Business

Solana Faces Market Challenges amid Broader Crypto Declines

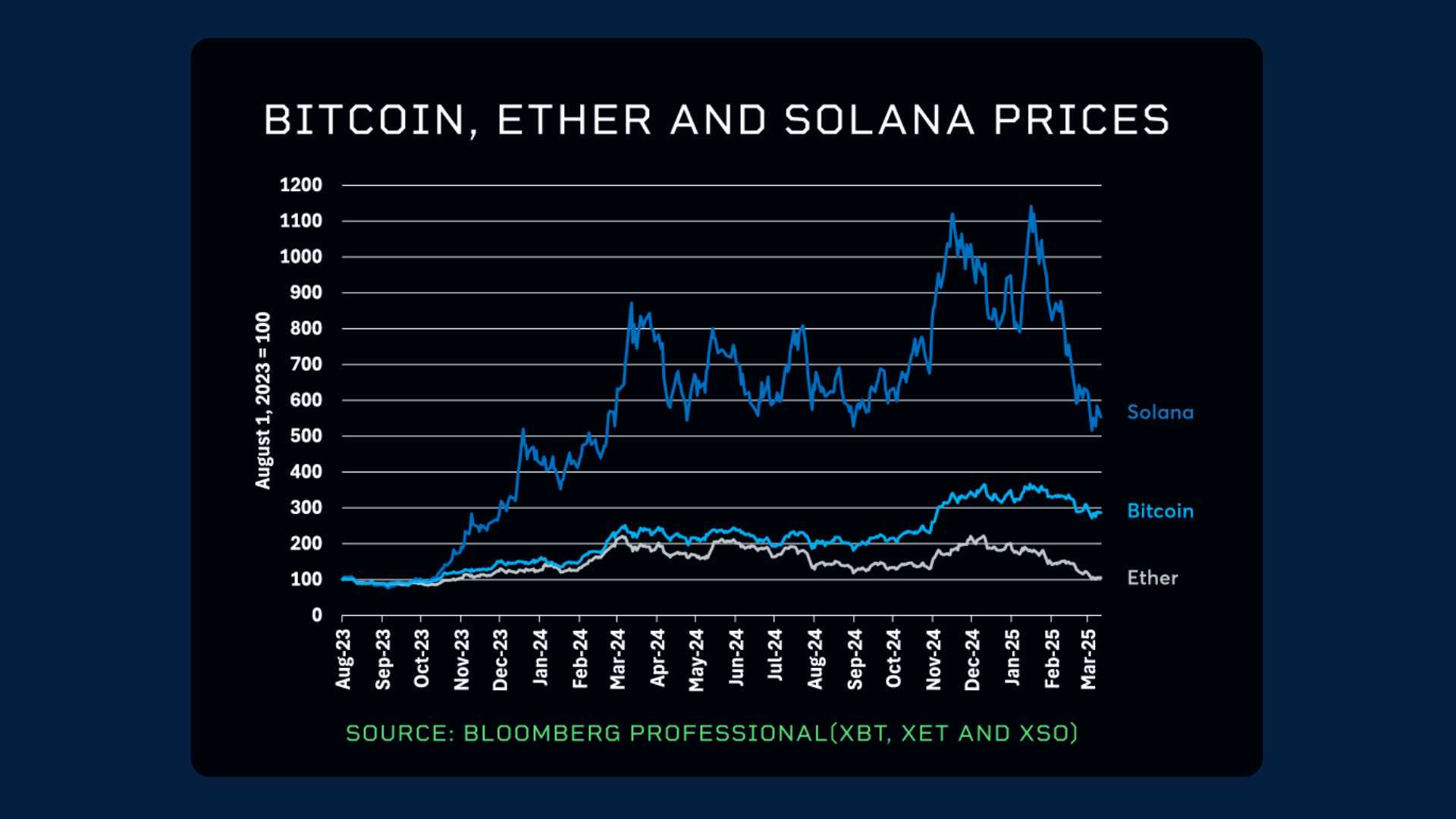

New York, NY — Solana has been struggling against its major competitors like Bitcoin, Ethereum, and XRP, according to analysts from Decrypt. The cryptocurrency is facing significant selling pressure as investors seek to take profits, especially during market downturns.

Dean Chen, a market analyst, noted that within the last 24 hours, forced liquidations across the market exceeded $290 million. He explained that assets with high leverage and low liquidity are experiencing sharper declines, with Solana being severely impacted.

Data shows that derivatives contracts have contributed to over $31.6 million in forced selling for Solana in just one day, while Bitcoin and Ethereum faced $68.5 million and $52.2 million in liquidations, respectively.

As of now, Solana is trading at $213, reflecting a 3% drop in one day and over 9% in the past week, according to CoinGecko, a crypto price aggregator.

Chen attributed the recent pullback to market sentiment following announcements from Forward Industries and DeFi Development Corp. regarding their investments in Solana. “Once the announcements became official, the market reacted with a classic ‘buy the rumor, sell the news’ dynamic,” he said. This led to speculative traders exiting their positions, contributing to the ongoing correction.

The downturn has left users on Myriad, a prediction market, uncertain about Solana’s future. As of now, predictors give it even odds of rising above its past record of $293.31 by 2025, a stark contrast to earlier this week when the probability was nearly 65%.

Gordon Grant, a portfolio manager at a crypto index fund, pointed out that the upcoming events near the end of the month have dampened market enthusiasm. “A 15% pullback from $210 does not feel extreme, given that SOL had rallied over 50% since early August,” he explained.

Additionally, the announcement last week that another $1.6 billion in funds will be distributed to creditors is also affecting market dynamics as investors reassess their positions.