Business

Spotify Stock Surges 7% on Bullish Fourth-Quarter Guidance Despite Mixed Q3 Results

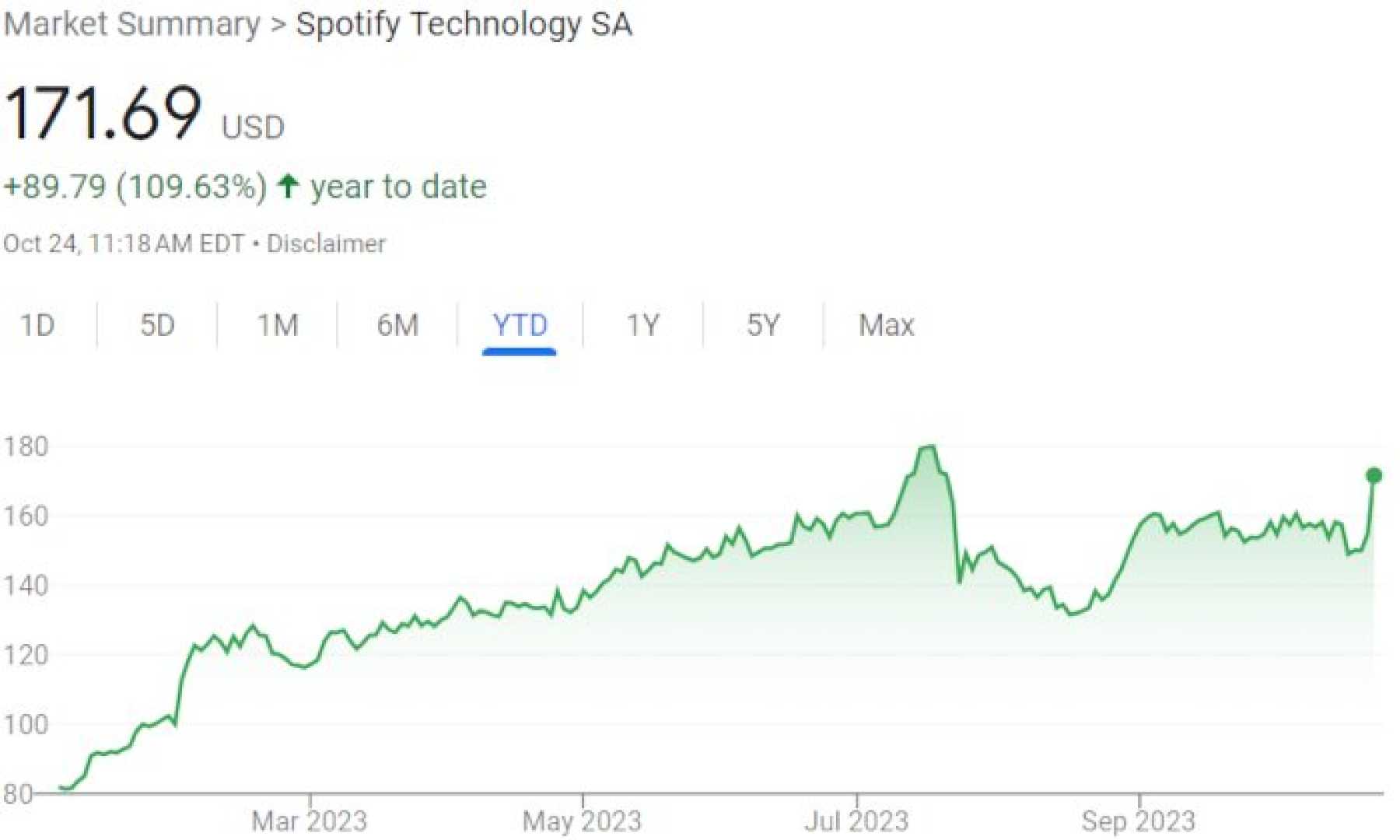

Spotify Technology S.A. (NYSE: SPOT) saw its stock rise by 7% in after-hours trading on November 12, 2024, following the release of its third-quarter financial results. Despite the company’s Q3 earnings and revenue falling short of Wall Street expectations, investors were buoyed by Spotify’s bullish guidance for the fourth quarter.

The Swedish audio-streaming giant reported earnings per share of $1.46, which missed the consensus forecast of $1.85. Quarterly revenue came in at $3.99 billion, slightly below the expected $4.02 billion. However, these misses were overshadowed by the company’s optimistic outlook for the current quarter.

Spotify highlighted strong subscriber growth, with 252 million paying subscribers at the end of September, exceeding analysts’ estimates of 250.1 million. Total monthly active users also increased to 640 million, surpassing Wall Street targets. The company anticipates adding about eight million premium subscribers in the fourth quarter, bringing the total to 260 million.

The positive forward guidance includes expectations of operating income reaching $509.76 million in the fourth quarter, driven by ongoing cost cuts and strong subscriber growth. Recent price increases in the U.S. and Canada are also expected to contribute to this growth.

Analysts have maintained a positive outlook on Spotify, with a consensus Strong Buy rating among 14 Wall Street analysts. The average price target of $431 implies a potential upside from current levels.