Business

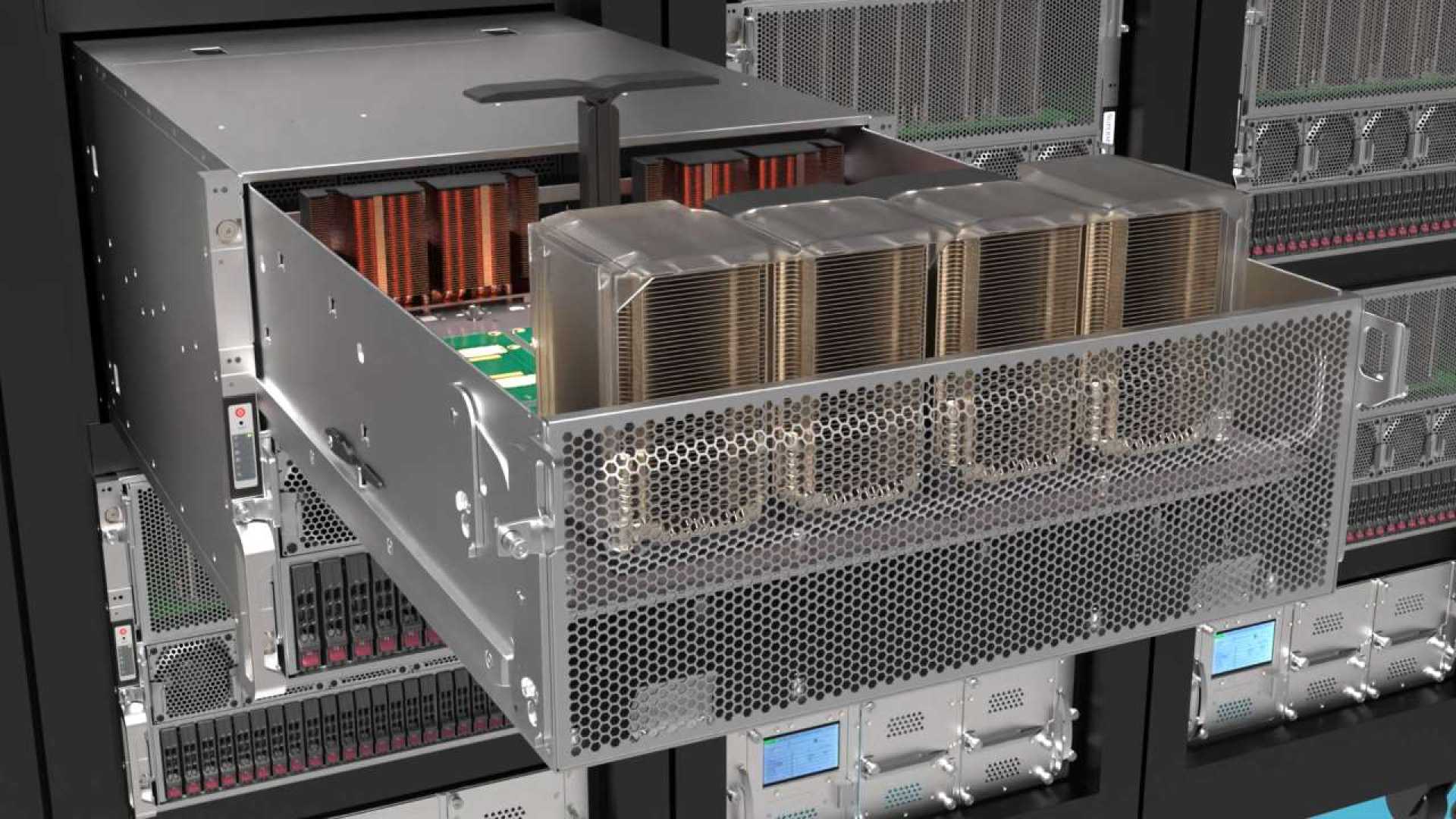

Super Micro Computer Cuts Revenue Forecast Amid Internal Challenges

BENGALURU, India — Super Micro Computer, a major player in the server market, lowered its revenue expectations for fiscal 2025 on May 6, raising concerns about its standing in the artificial intelligence (AI) sector.

The company now expects its revenue to range from $21.8 billion to $22.6 billion, a decrease from its previous estimate of $23.5 billion to $25.0 billion. This shift follows last week’s preliminary financial results, highlighting ongoing internal challenges that have led to fears of a potential delisting.

In after-hours trading, Super Micro’s shares dropped by 5.4%, reflecting investor worries. Financial analysts pointed out that delays in customer spending have significantly impacted revenue projections, specifically for the third quarter. The company’s adjusted quarterly profit estimates have also been reduced to between 29 and 31 cents per share, down from a previous forecast of 46 to 62 cents.

“Delayed customer platform decisions pushed sales into the fourth quarter,” the company stated, adding that these issues stem from higher inventories of older products and broader market concerns.

Market experts are increasingly cautious about the AI sector, particularly after U.S. President Donald Trump‘s tariffs have raised fears of a potential global economic slowdown. Recent developments include a significant drop in shares for competing firms, with Dell Technologies down 4.6% and Hewlett Packard Enterprise falling over 1.5% following Super Micro’s announcement.

“Super Micro’s difficulties seem more self-inflicted, rather than indicative of an industry-wide downturn,” said Michael Ashley Schulman, chief investment officer of Running Point Capital. He attributed the stock decline to internal mismanagement rather than external economic pressures.

Despite these setbacks, analysts maintain that demand for older generation AI chips remains strong, suggesting that Super Micro’s internal issues may be more critical to its future than overall market trends. Customers may pivot to competitors like Dell and HPE due to Super Micro’s recent challenges.

The company plans to address these issues in a conference call scheduled for later today.