Business

Strong April Jobs Report Alters Investment Strategies, Says Charles Payne

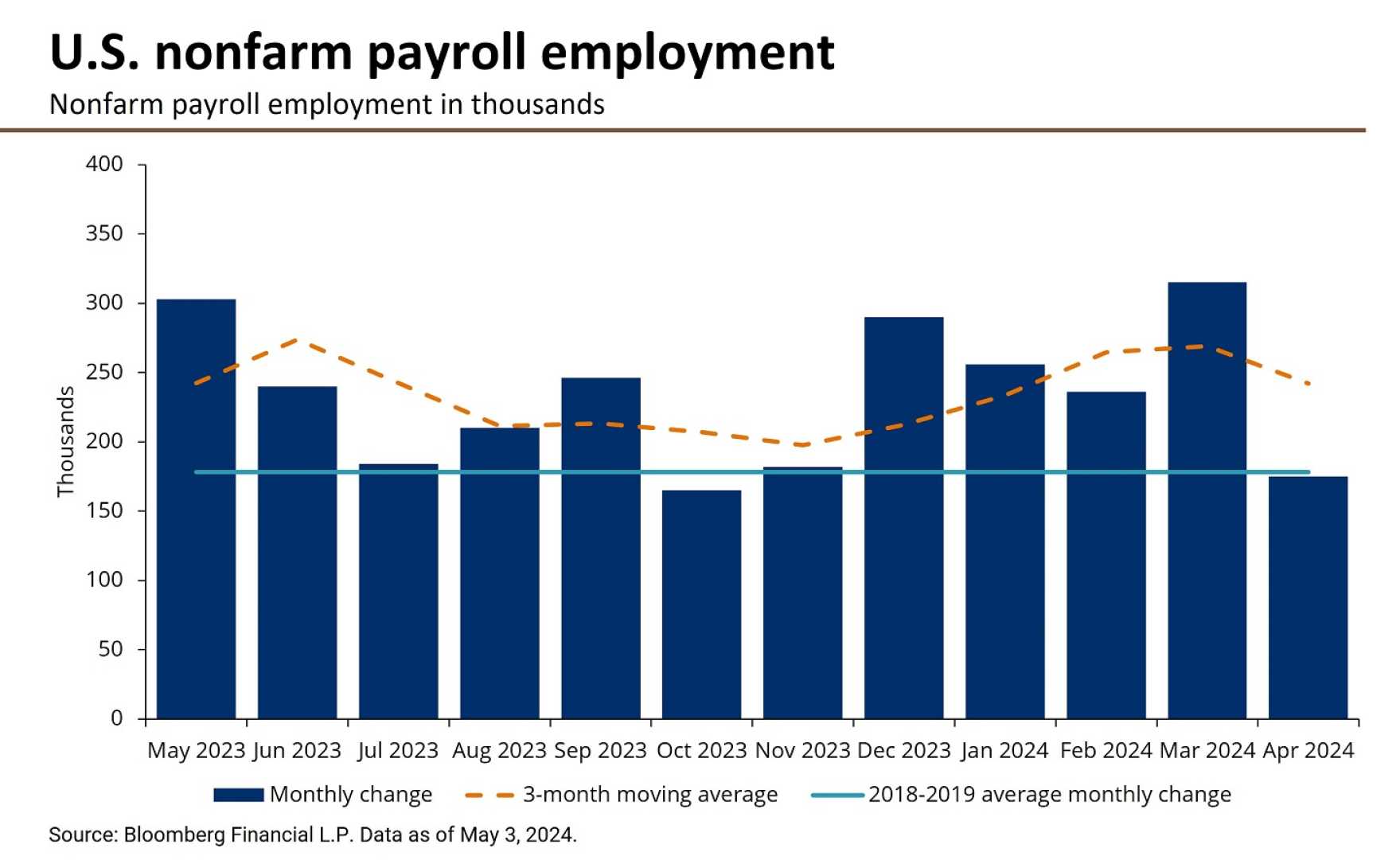

NEW YORK, NY — Charles Payne, host of ‘Making Money,’ recently discussed the significant influence of a better-than-expected jobs report for April on investment strategies. With U.S. household wealth in the stock market now totaling 170% of disposable income, Payne emphasized that investing is a lifelong commitment. Starting young, he noted, can result in greater financial security.

Investors aged 18 to 81 are encouraged to adopt a proactive stance. Instead of delaying investments due to market uncertainties, Payne urges individuals to seize the opportunity presented by the current market conditions. “This is more than just buying the dip; everyone should be preparing for the long-term,” he stated.

Payne pointed out that the top 10% of American households own 87% of all stocks. He implied that the current market turmoil may discourage some from investing, potentially strengthening the hold the wealthy have over the market. Instead, he advocates for the belief that the stock market can be a means for ordinary Americans to build wealth.

In his view, history has shown fewer and shorter recessions in recent years, implying that the economic system is designed to recover swiftly. “When the stock market is dropping and media urges you to sell, consider staying in and passively investing or buying the dip,” he advised.

Reflecting on his message, Payne pointed to the importance of tangible experience in investing, equating it to the principle of ‘time in the market’ being more beneficial than ‘timing the market.’ As a result, he concluded with a call for investors to treat current market corrections as opportunities for financial growth.