301 million net loss in the same period a year prior.

As SoFi continues to expand its lending and financial services offerings, its stock remains a focal point for investors, particularly those looking for growth in the fintech sector.