Business

Super Micro Computer Faces Scrutiny Ahead of Earnings Report

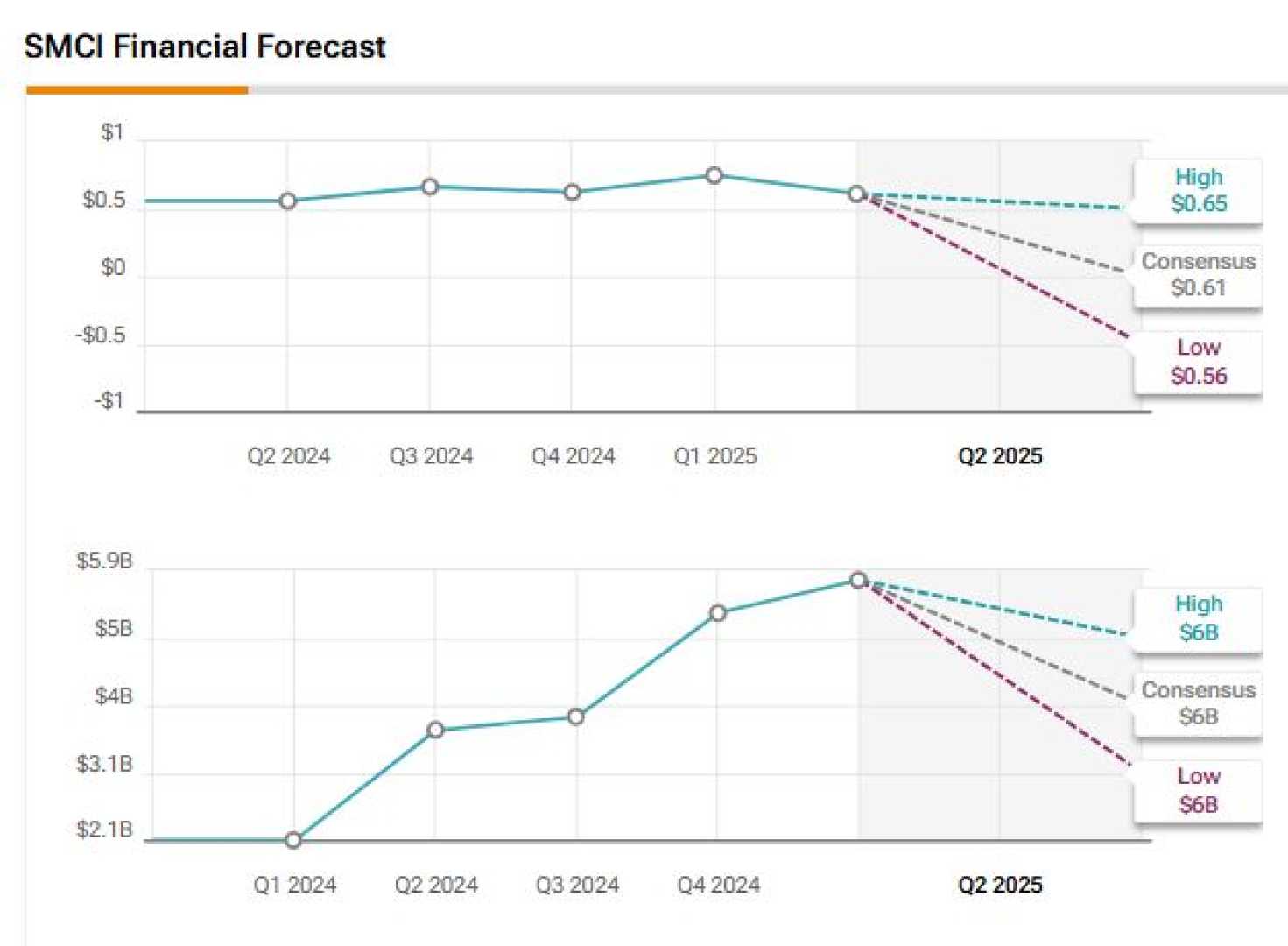

San Jose, California — Super Micro Computer (SMCI) is set to announce its financial results for the second quarter of fiscal 2025 on February 11, with analysts predicting earnings per share (EPS) of $0.61 and revenue of $5.77 billion.

The anticipated results reflect a significant upward trend for SMCI, which has seen its stock soar over 56% in the past three months, driven by the company’s technological advancements and strategic partnerships, particularly with Nvidia. Wall Street is forecasting a revenue increase of 9% year-over-year and a staggering 172% rise compared to the same quarter last year.

However, SMCI has faced ongoing issues related to its accounting practices. Following delays in financial report filings, the Nasdaq Exchange has warned that the company must submit its financials by February 25 to avoid potential delisting.

Amidst this regulatory pressure, analysts are questioning whether Super Micro can maintain its upward trend and successfully deliver strong earnings. Analysts at investment firm TD Cowen have raised their price target for SMCI from $35 to $40, affirming a ‘Buy’ rating and calling the company an important player in the tech sector.

Analyst Krishna Baruah stated, ‘Super Micro is poised to benefit from growth catalysts, especially as it resolves its SEC filing delays and capitalizes on strong fundamentals. The expected ramp-up of Nvidia’s next-generation Blackwell AI chips could further propel growth.’

CoreWeave, one of SMCI’s largest clients, reportedly plans to double its data centers from 30 to 60 by the end of 2025, which could significantly boost demand for Super Micro’s services. Other analysts, including those from Goldman Sachs and Wedbush, remain cautious, maintaining ‘Hold’ ratings due to uncertainties surrounding the company’s financial filings.

As the earnings report approaches, traders are monitoring SMCI closely. Using options analysis tools, expectations indicate significant market movement post-announcement, showcasing the stock’s volatility as it navigates through this turbulent period.

The consensus rating among five Wall Street analysts for SMCI stock is a ‘Hold,’ leaning on one Buy, three Holds, and one Sell recommendation, with an average price target of $29.75 that suggests an 18% downside risk from current levels.