Business

US Stock Market Experiences Mixed Results Amid Earnings Reports and Interest Rate Uncertainty

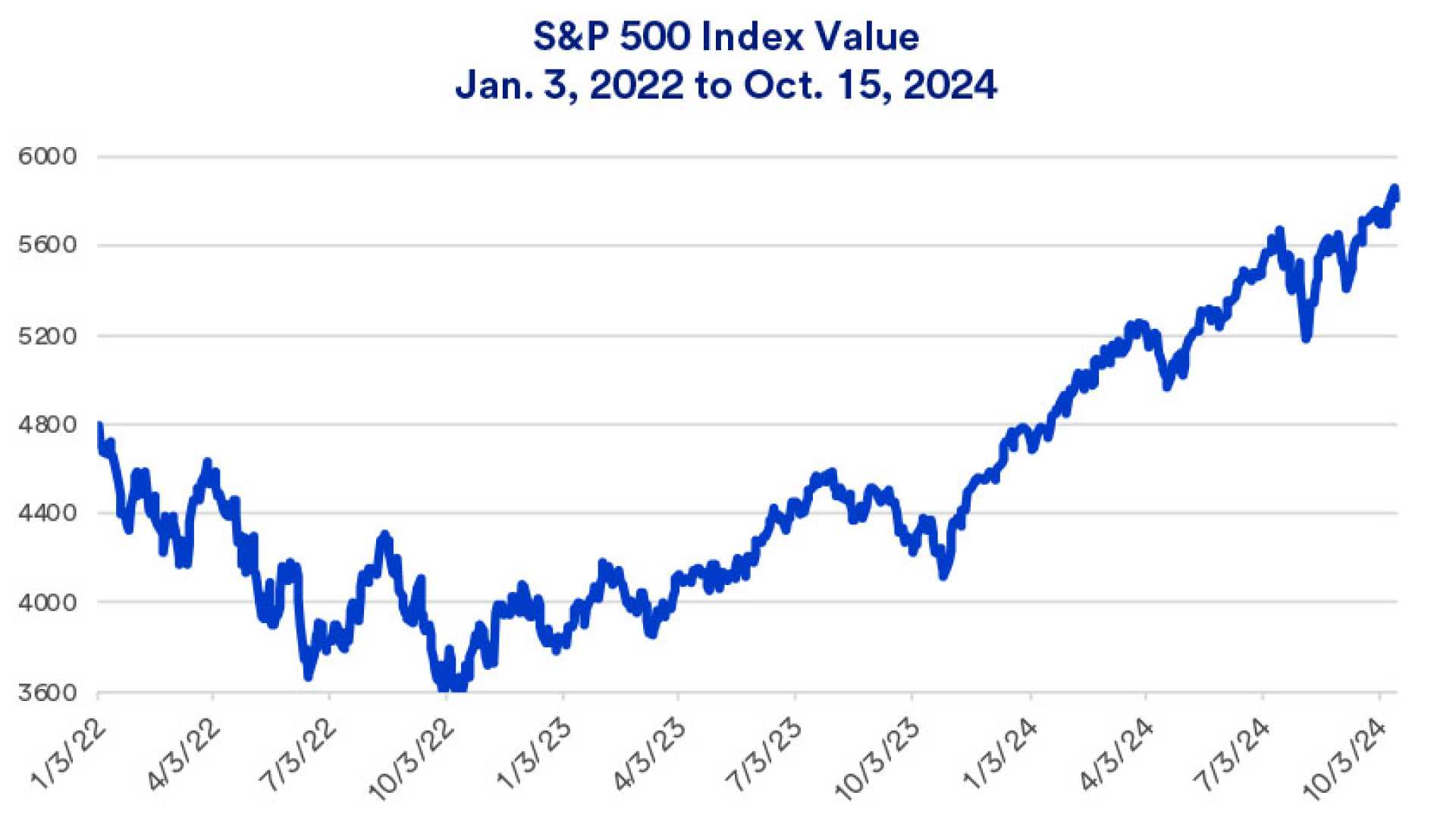

The US stock market has been experiencing mixed results over the past few days, influenced by a combination of factors including earnings reports, interest rate uncertainty, and the impending U.S. presidential election. On Tuesday, the S&P 500 posted back-to-back losses for the first time since September, marking a pause in the recent market rally. The Dow Jones Industrial Average finished slightly below the neutral line, while the Nasdaq Composite edged up by approximately 0.2%.

Investors are proceeding with caution due to increasing skepticism about the Federal Reserve‘s potential for aggressive rate cuts or maintaining current levels in November. Robust economic performance, cautious remarks from Federal Reserve officials, and worries about the fiscal repercussions of a potential election victory by Republican candidate Donald Trump are contributing to this sentiment. The yield on the 10-year Treasury note stabilized around 4.2% after significant gains earlier in the week, impacting rate-sensitive sectors such as real estate.

Earnings reports have been a significant focus, with General Motors boosting its guidance for the third time this year due to strong electric vehicle sales, resulting in a stock surge of over 10%. In contrast, GE Aerospace and Verizon saw their shares decline following mixed results for the third quarter. Tesla‘s earnings report, scheduled for Wednesday, is highly anticipated, with Wall Street speculating on whether the tech giants will drive the next upward movement in stock prices.

The stock market’s performance is also being influenced by the U.S. presidential campaign. Experts suggest that while the market may continue to rise regardless of whether Vice President Kamala Harris or former President Donald Trump wins, each candidate’s policies could favor different sectors and pose unique risks. A Trump presidency could bolster corporate profits through extended corporate tax cuts and deregulation, favoring sectors like oil and gas and artificial intelligence, but could also threaten market performance with proposed tariffs and labor policies. A Harris presidency might see a hike in corporate taxes and robust regulatory enforcement, potentially limiting stock market gains but benefiting renewable technology sectors.

On Wednesday, the Dow Jones led the decline in US equities, dropping by over 250 points, as uncertainty surrounding potential interest rate reductions weighed on investors. The Nasdaq Composite and S&P 500 also fell, with the yield on the 10-year Treasury note remaining above 4.20%. Additionally, McDonald's shares plummeted nearly 6% due to an E. coli outbreak associated with its quarter pounder burgers, further impacting the Dow.