Business

U.S. Stock Futures Steady Amid Mixed Earnings and Bitcoin Decline

NEW YORK, NY – U.S. stock futures remained stable Tuesday following a challenging Monday, where major indexes struggled to bounce back from last week’s decline. Meanwhile, the cryptocurrency sector experienced a significant setback as Bitcoin fell to its lowest level since November, impacting crypto-related stocks.

Futures on the S&P 500 were down 0.3% after a 1.2% drop on Monday, while tech stocks saw a slight uptick. Investors continue to focus on home prices and consumer confidence, with the yield on the 10-year Treasury note decreasing to approximately 4.3%. Commodities such as gold and oil also experienced declines.

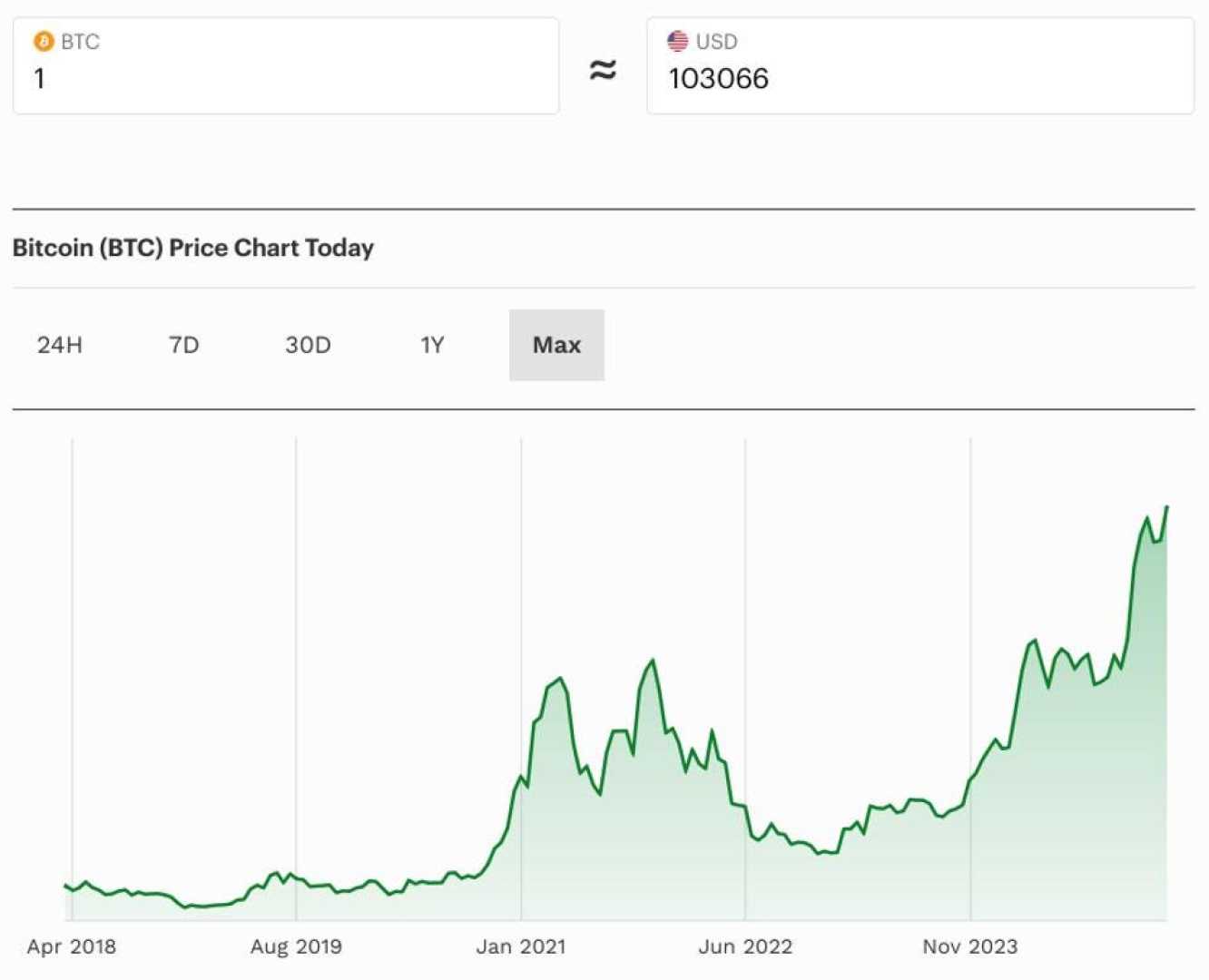

Bitcoin has plunged 2.5%, trading below $90,000, its lowest point in months. The downturn has led to a broader decline in cryptocurrency stocks, with shares of MicroStrategy dropping about 5% in premarket trading. Other platforms like Coinbase and Robinhood also saw a decrease of roughly 4%. Additionally, Bitcoin mining stocks, including Marathon Holdings and Riot Platforms, were down nearly 4%.

Retail giant Home Depot reported fourth-quarter earnings that surpassed expectations, with an adjusted profit of $3.13 per share against a revenue of $39.70 billion. Analysts had anticipated earnings of $3.03 per share on $39.12 billion in sales. However, the company’s forecast for 2025 indicated weaker than expected growth, startling investors and contributing to a dip in shares, though they recovered slightly in premarket trading.

Meanwhile, Super Micro Computer saw a 3% increase in premarket trading ahead of today’s deadline for filing delayed financial reports with the Nasdaq. The firm has faced scrutiny after failing to file financial statements due to accounting concerns. Super Micro reassured investors that it is working diligently to meet today’s deadline to avoid delisting.

In corporate leadership changes, Unilever announced the departure of CEO Hein Schumacher after less than two years. The company has appointed Fernando Fernandez as Schumacher’s successor. UBS analysts described the leadership change as “unexpected.” Despite positive performance in Unilever’s U.S.-listed shares over the past year, the stock slipped about 1% in premarket activity.

Investors are closely monitoring these developments as the market grapples with mixed signals amid ongoing volatility. Home Depot’s robust performance contrasted with cautious future projections, Bitcoin’s significant price drop raised concerns within the crypto sector, and Super Micro Computer’s deadline could impact its stock’s future. The uncertainty surrounding Unilever’s leadership transition also adds another layer of complexity for investors.