Business

Stocks Plunge as Tariffs Shake Investor Confidence

Washington, D.C. — Major U.S. stock indexes experienced significant declines on Tuesday as investors reacted to the Trump administration’s announcement of heavy tariffs against key trading partners Canada and Mexico. The S&P 500 and Nasdaq Composite indexes both fell over 1%, marking a continuation of the market’s downward trend amid growing concerns about the economy.

Treasury Secretary Scott Bessent stated during an interview on Fox News that the White House is dedicated to reducing interest rates to stimulate the economy, yet the backdrop of economic contraction looms ominously. “We’re set on bringing interest rates down,” Bessent said, emphasizing the administration’s strategy to bolster investors’ confidence.

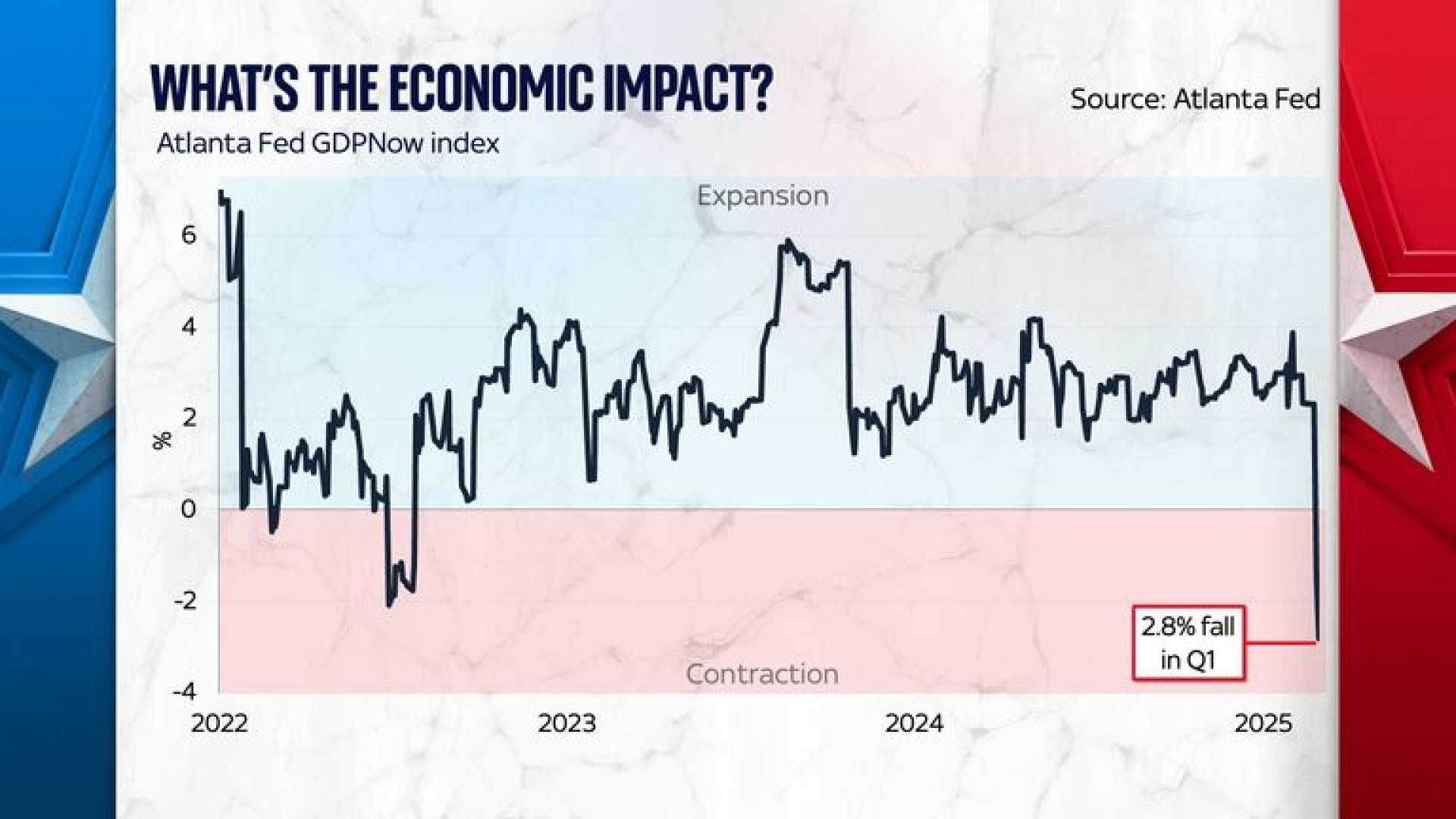

Economic predictions from the Atlanta Fed indicate the U.S. economy could contract by 2.8% in the first quarter of 2025, the steepest decline since the second quarter of 2020, when the COVID-19 pandemic hit. Analysts believe that the tariffs imposed by President Trump are the primary cause of these adverse economic forecasts, as they heighten inflation fears and complicate economic stability.

The market’s expectations for rate cuts have surged since Trump’s inauguration, with investors anticipating three cuts of 0.25 percentage points by the end of the year, bringing the federal funds rate down between 3.5% and 3.75%. Previously, the outlook had only considered a single cut.

During trading, the Dow Jones Industrial Average dropped by 1.63%, while the S&P 500 slid by 1.3%, and the Nasdaq Composite fell by 0.34%. Additionally, the yield on the 10-year U.S. Treasury note dropped to 4.1%, signaling a flight to safety among investors.

Shares of automakers, including Ford and General Motors, declined sharply as tariffs could raise production costs significantly. Ford fell nearly 3%, while General Motors and Stellantis dropped more than 4% each. Automakers are bracing for a constrained supply chain due to rising tariffs and potential retaliatory measures from Canada and Mexico.

Target‘s CEO Brian Cornell warned that the retailer may have to raise prices on some incoming goods due to these tariffs. “If there’s a 25% tariff, those prices will go up,” he said during a CNBC interview. Target, which relies on Mexican suppliers for fresh produce, may see immediate price increases on items like avocados and strawberries.

Market analysts remain split on the long-term impact of these tariffs. While some believe they could help restore manufacturing jobs in the U.S., others are concerned about their inflationary effects. Chris Galipeau, a market strategist, commented that the tariffs are part of a broader narrative that has shifted investor sentiment, rather than being merely a short-term strategy to impact pricing.

According to Gene Goldman, CIO of Cetera Financial Group, the uncertainty surrounding tariffs could lead to less productivity and a focus on risk aversion among investors. “This is an unprecedented territory for us,” he noted, signaling caution in the face of potential economic repercussions.

As businesses and consumers grapple with the implications of Trump’s tariffs, the market’s fluctuations reflect deeper concerns about the U.S. economy’s health and the investor sentiment surrounding trade policies. With upcoming releases of employment data and inflation statistics, the landscape for future market performance appears increasingly uncertain.